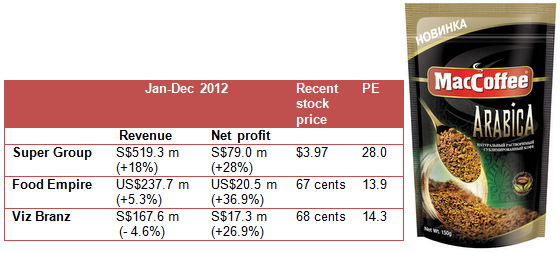

Data compiled by NextInsight. MacCoffee is a top product of Food Empire.

Data compiled by NextInsight. MacCoffee is a top product of Food Empire.FOOD EMPIRE and its Singapore-listed peers in the 3-in-1 instant coffee business have had a strong 2012, as the revenue and profit figures in the table above show.

As a result, the leader in the business, Super Group, saw its stock price jump 194% in 2012.

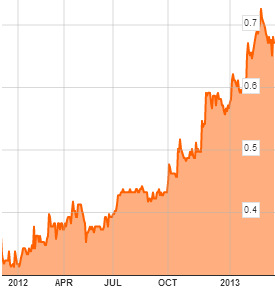

Food Empire stock more than doubled in 2012, and has continued to firm up in 2013 year to date. At 67 cents a share, the company has a market cap of S$357 million. Chart: BloombergFood Empire shareholders have reason to cheer too, as their shares rose 113% last year, and there is a dividend of 1.231 cent a share coming.

Food Empire stock more than doubled in 2012, and has continued to firm up in 2013 year to date. At 67 cents a share, the company has a market cap of S$357 million. Chart: BloombergFood Empire shareholders have reason to cheer too, as their shares rose 113% last year, and there is a dividend of 1.231 cent a share coming.In terms of valuation, Super can now be considered to be quite rich at 28X PE.

More attractive is Food Empire, for which RHB Research analyst Melissa Yeap has recently pegged a target price of 84 cents based on a (relatively modest) price-earnings ratio of 15X 2014 forecast earnings.

That's a 25% potential upside from the 67 cents that the stock recently traded at.

The target valuation of 15X is a sharp discount to Super's but analysts often can justify raising the valuation as the business performs. The valuation could still lag behind Super's because of Super's much bigger revenue and profit base.

In addition, Food Empire is generally viewed by analysts and investors as being more exposed to forex and country risks as its key markets are Russia and its neighbouring countries.

Closer to home, Food Empire will be seeing significant action, as we learnt from a meeting with senior management, including Mr Tan Wang Cheow, the executive chairman, and William Fong, the CFO, a few days ago.

Food Empire has started constructing a non-dairy creamer plant and a snacks plant in the Iskandar region in Johor. They will start production in the second half of this year.

Tan Wang Cheow, executive chairman of Food Empire. NextInsight file photoComing just several months after the opening of its packing plant in Ukraine (see video link at the bottom of the page), the non-dairy creamer plant is Food Empire's first step towards producing its own ingredients that go into its instant beverages.

Tan Wang Cheow, executive chairman of Food Empire. NextInsight file photoComing just several months after the opening of its packing plant in Ukraine (see video link at the bottom of the page), the non-dairy creamer plant is Food Empire's first step towards producing its own ingredients that go into its instant beverages.According to the RHB analyst report, the plant would have a production capacity that exceeds Food Empire's own needs, as a result of which 70% of the capacity is for external sale.

However, Food Empire can be expected to continue to buy some of its requirements from external suppliers in order to diversify its supply risks, among other reasons.

The snacks plant will produce Food Empire’s “Kracks” branded potato chips (currently outsourced to a manufacturer) for sale in Europe. Kracks is by no means a significant revenue contributor currently but the company aims to do more with the plant.

Both plants will extend Food Empire's business model which, until now, has been that of a brand manager -- and a very successful one at that, which is why Food Empire's instant beverages have commanding market shares.

In countries such as Russia, its market share is more than 50% while in Ukraine, 40%, and in Kazakhstan, 75%. Food Empire has also made inroads into smaller markets such as Iran.

Fueling that presence is Food Empire's promotional budget comprising a significant 15% of its revenue for activities such as sponsoring major sports events and product sampling.

William Fong, CFO of Food Empire.

William Fong, CFO of Food Empire. NextInsight file photo.You can see lots of evidence of these activities at its website, www.foodempire.com

Brand development at Food Empire is akin to a secret food recipe. "Food Empire is one of only a few Singapore-listed companies with a brand manual," said Mr Tan.

Aside from developing its various brands, Food Empire plays a manufacturing role too.

It sources for 3 key ingredients (non-diary creamer, instant coffee and sugar), determines the proportions to put into various products, and packs them in sachets in its plants in Singapore, Malaysia, Vietnam, Russia and Ukraine.

By the way, the cost of these raw materials has been on a downtrend over the last year or so (see charts here for coffee, sugar and crude palm oil, the latter being used for making non-diary creamer). This has contributed to profit margins expanding for not only Food Empire but also its peers.

New moves in India, Myanmar... even Ethiopia

While it maintains a lean HQ in Singapore, Food Empire continues to seek out markets and opportunities in new markets. That's its DNA.

Food Empire is building its own coffee processing plant in India. The country offers tax incentives and a ready pool of local engineers with experience in starting up and running coffee processing plants.

To be completed in 2014, Food Empire's plant will process coffee beans into coffee powder or granules that get packed into its 3-in-1 sachets.

Miss Myanmar 2012, Nan Khin Zayar, is MacCoffee's brand ambassador in her country.

Miss Myanmar 2012, Nan Khin Zayar, is MacCoffee's brand ambassador in her country. Photo: InternetMeanwhile, Food Empire has placed resources to kick-start sales in markets such as Myanmar, China, and Ethiopia.

Its promotional activities to grow its brand have a familiar ring. In January this year, Food Empire partnered Yoma Strategic in bring to Myanmar its very first international marathon -- the Yoma Yangon International Marathon.

Food Empire also appointed a Myanmar beauty queen, Ms Nan Khin Zayar, as its official brand ambassador for MacCoffee in her country.

In due course, Food Empire plans to set up a manufacturing plant there.

Said Mr Tan Wang Cheow, the executive chairman: "The 3-in-1 coffee market in Myanmar has a few local players already and international ones too. We intend to be one of the key contenders."

Recent articles:

FOOD EMPIRE opens its first manufacturing plant in Ukraine

FOOD EMPIRE: 3Q net profit surged 91% to USD8.1 m

FOOD EMPIRE: Stock price up on F&B sector re-rating

Click on the 62-second slideshow below for the opening of Food Empire's factory in Ukraine on 22 November 2012. (For higher resolution, move your mouse cursor over the base of the slideshow and click on 'Change Quality'.)

80% of 2011 revenue was sale of goods. Do you know what are "marketing service fee" and "packing service fee". They are likely of low-margin and depress the overall margin, masking the real one of sale of goods.