Photo: BlueFocus

Translated by Andrew Vanburen from a Chinese-language blog in Sinafinace

WONDERFUL SKY FINANCIAL (HK: 1260) is about to go public in Hong Kong.

This wouldn't usually warrant much of a headline other than the fact that it will be the first PR/investor relations firm to list in Hong Kong.

But investors should not blindly jump on board, thinking they've found a first-floor opportunity in a growing industry.

Instead, shareholders thinking of throwing their lot in the Wonderful Sky ring should tread carefully.

That's because it is heavily reliant on helping firms list to make its living.

And frankly, we simply don’t know enough about the listing environment in Hong Kong this year to be able to accurately predict the fate of this pioneering firm.

First of all, a bit of background on Wonderful Sky Financial.

Retail subscriptions opened on Monday for the firm’s planned March 30 listing in Hong Kong, with some 375 mln hkd in proceeds targeted.

According to the firm’s listing prospectus, Wonderful Sky’s shares will be traded in board lots of 2,000 each with a total of 250 million shares on offer, with 25 million of these designated as Hong Kong offer shares and the remainder as international offer shares.

The maximum offer price per share is set at 1.50 hkd, with Oriental Patron the sole sponsor and UBS and Haitong also playing roles.

As for Wonderful Sky’s revenue reliance on providing PR and IR consultancy services to firms on the verge of going public, it stood at over 46% of the top line, contributing some 270 mln hkd last year.

In its prospectus, it added that of the 90 or so IPOs in Hong Kong last year, Wonderful Sky provided public relations consulting services to 13 of these, including New China Life (HK: 1336).

Trying to assuage worries about the firm’s heavy dependence on the need for a steady stream of IPO clients, Chairman Liu Tianni said in the listing document: “I believe the Hong Kong IPO market this year will be better than last year," adding that the PR firm currently had “dozens” of IPO candidates in its pipeline.

But recent timidity on the part of Wonderful Sky’s clientele has some doubters pointing toward a possible overreliance on the IPO crowd for a big chunk of revenue.

Two examples include last-minute decisions by big ticket clients like China Everbright Bank and Xuzhou Construction Machinery Group last year to shelve listing plans amid tepid market sentiment and a spate of volatility.

To help sweeten the deal for potential investors, Wonderful Sky has already stated an intent to repay as much as 50% of profits to shareholders as dividends.

As for the firm’s post-public push, it would be looking to Mainland China to secure growth opportunities down the road, stating it would use 40% of IPO proceeds to explore expansion in the PRC via M&As or other tieups.

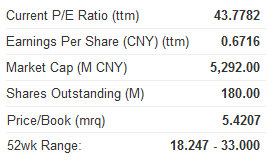

This would pit it against Beijing-based powerhouse BlueFocus Communication Group (SZA: 300058), a 5.3 billion yuan market cap PR firm that two years ago became the first such firm to list in the PRC.

And now Wonderful Sky aims to be the first Hong Kong-based PR firm to list in the Special Administrative Region.

However, the company’s enduring challenge will be to not only ensure that it can win over enough IPOs to its pre-listing consultancy services, but that there will in fact be enough IPOs on the docket this year to sustain its revenue growth rates.

Because Wonderful Sky is somewhat unique in focusing almost solely on pre-listing PR and IR services to clients, it is missing out on the steady, longer-lasting and more stable revenue streams that other PR and IR firms gain from a virtual lifetime of contracted consultancy services.

Therefore, investors should not only keep one eye on Wonderful Sky’s past performance, but also monitor the IPO landscape going forward before tossing the dice on Hong Kong’s first listed PR play.

See also:

BLUEFOCUS: PR/IR Play Reaped 100% Gain In Net Profit To 121 M Yuan

China IR Firm BlueFocus Nearly Triples Its 3Q Revenue

BLUEFOCUS: China PR Firm Share Price Up Over 56% Since End-Feb Debut!