This article was recently published on Calvin Yeo's blog, www.investinpassiveincome.com, and is reproduced with permission.

RECENTLY, ONE OF my readers asked me whether I would be interested in Felda Global.

I replied that I am not interested as the dividend yields are low, below 4% which is lower than the other primary palm oil producers and that it has rather high political and execution risks.

There seems to be a lot of excitement around this IPO, and for good reason as the $3.2 billion Felda IPO is probably going to be the world’s second largest IPO of this year.

The IPO is several times oversubscribed and will probably be priced at the top end of the price range of RM 4 to RM 4.65 per share.

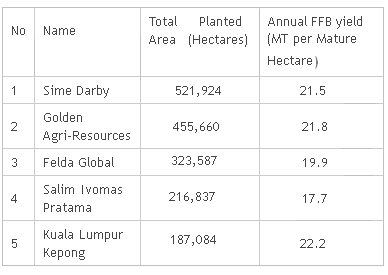

Currently, Felda is already the third largest palm oil producer in the world in terms of planted area, behind Sime Darby and Golden Agri Resources.

However, the annual FFB yield is lower than most of the other producers.

Here’s a brief look at the top 5 palm oil producers (see table on the right).

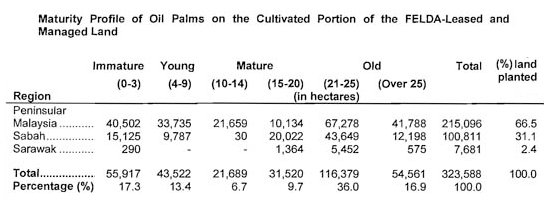

To further understand why Felda’s FFB yield is lower than the average, we have to look at the maturity profile of the palm oil plantations.

The average age of Felda’s plantation is around 20, compared with Golden Agri which is around 12.

That means that many of Felda’s plantations are past prime and replanting will have to occur.

Replanting will incur substantial costs and it will take at least 2.5 years before the trees start bearing fruit. It will take at least 9 years before they reach maturity for peak production between years 10 to 20.

Overall, plantation investing is mainly about investing when majority of the plantations are immature and young and then ride the growth as the plantations ramp up production during the mature years.

We can see from the chart above that more than 50% of the plantation are past prime of above 20 years. Felda also suffered from a history of lower yields compared to its competitors. Operationally, it does not make much sense to invest in Felda.

Recent story: CALVIN YEO: The rewards of investing in property