Translated by Andrew Vanburen from a Chinese-language piece by market watcher Gao Juan of Victory Securities

THE MONTH OF MAY was anything but charitable to Hong Kong shares, with the benchmark Hang Seng Index losing over 13% during the course of the month.

For those investors seeking something more closely resembling stability and serenity, Hong Kong might not be the ideal place right now as shares are expected to continue their wild ride in June.

In fact, the ride could be even bumpier going this month.

The anxiety was ratcheted up a notch or two with the recent denial from the country’s top economic planner – the National Development and Reform Commission (NDRC) – that the deterioration of the state of Spanish banks’ financial health would affect up to 40,000 investments in one way or another, either directly or otherwise.

Going out of the way to issue the denial brought renewed attention to the original estimate and added to the unease among investors in both Hong Kong and Mainland China.

This is a clear case where ignoring rumors and unsubstantiated statements would have been preferable to rejuvenating them in the headlines via a denial.

Regardless, whether the looming meltdown is true or not, or whether 40,000 or perhaps 39,999 investments are compromised by the Iberian imbroglio, the net effect of such items lingering in the news is yet another blow to investor confidence and more potential for share price volatility.

It is important to remember one critical thing about investor psychology, and that is this... even more unsettling to markets than an actual brick and mortar crisis is an unresolved or potential crisis on the horizon.

Daily turnover has been somewhat haphazard as well, with no sign of leveling off anytime soon.

Wednesday’s total hit 55.3 billion hkd, up 13% from the previous day.

Hong Kong-based developers led the downward spiral, but real estate plays with heavy exposure to the Mainland Chinese market outperformed the benchmark index thanks to numerous signs from Beijing that easing credit is on the way.

In fact, not to be overly pessimistic, but this might be one of the only reliable drivers in the month of June.

If the pundits are right on target, and the People’s Bank of China floods the PRC economy with stimulus cash via lower interest rates and other means, then Sino-centric property developers – always hungry for land bank accretion capital -- will be some of the clearest beneficiaries this early summer season.

And for those hoping for not only new cash in the market but new counters as well, better think again.

The IPO market in Hong Kong is suffering through a lengthening slumber, punctuated by the announcement this week that London luxury jeweler Graff Diamonds has shelved its planned one billion usd Hong Kong offer, the fourth sizable IPO to be nixed in the region this week, and the third such in Hong Kong.

Copper play China Nonferrous Mining and car dealer China Yongda Automobiles Services scrapped listing plans in Hong Kong recently.

“Consistently declining stock markets proved to be a significant barrier to executing the transaction at this time,” Graff said in a statement.

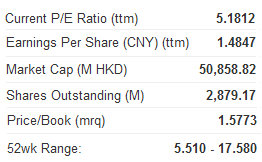

I would recommend defensive counters like China National Building Material (HK: 3323; CNBM) that, while recently hit by cost pressures, will likely be buoyed by stimulus packages and domestic spending down the road in the PRC.

See also:

HK Turnaround Possible This Week

12 HK-Listcos In M&A Crosshairs; FOCUS MEDIA Gets 'Buy'

FOCUS MEDIA Gets 'Positive Outlook', Eyes ‘Substantial’ Pickup

FOCUS Helps Out Mercy Relief