Source: annual report (DFZ became part of DFI last year)

Venue: 6 Battery Road.

Time & date: 2 pm, 27 June.

THROUGH A reverse takeover of Esmart Holdings, Duty Free International (DFI: recent market cap of S$345 million) emerged on the Catalist of the Singapore Exchange in January 2011.

The group operates in Malaysia where it is the largest duty-free trading group -- a positive cashflow business that will see a gush of cash flow in from an impending sale of a major property.

During the reverse takeover of DFI, a major duty-free zone in Johor Bahru (Zon) was injected into the group at a value of RM200 million.

The Zon is one of Malaysia’s largest duty-free zones with a gross floor area of about 1.6 million sq ft.

Subsequently, in February this year, Berjaya Assets, a listco in Malaysia, offered to buy The Zon for RMB325 million, which is at a premium to an independent valuation of RM286 million on 31 May 2012.

At the AGM, shareholder Stephen Yeo asked why DFI was proposing to sell out "so fast" instead of waiting for an even higher price when the Singapore MRT system could be extended to Johor Bahru by 2018.

Noting DFI's purchase price of RM200 million and its sale price of RM325 million, executive director Lee Sze Siang said: "The board feels this is a good return."

He added that DFI's business in The Zon would not be compromised, as DFI will retain the duty free business within The Zon for a period of 25 years and will continue to operate from there.

At the EGM following the AGM, shareholders went on to approve the sale.

In addition, shareholders approved the sale of an adjacent plot of land for RM27.99 million, which is a whisker lower than its independent valuation of RM28 million on 31 May 2012.

The 2 disposals are subject to approval by the Johor government.

The completion of the disposals will be within three months after all conditions have been met.

Not surprisingly, investors wondered what DFI would do with the gross proceeds of RM352.99 million.

According to the circular to shareholders, the monies will be used as working capital of the group and for investment in any new business opportunities that may arise.

Shareholder Stephen Yeo asked if a special dividend would be declared.

Executive director Lee Sze Siang: "The board will deliberate on this."

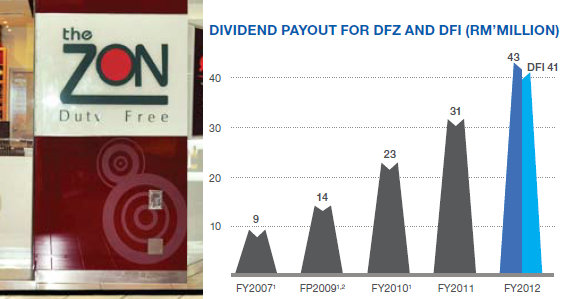

(In the last financial year ended Feb 2012, DFI paid dividends in 3 out of 4 quarters, totalling 1.5 cents a share. In its previous incarnation as a listco on Bursa Malaysia, it was also paying regular dividends.)

Shareholder KC Chiang asked when the disposal might be completed. Mr Lee replied: "Hopefully, by early next year."

Berjaya's intent for The Zon is unknown but a good guess is, based on the big sum it will pay for the asset, it would seek a good return by enhancing the traffic through it.

The Zon comprises a shopping mall, restaurants and a hotel (The Zon Regency Hotel by the Sea), and an international ferry terminal.

If the shopping bustle is enhanced at The Zon, DFI's business can only grow.

DFI generates about RM60 million in revenue a year from The Zon with a profit margin of around 10%.

As a group, DFI recorded net profit of RM66.9 million in FY2012, which is a massive 81% jump largely because of one-off expenses incurred in FY2011.

Revenue in FY2012 was stable at RM563 million, down 1.8% year on year.

Postscript: Based on my inquiries, there is no linkage between DFI and Berjaya Group buying a big stake in Atlan Holdings (the 81% owner of DFI). Berjaya is getting exposure to DFI in an indirect manner. Berjaya looks to be a passive investor in Atlan even though it now holds 9% of Atlan and is the midst of a married deal to buy another 15% of Atlan from an existing shareholder. Berjaya does not have a board seat on Atlan.

Read postings on Duty Free International in our forum here.

Previous story: Duty Free International: Independent director accumulates shares