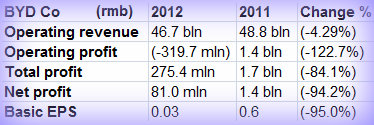

Morgan Stanley: BYD Most Fuel Efficient PRC Carmaker

Morgan Stanley said BYD Co (HK: 1211; SZA: 002594) remains China’s most fuel efficient automaker.

“BYD was the best among locals regarding FE (fuel efficiency) in 2012 thanks to good exposure to new energy cars. The EV and F3 DM models are on the market, plus good FE results from new models such as the Surui beat the FE target by 11%,” Morgan Stanley said.

Although revenue edged down last year, BYD took cheer from robust Q42012 salesThe stringent Phase III Fuel Efficiency Regulations have been issued, and the US research house said not all automakers with operations in China perform equally on how well they use fossil fuels.

Although revenue edged down last year, BYD took cheer from robust Q42012 salesThe stringent Phase III Fuel Efficiency Regulations have been issued, and the US research house said not all automakers with operations in China perform equally on how well they use fossil fuels.

“China’s actual Fuel Efficiency (FE) goals are largely differentiated. Local brands will face a tougher environment, and we expect this will push industry consolidation faster.

“Most mass global brands are fine, but we see sharp differences among local and luxury names.”

The Chinese government announced Phase III Fuel Efficiency Regulations on March 20 which will measure corporate average fuel efficiency (CAFE).

The aim is to reach average FE of 6.9L/100km by 2015, implying a 20% drop from Phase II, with a further reduction to 5.0L/100km by 2020.

Industry impacts positive for BYD

New Energy Vehicles (NEVs) are being encouraged, mainly pure EVs, fuel-cell vehicles and plug-in hybrids of which BYD is a market leader in China.

BYD recently 24.95 hkd“In our view, this will lead to auto industry consolidation from a policy perspective. Some small and weak OEMs cannot afford the huge costs of improving FE to such a large degree,” Morgan Stanley added.

BYD recently 24.95 hkd“In our view, this will lead to auto industry consolidation from a policy perspective. Some small and weak OEMs cannot afford the huge costs of improving FE to such a large degree,” Morgan Stanley added.

Most global volume brands are fine, and it will not be challenging for the brands missing targets to improve.

However, there is a big gap among local brands. BYD has the best FE, while some big players like Geely and Chery are still far from meeting the Phase III standards, the research house added.

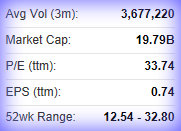

Goldman Sachs: BOC HK a ‘Buy’, HANG SANG Cut to ‘Sell’

Goldman Sachs said it is maintaining its “Buy” recommendation on Bank of China (HK) Ltd (HK: 2388) while downgrading its call on Hang Seng Bang Ltd (HK: 11) to “Sell.”

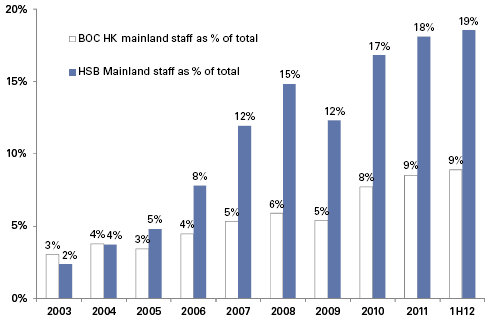

“BOC HK and Hang Seng Bank (HSB) have taken different approaches to growing their China exposure. While BOC HK has pursued a mostly ‘inbound’ approach, by focusing on offshore expansion of China loans/assets, HSB has targeted ‘outbound’ growth by expanding its onshore presence in China.

“We believe an outbound strategy is less profitable during the build-out stage but could be more profitable in the long-run,” Goldman Sachs said.

The research house added that although BOC HK seems to be executing better on new initiatives since the global financial crisis, it has a worse risk management track record vs. HSB, which is a risk to its view on BOC HK.

BOC HK on a firmer growth footing vs. HSB

Goldman Sachs said it believes more opportunities are likely to emerge in RMB banking than in US$/HK$ banking for HK banks, as China continues to open its capital account.

“In our view, BOC HK is better positioned to capture these opportunities, when compared with HSB as BOC HK seems to be on a relatively better growth footing when we compare its balance sheet/earnings mix, capital buffer and positioning.”

Goldman Sachs is maintaining its 12-month target price for HSB of 110 hkd, implying 12% potential downside, while raising its 12-month target for BOC HK by 5% to 30.5 hkd (2.10x 2013E P/B), implying 16% potential upside.

See also:

BYD AUTO: Finally Charged For Sustained Ride

Hong Kong Shares To Double In 2 Years?