Prior to his retirement, Chan Kit Whye worked more than 30 years as Regional Finance Director, Financial Controller and Manager in a multinational specialty chemical business. He previously played an active role in CPA (Australia) Singapore Branch, taking up positions in its Continuing Professional Development and Social Committees. Kit Whye is a Fellow of CPA Australia, CA of Institute of Singapore Chartered Accountants and CA of the Malaysian Institute of Accountants. He holds a BBus(Transport) Degree from RMIT, MAcc Degree from Charles Sturt University and MBA from Durham Business School.

Prior to his retirement, Chan Kit Whye worked more than 30 years as Regional Finance Director, Financial Controller and Manager in a multinational specialty chemical business. He previously played an active role in CPA (Australia) Singapore Branch, taking up positions in its Continuing Professional Development and Social Committees. Kit Whye is a Fellow of CPA Australia, CA of Institute of Singapore Chartered Accountants and CA of the Malaysian Institute of Accountants. He holds a BBus(Transport) Degree from RMIT, MAcc Degree from Charles Sturt University and MBA from Durham Business School.Asian Pay TV Trust

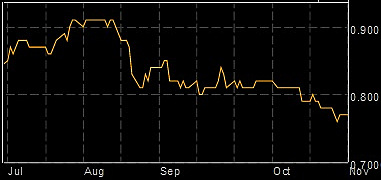

Asian Pay TV Trust stock recently traded at 77 cents, down from its IPO price of 97 cents in May this year.Asian Pay TV's nine months' net profit came in at $24.4 million, which represents 1.7 cents a share. Nine months free cash flow came in at $12.05 million or 0.8 cents a share.

Asian Pay TV Trust stock recently traded at 77 cents, down from its IPO price of 97 cents in May this year.Asian Pay TV's nine months' net profit came in at $24.4 million, which represents 1.7 cents a share. Nine months free cash flow came in at $12.05 million or 0.8 cents a share. On full year basis, net profit and free cash flow a share should come in at around 3 cents for both if I trim down its capex for the final quarter.

The company had paid 4.8 cents interim dividend. It also promised 4.1 cents final dividend to be paid sometime in March 2014.

As for 2014 year, the company re-affirmed a distribution guidance of 8.25 cents a share. Is the payment overstretched?

Looking at its Balance Sheet, its current assets are only $65 million with cash of $51 million, while its current liabilities are $207 million, which includes a tax payable of $132 million. Debt maturing after a year stood at $917 million.

While its total net assets stood at $1.3 billion, its intangible assets which formed part of its total net assets is a whopping $2.24 billion.

My opinion is that the financial engineering involved during the IPO process is overwhelming. Current dividend yield is more than 10%, but the balance sheet looks scary to me. The share is currently trading at a 21% discount to its IPO price at 0.97. Yet there are analysts out there putting a target price of more than $1.00. No matter what, the dividend yield is really attractive... and Soros like it. He is one of the cornerstone investors.

| Golden Agri Fundamentally, still ugly. Q3 operating profit declined 53% to US$66 million compared to prior year Q3. Q3 net profit dropped 63% to US$32 million as compared to prior year Q3. For YTD to Sept 2013, net profit attributable to shareholders was US$188 million, 47% down from prior year YTD of US$356 million. Current NTA per share is S$0.83. Full year EPS should come in at about 2.6 cents Singapore, as compared to prior year of 4 cents. This will give Golden Agri a PE of 23x and a price-to-book ratio of 0.67. The share price should hold as it should be supported by its NTA. |

Liongold

Liongold reported a Q2 loss per share of $4.89 which was caused by reflecting and writing down all its investments in interlocking securities at fair value.

Its NAV is not 22 cents, BUT that includes deferred exploration and evaluation expenditure of $140 million and intangible assets of $17 million. Both add together comes up to 16.6 cents a share. This means that in real terms, its NTA per share IS ONLY 3.66 cents a share.

I also don't believe my eyes when the report says $4.89 per share loss. When I did my own calculation, it should be $0.0489 a share loss. So, the CFO need to be shot for not vetting the report before submitting to SGX.