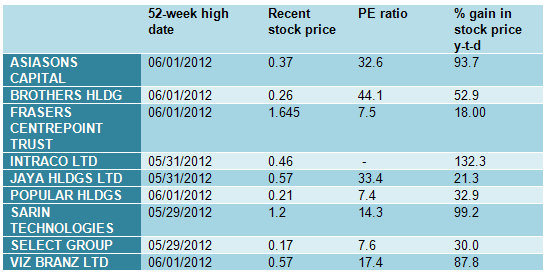

ACROSS THE BOARD, stocks have given up their gains for the year -- but most intriguingly, a bunch of stocks have just hit their 52-week highs!

According to our Bloomberg search, these stocks are sporting year-to-date gains that are sweet or, in some cases, heavenly. Four of them have hit 100% or so returns - Asiasons, Intraco, Sarin and Viz Branz.

Are you fortunate to have any of them? Here are some nuggets of information on them:

>> Asiasons Capital: It is an Alternative Asset Investment and Management group focused on private equity opportunities in emerging East Asia. It recently had a market capitalization of about S$352 million.

Its stock price had languished below the 20-cent level for at least three years until April this year. Then it rocketed up and has since clung to the 37-cent level. It drew a SGX query but nothing material came out of it. Any reader can offer some reasons for the spike up?

>> Brothers (Holdings): It is a Singapore investment holding company which listed way back in 1997. It has property development, investment and management businesses in China.

Its stock, which has been illiquid, ran up after a delisting offer at 26 cents was announced on May 30.

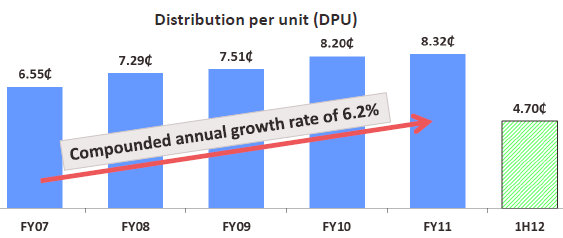

>> Frasers Centrepoint Trust: It is a developer-sponsored REIT with five suburban retail shopping malls in Singapore, including Anchorpoint, Causeway Point and Northpoint.

Its stock is up 17% year-to-date, probably as a result of investors seeking refuge in its decent dividend yield. It still offers a yield of about 6% per annum (see DPU trend below).

>>Intraco: It has businesses in supplying lighting, seafood and plastic products and leasing, managing and operating telecommunications infrastructure.

On May 30, the company’s controlling shareholder, Hanwell Holdings Limited, entered into a sale and purchase agreement to sell its 29.89% stake for $18.28 million.

The purchaser is TH Investments Pte Ltd, which belongs to the controlling shareholder of Tat Hong Holdings, another SGX-listed company.

The transaction worked out to 62 cents per share, prompting the market to chase Intraco stock up to nearly 60 cents from the level of 30 cents or so that it has been stagnant at for the past four or five years.

In the latest news, last night Intraco said Oei Hong Leong, the billionaire investor, has become a substantial shareholder with a 21% stake through open market purchases of 6,780,000 shares at S$0.5003 per share and a married deal for 14,047,323 shares at S$0.50 per share.

What does he see in it? Intraco suffered a net loss of $7.1 million last year after ekeing out a pathetic $378,000 in net profit in FY10.

>> Jaya Holdings: It is an Offshore Energy Services Group providing a wide range of services and solutions to the offshore oil and gas E&P domain.

Earlier this year, it was said to be the target of a takeover. However, the company denied it --- but the stock price has stayed resilient at the 55-cent level.

It is grossly undervalued relative to its assets. Read more about that in: KEVIN SCULLY: "The good, the bad and the possible regarding Jaya"

>> Popular Holdings: It is a publisher and operator of a retail network for books -- and has a property development arm.

Its stock has been relatively stable and has firmed up on significant buying of nearly 14 million shares by the executive chairman, Chou Cheng Ngok, since February this year.

It has a dividend yield of about 5%.

>> Sarin Technologies: Its business is one of a kind on the Singapore Exchange.

It is in the development, manufacturing, marketing and sale of precision technology products for the planning, processing, evaluation and measurement of diamonds and gems.

Sarin is enjoying strong profit growth. In FY2011, revenues rose 27% to US$57.8 million and net profit climbed a faster 56% to US$17.4 million.

Note the amazing 30% net margin, which strongly suggests a high barrier to entry into its business.

The stock has climbed steadily from around 60 cents at the start of the year to $1.18 recently.

>> Select Group: It is a F&B player which counts well-known brands in its stable, including Peach Garden and Stamford Catering.

For FY11, it achieve $3 million in net profit, a record high since its founding in 1991 and a turnaround from the $2 million net loss in the previous year.

Its dividend yield is 2.9% based on a 17-cent stock price. It stock is thinly traded and it has a market cap of just $24 million.

>> Viz Branz: It manufactures and exports instant beverages, mixes, snack food and non-dairy creamer. Its most recognisable brand is Gold Roast.

The company reported net profit of $13.6 million for the 9 months to March 31, up 37% year on year. This was on the back of a 7% increase in revenue to $134.2 million.

The results, coupled with strong buying by its MD, Ben Chng, have sent the stock shooting up from 33 cents at the start of the year to 55 cents currently.

In the past 12 months, Mr Chng has bought nearly 2.4 million shares, raising his direct stake to 50.89%.

Also fuelling the stock price movement is speculation of a takeover, given that Mr Chng has had some legal tussle with his father, Chng Khoon Peng, an executive director and a founder of the company who stepped down as executive chairman down in 2010. (This is reminiscent of the tussle at Hiap Hoe Limited currently).

The elder Chng has even lodged a complaint against his son to the Commercial Affairs Department over a matter.

At 16X historical PE, Viz Branz stock now doesn't look cheap, does it?

Comments

Yawn!

most of them are penny stocks. easy to manupulate and control

popular and sarin seem to be decent companies. did any of you buy these 2 companies?