Photo: Company

ABCI: ‘Buy’ Call on LENOVO Maintained

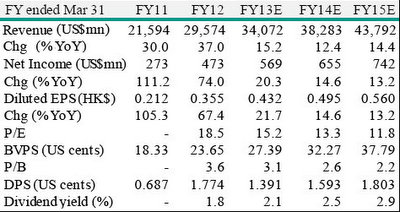

ABCI said it is maintaining its “Buy” recommendation on China’s top PC maker Lenovo Group (HK: 992) with a 12-month target price of 7.92 hkd, representing 16x P/E for FY3/13 (recent price: 6.96 hkd).

ABCI participated in Lenovo’s teleconference on November 8 in which the world’s No.2 computer maker said it outperformed the global PC market by gaining market share in all geographic regions.

“The fast ramp-up of its smartphone business will bring a new engine for its profit,” ABCI said.

Margins improved in 2QFY3/13 as sales and net profit grew by 11.4% y-o-y and 12.6% y-o-y to 8.67 billion usd and 162 million usd, respectively, in line with ABCI’s forecast.

Its operating profit margin increased by 0.3ppt y-o-y and 0.1ppt q-o-q to 2.4% in 2Q FY3/13 due to tight controls of operating costs.

Gaining market share in tough PC space

“Owing to proper consumer PC marketing strategy in developing markets, its global PC shipments grew by 10.8% y-o-y in 2Q FY3/13 while global PC shipments dropped 8.6% y-o-y for the same period.

“Its global market share reached 15.6% in 2Q FY3/13, further narrowed the gap with HP (market share of 15.8%). We expect it will surpass HP to become No.1 in 3QFY3/13,” ABCI said.

Lenovo’s MIDH business increased by 150% y-o-y and accounted for 8.3% of total sales (vs 3.6% in 1QFY3/13) in 2QFY3/13 due to strong smartphone sales in China.

Lenovo was ranked No.2 with a 14.2% market share in China’s smartphone market.

The group will launch its smartphones in other emerging markets like Indonesia to achieve business scale.

“We expect the smartphone business to become profitable over the next couple quarters,” ABCI added.

The research house said that although the overall PC market is weak, Lenovo’s management still has confidence it will see sequential PC shipment and sales growth.

“The launch of Windows 8 in October will boost PC sales over the next two quarters. We expect its 3Q and 4Q PC shipments to grow by 14.6% y-o-y and 13.0% y-o-y and we expect its operating margin to further improve to 2.5% in 3Q (vs 2.4% in 2Q).”

See also:

VST, BLUEFOCUS & Their Top Client LENOVO All ‘Buys’

VST CHAIRMAN: ‘IT Gadgets Already Life Necessity’

VST: Making ‘IT’ Happen In PRC; Shares Soar 26%

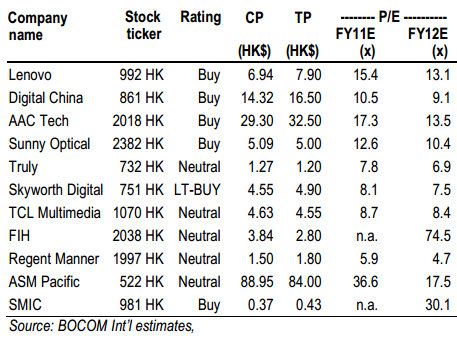

Bocom: HK-listed ELECTRONICS Kept at ‘Outperform’

Bocom International said it is maintaining its call on Hong Kong-listed electronics plays as Outperform,” with Lenovo Group (HK: 992) performing very well.

“SIA announced that worldwide sales of semiconductors reached 24.8 billion usd in September, which declined by 3.9% year-on-year or climbed by 2% month-on-month.

“The monthly growth in September suggests the industry continues to exhibit relative resilience to global economic headwinds,” Bocom said.

On a regional basis, the American market was encouraging with a 5.8% monthly increase.

“For the first nine months, worldwide sales of semiconductors still declined by 4.7% in 2012. BB ratios still suggested near-term weakness,” the research house added.

Book-to-bill ratio (BB ratio) for North American semiconductor equipment declined to 0.84 in September from 0.86 in August. The BB ratio for Japan semiconductor equipment declined to 0.65 in Sept from 0.74 in August.

IPC's combined PCB BB ratio declined to 0.97 in September from 1.0 in August.

“All these BB ratios still suggest weakness in the semiconductor sector in the coming months.”

LCD panel monthly revenue continued to expand in September.

Display Search reported that LCD panel monthly revenue growth expanded to 13% in September from 11% in August.

“In terms of the application segment, LCD TV panel monthly shipment growth was 16% in September (August: 18%), still retaining its strong momentum, likely driven by restocking by TV makers for the next demand wave,” Bocom said.

LCD monitor panel monthly shipments declined by 5% in September (August: 7% decline), which still suggests a near-term slowdown in desktop computers, though it continued to improve from a 14% decline in May.

Mobile PC panel monthly shipments continued to see strong growth momentum with a 22% increase in September (August: 18%).

As a result, Chimei and AUO reported monthly revenue growth of 9.4%/9.2% in September, and 4.5%/7.2% in October, respectively.

See also:

ELECTRONICS ‘Outperform’

Why LENOVO Isn't Celebrating Being No.1