DBS Group downgrades Dairy Farm International to 'hold"

Analysts: Alfie Yeo & Andy SIM CFA

The Dairy Farm group of companies.

The Dairy Farm group of companies.We believe earnings will likely be soft for FY13F, and lower margins from higher labour, utility expenses, as well as lower gross profit could impact growth for FY13F.

We are hence moderating our earnings for FY13F/FY14F, by cutting each by 15%, in anticipation of lower earnings going forward.

DFI now trades at 28.6x FY14F PE. We believe its current valuation is justified since DFI tends to trade at a slight premium to peers of 25x FY14F PE.

Following our earnings revision, we arrive at our new DCF-based TP of US$9.46, implying a valuation of 28x FY14F PE.

We see limited upside for the stock for now, given that earnings growth is under pressure by margins. Downgrade to HOLD.

NRA Capital maintains "overweight" rating on Petra Foods

Analyst: Joel Ng

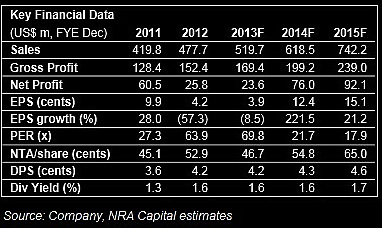

Earnings below expectations. Petra’s 3Q12 net profit of US$14.8m came in below our US$16.6m net profit estimate due to lower-than-expected gross profit margins.

Earnings below expectations. Petra’s 3Q12 net profit of US$14.8m came in below our US$16.6m net profit estimate due to lower-than-expected gross profit margins. Cut forecasts but maintain Overweight. We slightly reduce our FY13-15 net profit forecast by 2-4% to account for the weaker Indonesian Rupiah (73% of revenue contribution from Indonesia) that have resulted in lower translation into the US$.

However, we change our fair value model from 20x FY14 SOTP to 26x FY14 PER given the strong bottom line growth that we estimate will average 20% over the ne xt 3 years and the dominant market position Petra commands in the fast growing markets of Indonesia and expansion plans in emerging markets such as the Philippines.

26x FY14 PER represents a 20% premium over its industry peers which we believe can be justified given its dominant market position in Indonesia.

As a result, our fair value is adjusted slightly from S$4.12 to S$4.10. With an 18% upside potential, Maintain Overweight.