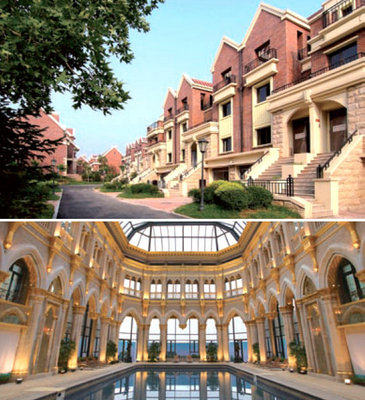

China's property sector is drawing the attention of market regulators looking to ease price inflation.

China's property sector is drawing the attention of market regulators looking to ease price inflation.

Photos: China New Town DevelopmentMain reference: Story in Sinafinance

AFTER A STRONG finish to 2012, A-shares have been moving in stutter steps of late.

Here are some important numbers to keep in mind in looking at recent trends for Chinese shares.

In early December 2012, the benchmark Shanghai Composite Index hit a near-term low of 1,949 points – a nadir which quickly evaporated as the Index soared 25% in just two months to reach 2,434 in early February.

However, since that period -- when the Year of the Dragon passed the baton to the Year of the Snake -- the market has lost over 8% in the past two months and is currently trading at around the 2,230 point level.

And trading of late has been whipsaw like in its volatility, with timid investors often dipping a tentative toe or two into the pool before withdrawing altogether.

Part of the problem behind the current share price rut lies in four factors which are holding down the next upswing.

Property pressure

The recently-concluded National People’s Congress introduced a new national leadership team to govern the world’s most populous country.

The annual event also saw much talk about the need to maintain market stability within the high-flying real estate sector, and a five-pronged approach via macro-measures meant to stem runaway housing price inflation was proposed.

Some of the proposals made public so far include only allowing single adult in Beijing one apartment purchase versus two units previously.

In a further anti-speculation move, if homeowners flip properties within five years of purchase, they will be assessed an additional 20% capital gains tax, and down payments on subsequent property purchases will be boosted.

The Beijing municipal government will also no longer issues sales licenses for property projects assessed at prices “much higher” than average levels in the area.

Indeterminate phraseology like “much higher” often spook away investors yearning for more market clarity.

Another major domestic property market – Shanghai – will also begin banning loan approvals for third properties.

These measures have scared off a good deal of investment in property developers of late because they so far only seem to be targeting China’s two biggest real estate markets and are very thorough – if implemented – in keeping speculators at bay.

China shares recent performance. Source: Yahoo Finance

China shares recent performance. Source: Yahoo Finance

And given the heavy weighting that listed property developers enjoy on the benchmark Shanghai Composite Index, it is little wonder that real estate listcos have been holding back the bourses as they are not the most attractive buying options at present.

IPO freeze

The PRC’s bourse regulator, the China Securities Regulatory Commission, has not allowed a firm to go public in either Shanghai or Shenzhen since October of last year.

The IPO “freezeout” has now approached the half-year mark, and it hardly says much about market confidence when the stock market watchdog is wary of letting domestic firms go public for fear of the frigid investor reception they might receive.

And the fact that there is no clear indication on when IPOs will once more be approved is doing little to light a fire under A-shares these days.

Burdened banks

The deadline for A-share firms to release full-year results is fast approaching, yet several lenders have yet to do so.

Recent reports suggest that many financial institutions are burdened by larger than anticipated debts and non-performing loans.

This does not augur well for the sector’s overall performance, and their heavy presence within the Shanghai Composite Index is another reason for the recent lack of bullishness among investors.

Lack of leader

The slumping fortunes of property and financial sector shares of late has on its own been responsible for the general tentativeness in the market this spring.

But since so many industries are reliant on these two industries – including banks, insurers, brokerages, developers, construction material plays, etc – there have been no white knight sector themes to swoop in and take over the baton of bullishness.

Looking ahead, investors would serve themselves well to keep one eye on any new developments on the property policy front and another eye peeled for any surprises in either direction on the earnings front.

See also:

What Is China's Top Fund Manager Up To?

China's property sector is drawing the attention of market regulators looking to ease price inflation.

China's property sector is drawing the attention of market regulators looking to ease price inflation. China shares recent performance. Source: Yahoo Finance

China shares recent performance. Source: Yahoo Finance NextInsight

a hub for serious investors

NextInsight

a hub for serious investors