SUZHOU BOAMAX Technologies Group Co Ltd (SZA: 002514) recently signed a deal to jointly develop brake disc technology with applications in high-speed railcars, aircraft and automobiles.

Suzhou Boamax General Manager Mr. Zhu Yongfu said at the Aries Consulting-sponsored “Braving the Waves: China Investment Strategies 2013” conference that his Shenzhen-listed A-share enterprise would benefit from Beijing’s unwavering support for the high-speed railway sector.

“There is huge market demand for high-performance braking products, especially in the high-speed railway and aviation sector. Currently these types of brake discs are all imported, so China is keen to see domestic producers break into the brake market,” said Mr. Zhu.

Speaking at last week’s investment conference in Shenzhen featuring China, Hong Kong and Singapore-listed firms, Mr. Zhu said it would be a challenging task to wrest market share from established overseas suppliers to the high-performance brake products sector, but Suzhou Boamax was up to the task.

“Our strength is both our high-tech innovative background as well as our capability to lower ASPs for end users, he added.

Since listing in Shenzhen in 2010, Boamax has seen strong order growth, helping its 2008-2012 revenue grow at a CAGR of nearly 24% and its net profit see an average annual rise of over 6%.

“We enjoy a strong market position, a quality client base, technical expertise, quality production sites and a cutting-edge R&D team,” said Mr. Zhu.

The core operations of Suzhou Boamax still revolve around the design and manufacture of industrial grade sheet metal folding products in the PRC and internationally.

The Eastern China-based firm offers its goods to end-product manufacturers in various fields including electrical, medical, communications, finance, renewable energy and automotive, with a product range already exceeding 3,000 items with most being custom made according to client specifications.

Boamax said that numerical control-based sheet metal product fabrication is a mature industry, with only a marginal difference between various manufacturing apparatus, and the technological standards for different manufacturers are principally the same.

Boamax’s core competitiveness is its downstream client base which includes APC, Schneider Electric, Delta Electronics, NCR, Alcatel-Lucent and Denmark Foss among others.

Suzhou Boamax said it is seriously considering a broad expansion into the high-speed railway sector as well as aviation

“We have grown to develop a broad product portfolio with wide applications and enjoy strong government support and stable growth. We expect 10-15% average annual growth between 2011-2015 as part of the 10th Five-year Plan,” Mr. Zhu said.

There are a number of enterprises in China producing sheet metal folding products.

Boamax, founded in 2001, possesses competitive strengths in business segments such as ATM housings and new energy equipment -- particularly solar – which help differentiate it from the competition.

Also, Boamax has branch offices in the Philippines and Xiamen, PRC, making it more responsive to customer needs and providing advantages in transportation costs with closer proximity to clients.

Brakes: Full Speed Ahead?

Suzhou Boamax said it is seriously considering a broad expansion into the high-speed railway sector as well as aviation.

In November 2012, Boamax signed a strategic cooperation deal with Beijing Fuweihao Tech on R&D to produce carbon/carbon-silicon carbide composites and brake disc products.

Carbon/carbon-silicon carbide composites deliver better performance against erosion, friction, heat and vibration within brake discs and are applicable to projects such as high-speed railcars, aircraft and luxury vehicles.

“At present, brake discs for China’s high-speed railway are all imported, creating strong demand for domestic production of such products. The market potential amounts to several billion yuan, and any successful development of these new products will allow the company to enjoy high-speed growth in its businesses,” Mr. Zhu said.

For the July-September 2012 period, operating revenue for Boamax rose 5.6% y-o-y to 72.9 million yuan with gross profit up 1.5% at 15.6 million.

Gross margins declined slightly to 21.4% from 22.3% with net profit falling 72.5% to 4.4 million yuan.

“The main reason for the decline was more government subsidies granted during the previous period amounting to 15 million yuan. Our goal has become our slogan: ‘To be a 10 billion yuan firm for 100 years',” Mr. Zhu added.

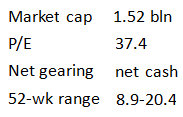

Suzhou Boamax currently has a market cap of around 1.5 billion yuan.

See also:

BOAMAX: Bright Future In Solar, Hi-Mix/Low-Volume

SUZHOU BOAMAX: Touched By Billions Worldwide