CCBI: XTEP Upgraded To ‘Outperform’

CCB International said it is raising its recommendation on fashion sportswear play Xtep International (HK: 1368) thanks to strong, steady margins and healthy full-year results for the Hong Kong-listed firm.

It is also raising the target price to 4.20 hkd from 3.20 previously.

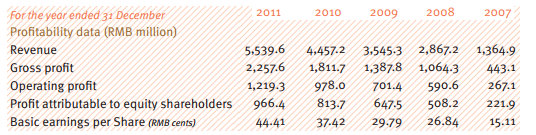

Xtep’s 2011 net profit of 966 mln yuan, up 19% y-o-y, is 3% ahead of consensus on solid trading trends but 2% below CCBI’s estimate due to tax rate differences.

“Revenue growth of 25% and a largely stable gross margin at 40.8% are in line with our forecasts,” the brokerage said.

It added that Xtep enjoys a solid cash flow, and working capital deterioration has been contained.

“The highlight is the better-than-expected improvement in inventory which showed a 25% h-o-h decline,” CCBI said.

Like many peers, Xtep considers 2012 to be a year of de-stocking and adjustments, the brokerage said.

“It has laid out several sensible initiatives and a conservative approach has been taken towards its 2012 sales orders allowing its distributors to work though excess inventory (5x currently).”

To this end, 3Q12 orders saw only a mid-single-digit increase following 9% and 5% growth achieved for 1Q12 and 2Q12, respectively.

“More flexible discounting policies will be allowed on old inventory in the retail channel. Xtep’s store network will also be consolidated with minimal net new openings expected for 2012 (store count of 7,600-7,800 by end-2012 versus 7,600 currently),” CCBI said.

In addition, some of its fourth-generation stores will be upgraded to the sixth generation and sales improvement is expected upon completion of the exercise.

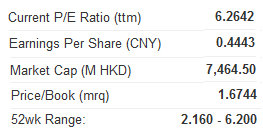

CCBI called Xtep’s current valuation “attractive.”

"This set of results show Xtep’s operation and financials remain healthy despite the industry challenges.

"On our upgraded earnings, the stock trades on only 5.6x FY12F P/E and offers 9% yield. We value it on 7.5x FY12F P/E.”

See also:

XTEP Orders Lead Sector

XTEP: In It For The Long Run With Marathon, Social Media

FIRST SHANGHAI: XTEP Raised To ‘Buy’

First Shanghai said it is raising its recommendation on Xtep International to ‘Buy’ given healthy 2011 results.

“Xtep’s fiscal year 2011 results were in line with expectations,” the brokerage said.

Turnover increased by 24.3% to 5.54 bln yuan and net profit rose 18.8%.

Earnings per share stood at 0.44 yuan with the final dividend per share set at 14.5 Hong Kong cents.

“Product composition remained stable, the gross margin increased slightly by 0.2%. Xtep’s income has shown stable growth over the past 11 years,” First Shanghai said.

Clothing and footwear accounted for 53.3% and 44.9% of revenue, respectively.

“High-end sportswear market competition is relatively intense. Xtep continues to benefit from improved gross margins of apparel products.”

The target price is set at 3.92 hkd.

See also:

XTEP: Fashion Sportswear Co's 1H Net Soars 25% To 466 Mln Yuan

XTEP, INTIME, LE SAUNDA: What Analysts Now Say...

Goldman: Maintains ‘Neutral’ Call on Xtep

Goldman Sachs said it is maintaining its ‘Neutral’ recommendation on fast-rising fashion sportswear enterprise Xtep International (HK: 1368) thanks to the Hong Kong-listed firm’s “in-line” 2011 results, while giving the counter a 2.3 hkd target price.

Xtep’s 2H11 net income of 499 mln yuan (+13% y-o-y) was 6% above/’in line’ with Bloomberg/GH estimates. Sales rose 23% y-o-y, driven by a 27% growth in Xtep brand products (order growth: 24%), Goldman Sachs said.

The operating profit was 7% above Goldman Sachs’ estimates, primarily driven by lower-than-expected A&P spending.

On the balance sheet side, inventory days decreased by 18 days and AR days increased by four days compared with the end of 1H11. Operating cash flow turned positive (2H11:539 mln yuan vs 1H11: 335 mln), thanks to working capital improvement.

The company declared a final dividend of HK$14.5cents/share. Xtep also announced its 3Q12 order book value rose by mid-single digits y-o-y.

“We maintain our ‘Neutral’ call as 2H11 results and 3Q12 order growth both suggest Xtep’s businesses are more resilient than peers including Anta, 361 Degrees and Peak. This is possibly explained by the company’s somewhat differentiated marketing strategy with an emphasis on entertainment.

Key upside risks on the horizon include better-than-expected end-demand, while downside risks are slower-than-expected channel inventory clearance.

See also:

MING FAI Gets ‘Buy’ On Retail; TIANYI ‘Positive’ On Strong Earnings

KINGSTON: GIORDANO Target Set At 7.28 hkd

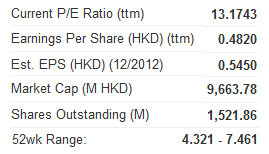

Kingston Securities says it is setting clothing retailer Giordano Ltd’s (HK: 709) target price at 7.28 hkd, representing a 15% upside to the current 6.36 hkd level.

The Hong Kong-listed fashion clothing and apparel brand saw sales increase by 18.7% y-o-y to 5.6 billion hkd in 2011, in which sales in Hong Kong and Taiwan rose 21.6%.

“The group claimed that the slowdown in customer demand in Mainland China, as well as the floods in Thailand, reduced its sales growth rate,” Kingston said.

Sales in the fourth quarter last year were also impacted by the closure of a major store in Hong Kong due to a high rental increase.

“Reduced sales from this closure have been partially offset by improvements in the sales efficiency of the remaining stores with sales per sq. ft. rising by 26.6%. Giordano continues to invest in expansion programs, adding 184 stores in Mainland China in the year, taking the total number of Giordano stores world-wide to 2,671.”

Operating profit in Mainland China last year decreased by 7.7% to 265 million hkd with the operating margin decreasing by 3 percentage points compared to last year.

Meanwhile, same store sales growth expanded by 10%.

The number of days of trade receivables was 40 days, while the number of days of inventory rose to 39 days, partly due to slowing demand in Q4 2011, and it is expected to improve in Q2, the brokerage added.

Kingston’s buy-in price for Giordano is 6.4 hkd, the target price is 7.28 hkd and the stop loss is recommended at 6 hkd.

See also:

How To Cash In On China’s Domestic Consumption Craze

Time To Consume PRC Consumer Plays