This article was recently published on www.nracapital.com and is reproduced with permission.

Jaya Holdings reports strong Q1-2013 results as earnngs recovery continues.....but there could be more good news for my Stock Pick

Jaya Holdings, one of my Stock Picks, has reported a good set of Q1-2013 results.

In a recent investment seminar organised by ShareInvestor, I highlighted Jaya as one of a few companies which I expected would report improving earnings despite the gloomy outlook for the Global economy.

Key highlights of the results:

a) revenue for Q1-13 rose 36% to US$36.7mn

b) gross profit was up 40% to US$12mn

c) Pretax profit rose 104% to US$10.3mn

d) net attributable profit rose 113% to US$10.13mn

e) the results were boosted by a reversal of an impairment charge of US$1.45mn

f) gross cash was US$183mn down from US$200.4mn in Q1-2012

g) Long term debt down to US$181mn down from US$196mn

h) EPS was US$ 1.31 cents while NAV was US$65.8 cents

Commentary

The recovery in the OSV charter market continues with only one vessel sold this quarter similar to Q1-2012. But at the charter side on the same fleet of 28 vessels, charter utilisation was more than 84% compared to 65% while charter rates also improved.

This recovery materialised in the second half of 2012 and should continue into 2013 with a growing preference among charterers for newer vessels which favours Jaya.

The company has also announced that its raising a new US$150mn loan facility. This facility will allow Jaya to retire its existing debt - the existing long term debt was preventing Jaya from paying dividends to shareholders through its loan convenant.

This is good news as investors can expect Jaya to start paying dividends as the new loan facilties do not have this restriction. However, while there is no penalty for early redemption of the loan - the cost of funds for the new loan are higher than the old facility.

I think we can continue to expect good news from Jaya in terms of a steady business recovery from both utilisation and charter rates boosted occassionally by vessel sales and, finally, dividends.

I have been recommending Jaya for some time because it's been significantly undervalued but a combination of financing problems and problems with its previous controlling shareholder have undermined its stock performance.

The shares are now set to resume a steady recovery to match that of its peer group. Retain in my Stock Picks - if you don't own the stock, its time to accumulate below the $0.60 level. As to my price target - please check my Stock Picks section.

Recent story: @ JAYA's AGM: Business transforming in the right direction

Comments

Where do you retrieve the information for the delivery date of the 2 vessel?

An astute market trader shorts a counter when it's operations and financials are on a declining trend and facing unfavourable contingencies at the horizon, and will buy a counter on contra when it is on the ascendant. I hope your idea to "short" the counter was given in jest and that no such action was actually taken because Jaya's prospects are on the ascendency and at close of 21 Dec 12 it's price has already risen to 0.61 after DBS Vickers issued a BUY call to its clients (target price 0.85) on the same day.

On 29 Nov 12 the group delivered a 16,000 BHP high end technically specified AHTS (Jaya Supreme) to Canadian operator Atlantic Towing with another similar ship to be delivered in November 2013. Vessel sales for 2nd Q 2012 is expected to generate revenue of US$95m and a gross profit in the region of US$35m-40m, which will probably catapult its half year net earnings to at least US$50m. I am expecting management to declare an interim dividend, perhaps at even $0.05 in their coming announcement in early February 2013. However, given the sentiments and DBS Vicker's bullish call, the counter may have reached above 0.70 by that time.

Whenever this person issues a buy call, the stock's price starts to decline. Not sure if it is co-incidentally or what. one thing, the next time he call for a buy, i will short the counter. We need more people like Muddy Waters .

Cheap will get cheaper. I will buy more when the market decides that the shipping industry turn around. Doubt any soon.

Huat ah!

(1) The recent credit facilities of US$150m has a higher rate of interest than that which Jaya is paying under the soon to be replaced Debt Scheme. This is not necessarily a bad thing. In fact, that action is telling us that for the current financial year (and the years to follow thereafter) profitability will be greatly enhanced that the extra interest cost would become insignificant relative to the surge in profitability. The new management is confident enough to pay a higher price for the funds based on their profitability forecast and in exchange for a dividend yield (the majority institutional stakeholders needs to add on to their total composite ROI for distribution to their stakeholders).

(2) Q1 for YE 30 Jun 13 ended with a net profit of US$10.1m. It can safely be assumed that the figure will be maintained at the same rate at the minimum bearing in mind the group has a backlog of US$196m in chartering income to be booked. On top of the sale of 3 vessels at US$95m will be booked in Q2 figures. Another 3 vessels would be due for completion by Q4 and another 6 from 2014 onwards.

(3) Currently Jaya's NAV is standing at US$0.66 cents (S$0.80) per share. The 12 vessels under construction would add approximately US$250m in value making RNAV at US$0.98 (S$1.20) per share. Its current share price is between the 0.55 - 0.60 range which is at a discount of 25 % to its NAV and a tremendous discount to its RNAV. With a potential dividend in the pipeline (my anticipation is S$ 0.05 at the least) the current stock price is considered cheap when compared to its peers.

I hope to have answered Jeanne's query, especially the contents at point no. (3).

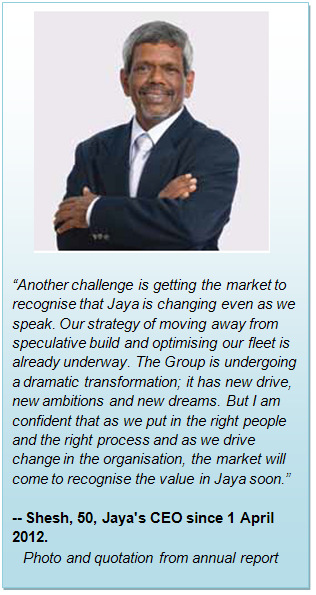

the previous CEO payroll more on fixed payment while current CEO payroll high percentage on bonus.. meaning if CEO can perform better, more bonus.. i think the CEO bonus somehow will link to their charter rate..

I will buy more when it is below 50cents. down 4.3% today. Huat ah

I'm glad you have a more optimistic regarding Jaya than a lot of other retail shareholders. Your expectations will be fulfilled in the coming months.

Based on current developments and operational statistics (provided no other major international business disruptions to cause another downward slide for crude oil prices) I forecast the group to achieve a net profit figure somewhere between US$60m-70m for the YE 30 Jun 2013. and if the loan roll-over is completed within the period a dividend of about 5 cents (bearing in mind the institutional majority shareholders need to show returns on their investments).

JAYA is not a stock for trading, in my opinion. At the current level, it's a buy & keep for significant capital gain in the months ahead. It won't be 50 cents in Jan 2013 but higher than current level of 58 cents. Just my 2 cents' worth

One quarter does not tell the whole story.

Wait, if someone keeps pushing stories for people to buy into the stock, they want to offload some and then reaccumulate again later.

See you at 50 cents in Jan 2013!

The main "fault line" was that while previously its emphasis was more on speculative built-and-sell program (not a wrong strategy as the price of crude oil was then hovering above US $150 per barrel and demand for new OSVs were outstripping supply) its financial cash flow was not concomitantly designed to cushion an unexpected cash call. The group was therefore caught offguard during the financial meltdown of 2008-2009 when banks started recalling credit advances that were unsecured and repayable on demand. Had the group taken their bank facilities on a well defined repayment term period, none of this problem would have arisen. Take for example ASL Marine, which had an even higher loan liability to the banks but which sailed through the crisis period unscathed because their bank debts had a defined repayment schedule, unlike Jaya's which was repayable on demand (a very risky form of credit liability since the banks can recall on 7 days' notice and the borrower's business is an ongoing long term affair which cannot afford the banks to pull the rug at their discretion). Perhaps the previous management had opted for such faciliies because they were given on a clean basis and not collaterised, and similarly, the very reason the banks started recalling the facilities when there was a credit crunch. Another point of contention was the finance director's heavy involvement in the foreign exchange and derivatives market to hedge against their currency risks (their operations were booked in S$ but their operational transactions were in US$).

Notwithstanding the unfortunate episode, the group is now well poised to meet future challenges, having taken changes to meet changing industry conditions. Their reporting currency is now in US$ which is more in line with its operational currency and hence obviating exchange risks. The business strategy has switched to more stable recurring revenue streams from time charters, and, in addition to building new vessels for both its chartering needs as well as clients', they are also opening up to ship repairing as well. The tie-in with IHC Merwede will see more tangible results over the mid to longer term when the orders for more high-end technically specified vessels come in.