Translated by Andrew Vanburen from a Chinese-language piece by Dazuiba Diantai in Sinafinance

TOO MUCH OF a good thing isn’t always a bad thing after all.

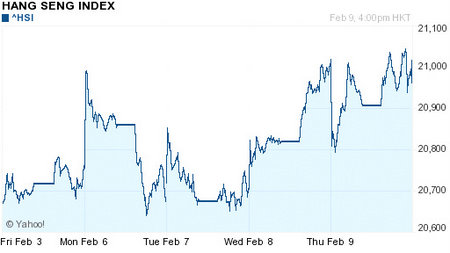

The Hong Kong stock market is trading at six-month highs with daily turnover the most robust since mid-December.

But the benchmark index is set to head even higher as soon as some of the window shopping funds jump in.

The main driver in both A-share and Hong Kong capital markets – two bourses inextricably intertwined by the sheer number of PRC-based firms listed on the latter mainboard as well as cross-border investment volume – is undoubtedly the remarkable success of central bank policy in Beijing these past several months in nipping inflation in the bud via monetary policy.

That being said, the consumer price index (CPI), the broadest measure of inflationary growth, did rise 4.5% year-on-year, a slight upside surprise.

Nevertheless, the Hong Kong stock market continues to steadily gain ground, with many analysts chalking up the CPI uptick last month to “irrationally exuberant” consumer behavior by Chinese New Year celebrants and the more than willing price hikes the F&B industry put into play.

The frantic raft of pro-growth policy moves by Beijing on Thursday – just prior to the release of January inflation figures – also helped spur late week confidence in Hong Kong.

Thursday thus marked an important day in the current standoff between the bulls and the bears, and thanks to the news on the policy front, it seems as if the former emerged victorious – for now.

Market watchers say that the potential for even more bullish bourse behavior is strengthened by the absence of a sizable number of funds currently sitting idle on the sidelines and looking for more upside indicators.

With the enviable performance of the benchmark Hang Seng Index year-to-date, it is highly doubtable that thinking minds behind these myriad funds will wait much longer to ride the current wave.

In fact, if the normal population of funds were all in, analysts expect the benchmark index would have little trouble surpassing the 21,800 mark.

For reference sake, Hong Kong shares closed down 1.1% on Friday to close at 20,784, still up a fair spell from the 18,434 achieved on the last trading day of 2011.

So what is holding these timid invetors back, and forestalling an even stronger recovery for the main Index?

All the hesitation on the sidelines is almost certainly the result of past experience, and the wounds sustained from the 20% fall last year have not fully healed for many.

Therefore, if some of the shell-shocked funds still recovering from recent losses can get back on the horse and ride back into battle, there is much less of a downside risk in terms of unpleasant surprises on the policy front or disappointing earnings among key counters.

After all, in the holiday shortened month of January, the Hong Kong market already regained 14% of its value, reclaiming most of the territory ceded last year.

So it shouldn’t be too much of a stretch to see a full recovery this year.

That is, provided the hesitant funds decide the water isn’t so cold after all.

See also:

Two Different Drivers In Hong Kong’s Ongoing Mini-Bull

Hong Kong Developers On PRC Bargain Hunting Spree

ALEX WONG: Don’t Let Gyrations Make Gamblers Of Us