Excerpts from analysts' reports

CIMB expects Singapore's housing boom to boost Courts' profits

Analysts: Kenneth Ng, CFA, and Lee Mou Hua

Singapore’s FY13 operating profit (S$42m) was more than twice Malaysia’s (S$19m), at 69% of group operating profit.

This exceeded our previous estimate of 55-65%. The above may seem counter-intuitive given the greater prevalence of credit sales in Malaysia but Singapore’s more efficient logistics infrastructure seems to have won out.

CIMB expects Singapore's housing boom to boost Courts' profits

Analysts: Kenneth Ng, CFA, and Lee Mou Hua

Singapore’s FY13 operating profit (S$42m) was more than twice Malaysia’s (S$19m), at 69% of group operating profit.

This exceeded our previous estimate of 55-65%. The above may seem counter-intuitive given the greater prevalence of credit sales in Malaysia but Singapore’s more efficient logistics infrastructure seems to have won out.

Because of the higher absolute profits in Singapore, the impact on the bottom line from faster SSSG (same store sales growth) led by a housing boom should outweigh rapid retail-space expansion in Malaysia.

Courts started 2013 at 87 cents and recently traded at 97 cents. Dividend yield is 1.04%. Chart: BloombergFY13 SSSG was 8.2% in Singapore, compared with just 6.3% (local currency) in Malaysia.

Courts started 2013 at 87 cents and recently traded at 97 cents. Dividend yield is 1.04%. Chart: BloombergFY13 SSSG was 8.2% in Singapore, compared with just 6.3% (local currency) in Malaysia. Full effects of housing boom not yet felt: We think there is a good chance that SSSG in Singapore could spike above 10% because the number of housing units is set to rise dramatically.

About 30,000 units are due for completion in 2013, before rising to 50,000-63,000 annually in FY14-16.

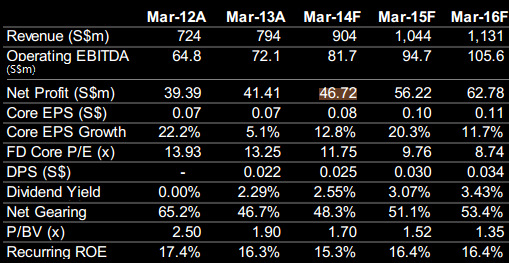

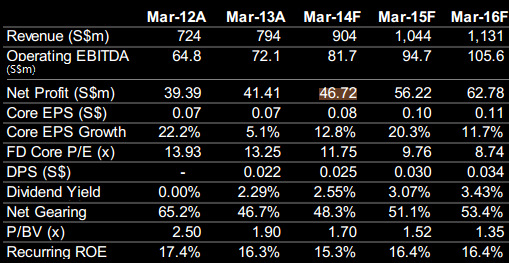

Valuations: Courts trades at just 12x CY14 P/E while our residual income valuation implies 17x CY14 P/E. Net gearing was 0.47x at end-FY13 but could tick up to about 0.86x if all the cash raised from fixed-rate notes is used to extend loans.

OUTPERFORM - Maintained. Target: S$1.41

OUTPERFORM - Maintained. Target: S$1.41

Deutsche stays negative on palm oil stocks with peak production months looming

Analyst: Michelle Foong

Malaysian Palm Oil Board (MPOB) reported May-13 inventory data of 1.8m MT, 5.1% lower MoM and moderately flat at +1.7% YoY, as expected.

Analyst: Michelle Foong

Malaysian Palm Oil Board (MPOB) reported May-13 inventory data of 1.8m MT, 5.1% lower MoM and moderately flat at +1.7% YoY, as expected.

Lower inventory data will support plantation co. share prices in the immediate term, we believe.

However, negative trends such as increasing supply of competing edible oils, rebound of CPO inventory levels as palm trees enter peak production period on the back of supportive weather conditions, high CPO stock inventory at ports in China and India and range-bound crude oil prices are likely to depress CPO prices over the next 6-12 months, we believe.

However, negative trends such as increasing supply of competing edible oils, rebound of CPO inventory levels as palm trees enter peak production period on the back of supportive weather conditions, high CPO stock inventory at ports in China and India and range-bound crude oil prices are likely to depress CPO prices over the next 6-12 months, we believe.

We maintain our bearish view on the sector due to sustained earnings weakness ahead.

GGR (Golden Agri Resources) and FGV (Felda Global Ventures) remain our top Sells for their greater earnings sensitivity to CPO price changes and lofty valuations.

GGR (Golden Agri Resources) and FGV (Felda Global Ventures) remain our top Sells for their greater earnings sensitivity to CPO price changes and lofty valuations.