Translated by Andrew Vanburen from a Chinese-language piece in Securities Times

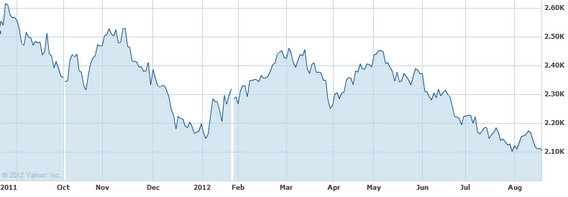

THE SHANGHAI COMPOSITE Index -- chief tracker of A- and B-shares listed in Shanghai and Shenzhen -- is down 20% from year-earlier levels and has lost over 7% since the beginning of the year.

And on Monday, shares fell another 1.7%, hitting a 41-month low.

And if investors were looking for some good news, they won’t get it from a leading fund targeting the Chinese stock market, as it predicts even darker days for A-shares this year.

He Jiangxu of ICBC Credit Suisse Asset Management said the Shanghai Composite should struggle to gain much ground this half and runs the risk of finishing the year lower with expected trading volatility throughout the duration.

“Macroeconomic conditions in the second half of the year will likely prompt Chinese shares to seek a new low upon which to build a hoped-for sustained run.

“However, things will start to solidify over time as the bulk of the poor performing enterprises with their weak earnings have already been more or less digested by the market,” Mr. He said.

The analyst added that any new stimulus from Beijing will likely serve to stop the bleeding rather than boost the bourse.

“Another round of credit easing or a stimulus package of some sort will probably keep the Shanghai Composite from weakening further, but it’s hard to envision any major upsurge in share prices following another move from Beijing this half.”

Mr. He said that for those firms surprising on the upside in terms of either profitability or revenue, if they also don’t show an immediate commensurate rise in share prices they will almost certainly become the favorites of the countless funds scouring the landscape for unappreciated bargain plays.

“However, there are simply not that many attractive bargains out there right now and it’s hard to find any visibility on where things are headed. Nor is it easy at this point to separate the wheat from the chaff, as far as quality stocks are concerned.”

After the big selloffs last week and again this Monday, we now face a Shanghai Composite Index struggling to regain the key 2,100 level.

In theory, this should expose a wide range of underpriced counters across a broad spectrum of sectors.

But current share prices still leave most fund managers underwhelmed at current market opportunities given the relatively lackluster earnings statements issued so far.

Most said they were cautious or guarded regarding investment opportunities in the current half.

Their sentiment is hardly a ringing endorsement of market potential these days.

And given the fact that there is a decided lack of excitement about the upside potential following a possible stimulus measure from Beijing also does little to inspire market confidence.

The same can’t be said for Hong Kong, where market chatter these days is revolving around when and how big the next boost from Beijing will be, with expectations of a “shot in the arm” effect for the local bourse.

See also:

SEASONAL SELECTIONS: Five China Shares Likely To Shine

Five China Sectors About To Get Hot

BUCKING TREND: China Shares Ready For Rebound?

TOUGH TALK: Dissecting China Market Fall, Fate