ELEKTROMOTIVE GROUP is loss making and illiquid with a tiny market cap of only S$13 million and a stock price of 0.3 cent

It has an unusual business on the Singapore bourse: manufacturing devices for charging electric vehicles with models for public as well as home use.

It has an installed base of over 3,000 charge points, and exports its devices to about 20 countries.

Formerly known as Lexicon, the company was renamed Elektromotive in July 2011 after it acquired a 51% stake in Elektromotive, a UK-based provider of technology and engineering solutions for electric vehicle recharging stations.

The subsidiary, established in 2003, has sealed contracts with the UK government and Hong Kong’s China Light & Power for its fast charging Elektrobay units.

According to global cleantech intelligence company Pike Research, Elektromotive is the no.1 European electric vehicle supply equipment vendor and ranks number three globally.

For the financial year ended 31 March 2012, the Group's net loss attributable to shareholders widened to S$13.6 million from S$5.4 million in FY2011.

The group lost S$716,000 before accounting for interest and taxes for its business on electric vehicle charging poles and another S$129,000 from its publishing, exhibition and events segment.

But if the electric vehicle market takes off the way industry watchers expect it to, Elektromotive could ride on a revolution that addresses the world’s depleting store of fossil fuels.

Global energy consumption today is largely dependent on fossil fuels such as petroleum and coal (accounting for 87% of fuel resources), but this is unsustainable economically, environmentally and socially in the long run.

What governments and environment groups are doing to address this is to push for use of electric and plug-in hybrid vehicles through incentives and subsidies.

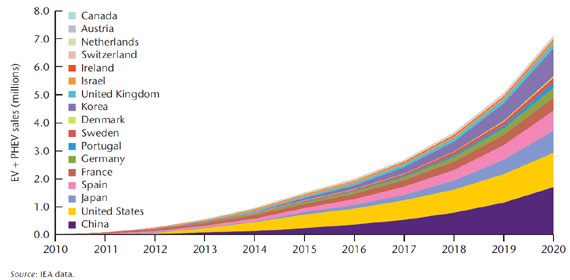

Electric vehicles contributed only 0.1% to global automotive sales last year, but IDC Energy Insight expects this to increase to 1.3% or 2.7 million cars by 2015.

As a cleantech alternative, such vehicles are able to consume electricity from a wide range of sources, including fossil fuels, nuclear power, and renewable sources such as tidal power, solar power, and wind power or any combination of those.

The big boys certainly believe that the electric vehicle will take off as technology and infrastructure hurdles are overcome.

Major automotive brands, including Toyota, Renault, BMW, Honda, Ford, Audi, Mercedes-Benz and Volkswagen, are already producing electric vehicles to widen the offering for consumers.

PayPal founder Elon Musk is also a believer. He co-founded Tesla Motors in 2003 to manufacture electric vehicles, and the company is now worth more than a billion dollars on NASDAQ.

Currently, the major barriers to mass consumption are ease of recharging the vehicle, cost of purchasing an electric vehicle and the range of vehicle models.

On Mon, Elektromotive announced a joint venture to improve the infrastructure landscape for electric vehicles.

It is collaborating with Charge Your Car (North), which operates a network of 400 electric vehicle recharging points in England, to add 10,000 public access pay-as-you-go charge points located across the UK.

”We hope to create the UK’s largest pay-as-you-go, open source network of public access charging stations for electric vehicles using proven pay-by-phone technology,” said executive vice chairman Ricky Ang.

By "open source", Mr Ang means any electric car battery manufacturer can be included in the network if they use the industry standard 'Open Charge Point Protocol'.

Related story: Insider Buying: GK GOH, ELEKTROMOTIVE, XMH, SING HOLDINGS