HK Daily News: FOCUS MEDIA Initiated 'Buy'

Singapore and Hong Kong's largest out-of-home digital media enterprise measured by the number of eye-level screens strategically located in elevator lobbies – Focus Media Network Limited (HK: 8112) -- has been initiated with a “Buy” recommendation in the financial section of the Hong Kong Daily News.

The Hong Kong-listed firm's first quarter sales revenue rose 24% year-on-year to 6.7 million hkd, producing a 15% bottom line increase to 4.5 million.

The Hong Kong Daily cited as its major justification for the 'Buy' initiation the robust expansion of the media firm's venue coverage.

"Focus Media expanded its digital flat-panel coverage in Hong Kong and Singapore office and commercial buildings over the period by 10% and 19%, respectively," the daily newspaper said.

The translates into 570 and 339 venues, respectively, in the two markets.

Focus Media Network and China's biggest Internet television firm YouKu Inc (NYSE: YOKU) signed a cooperative deal in February to go after the big prize: the 530 mln and growing online population in the PRC.

See also:

FOCUS MEDIA Gets 'Positive Outlook', Eyes ‘Substantial’ Pickup

FOCUS Helps Out Mercy Relief

FOCUS MEDIA, YOUKU: Landmark Tieup Targeting PRC's 530 Mln Netizens

FOCUS MEDIA: Gen2 Fund Boosts Stake In HK/Singapore Ad Firm

Kim Eng: Dozen HK-listcos Make Ideal Takeover Targets

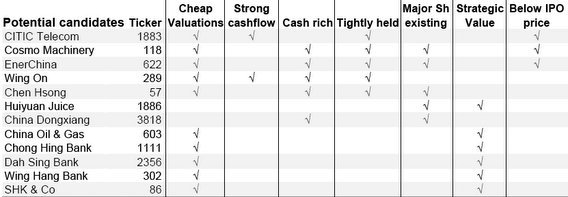

Kim Eng has identified 12 well-known Hong Kong-listed plays that it believes are likely candidates for M&A activity.

They are: CITIC Telecom (HK: 1883), Cosmo Machinery (HK: 118), EnerChina (HK: 622), Wing On (HK: 289), Chen Hsong (HK: 57), Huiyuan Juice (HK: 1886), China Dongxiang (HK: 3818), China Oil & Gas (HK: 603), Chong Hing Bank (HK: 1111), Dah Sing Bank (HK: 2356), Wing Hang Bank (HK: 302) and Sun Hung Kai & Co (HK: 86).

The research house said that with takeover activities on the rise, cheap capital flooding the market and major equity markets trading at recent lows, corporates are capitalizing on low funding costs to buy up deep value assets.

“We see a rise in takeover activity in the region. As the macro environment should stay conducive for corporate activity, we has looked at M&A deals in Hong Kong over the past three years and identified a few shared characteristics among targets.

“We have broadly divided them into three categories. The first includes stocks that are trading close to or below their book values but have strong cashflows. They usually trade below their IPO prices if they are recently listed. The major shareholders usually own a large stake in these companies, giving them a strong incentive to privatize these companies.”

The second grouping includes stocks whose major shareholders want to exit the business.

“Usually the major shareholders are old but without trustworthy successors, or it may be that they simply want to shift to other businesses.

The third category consists of companies that are leading players in strategic industries in China/HK which would provide potential acquirers with an immediate market presence, particularly in industries with high entry barriers.

Kim Eng said the mining machinery industry is a good example of the third category, with two acquisitions made by global industry leaders last year – IMM (HK: 1683) and ERA Mining (HK: 8043).

Using its methodology, the research house has identified 12 potential takeover candidates.

“One of the key criteria to trigger a privatization/takeover is cheap valuations. The addition of healthy cashflows would make them even more enticing as targets. We have seen many recent deals in this category, including Samling Global (HK: 3938), CR Microelectronics (HK: 597), Hannstar Board (HK: 667) and Delta Networks (HK: 722).

“Before the deals were announced, their valuations were depressed (i.e. they were trading at low P/B ratios and/or high free cashflow yields) for various reasons; for instance, the companies’ share prices might have been dragged down by scandals involving peers resulting in markets according a discount to the entire sector, unfavorable industry conditions, and low trading volume.”

Here are four of the more notable firms Kim Eng says are potential takeover targets.

CITIC Telecom International (HK: 1883) provides connectivity and value added services to telecom operators with a focus on the China and Hong Kong markets. It operates independent telecom hubs bridging communication standards and protocols between telecom operators.

“As it collects fees from operators for traffic going through its hub, the business offers a very stable income stream. Cashflow from operations was 349 mln hkd last year and it has been pretty stable over the years.”

The stock is currently trading at undemanding valuations with FY11 P/B at 0.96x, and is still 50% below the HKD2.58 it sold at in its 2007 IPO, at which CITIC Pacific pared down its 100% stake. CITIC Pacific still owns 60.6% in the company, Kim Eng added.

“Given its strong, stable cashflows and cheap valuations, we believe there is a chance that some private equity funds may be interested in buying it – a recent example being CVC buying the assets of City Telecom (HK: 1137). As CITIC Pacific would need a substantial amount of investment for its mining projects, it could consider selling the company when price is right.”

Cosmos Machinery (HK: 118) manufactures industrial machinery, plastic products and printed circuit boards (PCBs).

The Tang family owns 42.66% of the company while China Resources Group is the second-largest shareholder, with a 23.98% stake. China Resources injected various assets into the company in 1997 and in return received Cosmos shares.

Cosmos is currently trading at 0.20x FY11 P/B. It listed its 31.6%-owned associate Shenzhen Haoningda Meters on the Shenzhen Stock Exchange in 2010. Its stake is now worth HKD553.1m – 1.75x Cosmos’s own market value.

“Meanwhile, its main businesses had a lacklustre performance last year. Revenue dropped 0.4% while gross profit declined 7.3%. There have been rumors in the past that China Resources may inject more assets or take the company over altogether,” Kim Eng said.

Huiyuan Juice (HK: 1886) is also being squeezed by the competition, and may be taken over sooner than later.

“The major shareholder of Huiyuan Juice, Mr. Zhu, has indicated his intention to sell the business despite failing to do so during the attempted takeover by Coca-Cola in 2008. After several recent successful deals in the consumer sector involving Chinese companies being taken over by global companies, such as Little Sheep’s takeover by Yum! Brands and Hsu Fu Chi’s takeover by Nestle, hopes of new potential acquirers coming in have increased,” Kim Eng said.

Recent market rumours have it that Coca-Cola had contacted the company to revisit the possibility of potential merger. The current market cap of Huiyuan is approximately HKD4b, making a renewed cash offer a lot less expensive than Coca-Cola’s last attempt, the research house added.

In September 2008, Coca-Cola made a conditional cash offer to acquire all of Huiyuan at HKD12.2 per share for a total consideration of HKD17.92b. The offer price was about a 195% premium to the last closing price of HKD4.14. The valuation was very high at about 41x the forward PER at the time. The deal was rejected in March 2009 by the Ministry of Commerce, which said the deal would limit competition in the juice market, forcing consumers to accept products with higher prices and reducing the variety of products available.

Photo: Company

China Dongxiang (HK: 3818) has also been rumored to be a takeover target due to: 1) its poor track record amid intense competition in the industry and frequent changes in management (it has had two CEOs in about two years), and 2) a valuation below BVPS, at 0.62x FY11 PBR, Kim Eng said.

“The owner of the Kappa sportswear brand is less attractive as a takeover target as its brand equity is much weaker than brands like Li Ning, which has attracted TPG and GIC as investors through the issuance of convertible bonds,” the research house said.

Also, the sportswear industry is structurally very competitive and the sector may be in the early stages of a downcycle driven consolidation.

“New investors or potential acquirers may prefer to enter at a later stage when companies are more distressed. Meanwhile, the company has been active in repurchasing its shares (a total of 100m shares, about 1.77% of shares outstanding, were repurchased between 24 Apr 2012 and 4 May 2012 at an average price of just over HKD1/share, on top of another 30m shares repurchased in Jul 2011 which were later cancelled).”

See also:

CHINA SPORTSWEAR Losing Footrace

XTEP: Off And Running After Standup 2011

Juice Wars: PRESIDENT Squeezing HUIYUAN'S Hold Over China

JUICED UP: CHINA TIANYI Crushing Peers In PRC Orange Juice Market