The following article by Sim Kih of NextInsight was published in the 2Q2012 edition of the CFA Singapore newsletter, and is reproduced here with permission. Visit www.cfasociety.org/singapore

He heads the CFA Institute’s education division, which formulates the CFA program curriculum and exam.

What are the typical irregularities that show up in the statutory reports filed by listed companies that get embroiled in accounting scandals?

Dr Tom Robinson, CFA, CPA, CFP managing director of CFA Institute’s education division, was in town for the 50th anniversary celebrations of the CFA program and shared with about 150 fund managers and other investment professionals some red flags one should look out for when investing.

FINANCIAL STATEMENTS have in-built checks and balances to limit the accounting games that companies can play.

One can massage the profit and loss numbers, which are what media reports focus on. However, one can’t manipulate one financial statement without affecting the others.

So what does this mean for unscrupulous managers?

For example, if one tries to book revenues with no corresponding sale transaction, earnings and retained earnings will be overstated.

The balance sheet will then not reconcile the accounting equation of assets = liabilities + owners equity.

Then, one has to either overstate one’s assets, or understate one’s liabilities.

Typically, the accounts receivables will then be overstated, as this item would then include sales that would not eventually result in cash inflow.

So, an accounts receivables entry growing faster than sales should always raise eyebrows.

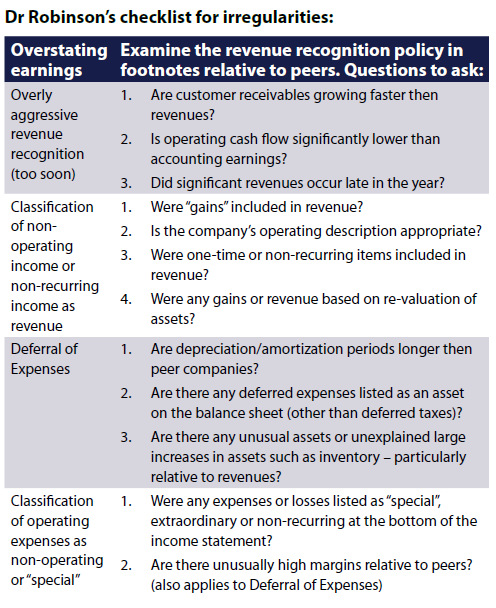

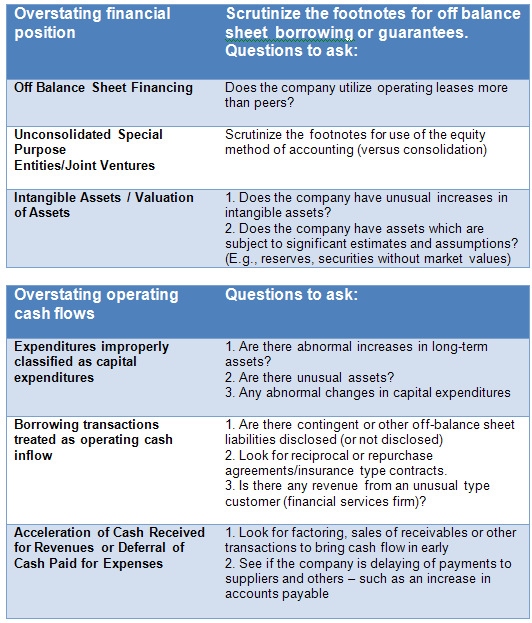

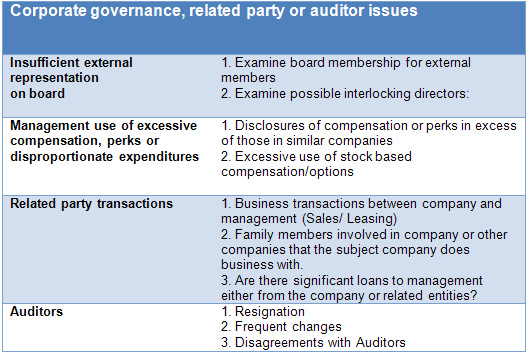

Overstatement of earnings, financial position, operating cash flows as well as the existence of poor corporate governance, related party or auditor issues are some irregularities that should raise eyebrows if they show up in a company’s financial statements.

He is the founding partner for Apollo (Singapore), one of the largest private equity funds in Singapore.

Dr Robinson’s framework for forensic accounting was illustrated with two case studies (China Forestry and Chaoda Modern Agriculture) by Tan Chin Hwee, CFA, CPA.

Mr Tan tells investors that numbers only tell half the story.

It was important to understand both economic and political nuances. It was also important to ascertain the ownership structure of a company’s support network as distribution networks and supply chains are potential avenues for pilferage of cash.

China Forestry

China Forestry is one of the three largest privately held forest operators in China with 172,000 hectares of reported forest land.

It started operations in 2003, when the government allowed forest assets to be transferred. Founder and Chairman Li Kwok Cheng is a member on the China Council for Promotion of Environment and Forestry.

The company raised US$85 million in pre-IPO financing from well-known private equity investors between December 2007 and June 2009.

On 3 December 2009, the Company listed on HKSE and raised US$230 million. In November 2010, China Forestry issued US$300 million in high yield notes.

On Jan 31 2011, China Forestry announced that possible irregularities have been identified by auditor KPMG.

The shares have been suspended from trading since. CEO Li Han Chun was removed from his position on Feb 2011 and detained for the embezzlement of Rmb 30 million (S$5 million).

After a preliminary investigation, the auditor discovered that cash proceeds from sales transactions were not deposited into the company’s bank accounts.

Not all sales transactions were recorded. Pilferage was happening on a wide scale.

The management had maintained more than one set of accounting records and falsified documents, including management accounts, harvesting records, logging permits, bank statements.

Was there anything that could have triggered suspicions that all was not as it seemed?

The Warning Signs

Firstly, the company generated significant positive net profits almost entirely from non-cash revaluation of plantation assets at the time of acquisition.

Secondly, the timing of the bulk of the revaluation in 2008 coincided with the main reporting period for the IPO in 2009.

Given the political sensitivity of farmland ownership in China, the appearance of being allowed to get away with buying farmland on the cheap and then booking a RMB 6.6 billion (about S$900 million) profit due to revaluation was a big red flag.

Lessons Learnt

Businesses based on biological assets with long-dated harvesting periods are more susceptible to earnings manipulation.

The lack of an independent third party or regulator who can verify transactions and holdings should raise investor skepticism.

Secondly, knowledge of intangibles like the political landscape can help draw attention to red flags.

For example, the revaluation of farmland during a period when income inequality has become a politically sensitive issue would have led to further questions on the veracity of the business model.

Chaoda Modern Agriculture

Chaoda is the largest public agricultural company and has a production base of 44,000 hectares. It was listed on the Hong Kong main board in 2000 with a peak economic value (EV) of US$3.7 billion.

Its EV was US$75 million just before it was suspended.

The company consolidates small pieces of farmland from farmers into large parcels, increasing yield by upgrading infrastructure, diversifying the product line and bypassing the middle-man.

Farmers are hired back and paid a salary to grow a variety of vegetables on the new and improved land.

The chairman was its key shareholder with a 20.6% stake, followed by Janus Capital (8.9%) and Blackrock (5.5%).

Chaoda reported revenue of US$600 million with EBITDA of US$300 million for the 6 months ending December 2010. Both revenue and EBITDA grew at a compound rate of 30% since 2001.

It had cash reserves of US$607 million and an outstanding convertible bond of US$200 million issued in August 2010 (5-year 3.7% coupon with strike 5% discount to market and 7% premium to equity offering).

Chaoda Chairman Kwok Ho, its Chief Financial Officer Andy Chan and Fidelity Management’s George Stairs were accused by the Hong Kong Market Misconduct Tribunal of insider trading on September 23 2011.

On September 26 2011, the Company requested for a trading halt and trading of the shares has remained suspended since.

Also on on May 26, Next Magazine had put out a report alleging that Chaoda had overstated the farmland under its management.

Anonymous Analytics subsequently made a similar accusation.

Red flags

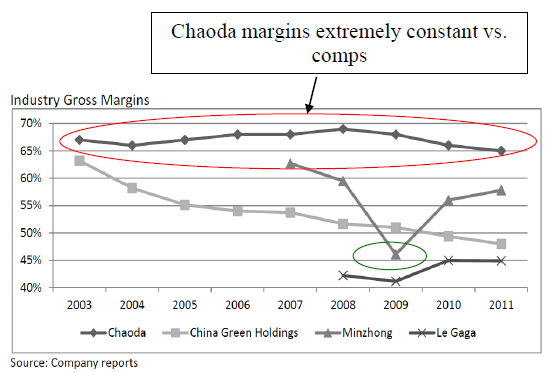

Chaoda’s gross margins were about 67% from 2007 to 2009. It appeared to manage its gross margins very well compared to competitors, and generated margins above 65% for 8 years.

In contrast, Minzhong, which was in the same business, saw its margins fall from 63% to 45% over the same period. China Green’s margin also declined from 64% to below 50% over the same period.

Four auditors since listing

Chaoda’s auditor, PWC, resigned in 2001. CCIF was its 2nd auditor and was replaced in 2007 by Grant Thornton. BDO took over in December 2010.

The company has yet to release its financials for 30 June 2011 and 30 Dec 2011. This, along with the frequent change in auditors, is a strong signal that it has some financial issues.

Related-party transaction

Fertilizer is the largest component of Chaoda’s raw material costs (~30%). Unlike its competitors, Chaoda’s fertilizer is sourced from a single source – Fujian Chaoda, which is owned by the Chairman and is outside the listco.

Since 2001, about US$500 million of fertilizer has been purchased from Fujian Chaoda.

While there is no evidence that Chaoda overpaid for its fertiliser, it is difficult to authenticate the payment.

Given that the Chairman controls both companies, this is an easy way for the management to pilfer cash.

Lessons Learnt

Frequent auditor resignations are a red flag that should not be ignored.

It can point to some fundamental difficulty with the company’s internal controls. Related party transactions are always something that investors should look out for.

The supply chain or distribution network of a company is the easiest way for management to funnel cash out, so a check on the ownership is a must during due diligence.

A comparison of the gross margins to those of peers should have called the business model into question due to the divergence in performance when compared to peers.