A Good Bet: Chu Kong High-Speed Ferry tied up with Cotai Ferry in 2012 to shuttle passengers to and from gambling mecca Macau. Photo: Chu Kong Shipping

A Good Bet: Chu Kong High-Speed Ferry tied up with Cotai Ferry in 2012 to shuttle passengers to and from gambling mecca Macau. Photo: Chu Kong Shipping

CHU KONG SHIPPING issues positive profit alert

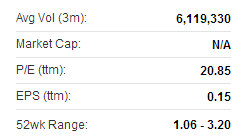

CHU KONG SHIPPING Enterprises (Group) Co Ltd (HK: 560) has issued a positive profit alert, with its Board saying first half revenue and profit have increased on a year-on-year basis.

“The increments are due to the profit newly attributable to Chu Kong High-Speed Ferry Co Ltd in this period, which increased the Group’s profit higher than expectations.

“Chu Kong Shipping is in the process of finalizing the interim financial statements of the Group for the six months ended June 30, 2013,” said Managing Director Xiong Gebing.

Chu Kong recently 3.12 hkdThe Group’s interim results are expected to be announced by August 15.

Chu Kong recently 3.12 hkdThe Group’s interim results are expected to be announced by August 15.

In the first half of 2012, consolidated revenue rose 4.5% year-on-year to 685.7 million hkd while the bottom line fell 15.3% to 70.1 million.

Last summer, Chu Kong High-Speed Ferry Co Ltd, a wholly-owned subsidiary of CKS – along with Cotai Ferry Co Ltd, a company indirectly owned by Sands China Ltd (HK: 1928) – inked a deal on the provision of management and operation services for Cotai Jet’s fleet.

“This cooperation has run well for the past five months,” CKS Chairman Liu Weiqing said earlier this year in Hong Kong regarding the five-year contract.

Chu Kong Passenger Transportation Co Ltd (CKPT) achieved fast business growth in 2012, with passenger business contributing profit of 74.6 million hkd, representing year-on-year growth of nearly 21%.

Ridership of Guangdong-Hong Kong routes rose 3% to 6.2 million, and CKPT was able to raise ferry ticket fares, resulting in positive contribution to financial results.

Patronage of Macau-Hong Kong routes rose by 20% last year to 7.36 million.

Chu Kong Shipping Enterprises (Group) Co Ltd. (HK: 560) is held by Chu Kong Shipping Enterprises (Holdings) Co Ltd with a strategic orientation of being ”based in Hong Kong, backed by the mainland and facing the world.” CKS is principally engaged in port-based navigation logistics, high-speed waterway passenger transportation and tourist business between Hong Kong, Macau, the Pearl River Delta Region (PRD) and coastal areas. After 15 years of development, CKS owns equity shares of 20 PRD inland barge terminals and operates more than 35 container barge routes, as well as 18 bulk freight routes between Hong Kong and PRD inland terminals. CKS operates a total of 18 passenger routes with 16 passenger destinations in Hong Kong, Macau and Guangdong Province. CKS is a market leader in the PRD waterway logistics and high-speed waterway passenger transport markets.

Bocom: Keeping ‘Market Perform’ call on CONTAINER SHIPPING

Bocom Research said it is maintaining its “Market Perform” recommendation on Hong Kong-listed container shipping firms.

“Without a strong volume rise to lift freight rates higher, we remain cautious on the earnings outlook of HK-listed container shipping companies for the rest of the year.

“The freight rate on the Asia-Europe tradelane rose recently as a result of cargo exporters front-running the scheduled implementation of the General Rate Increase (GRI) effective from August with early cargo dispatch,” Bocom said.

Source: BocomAccording to the Shanghai Shipping Exchange, such front-running activities have lifted the load factor on the Asia-Europe tradelane to about 90%.

Source: BocomAccording to the Shanghai Shipping Exchange, such front-running activities have lifted the load factor on the Asia-Europe tradelane to about 90%.

“Meanwhile, the market is still concerned about the oversupply risk, particularly after Maersk, the world’s largest container shipping company, took delivery of its first Trip-E container vessel (18,000-TEU capacity) of late.

“According to Lloyd’s List, the idle global container vessel fleet has decreased to 1.9% of the global fleet as at 17th July, down from 2.4% as at 26th June.”

Other than the freight rate increase on the Asia-Europe tradelane, the freight rate on the Asia-Middle East tradelane also increased recently.

“According to Drewry, an international shipping consultant, the market is unlikely to see any peak season volume again this year,” the research house added.

See also:

CHU KONG SHIPPING: HK-Macau Routes Help Boost Revenue 9.4%