Value Investor, who used to work in corporate finance and is vested in Jaya Holdings shares, contributed the following article to NextInsight

IHC Merwede, the world's biggest builder of dredgers, had shared in December 2011 that they were keen to acquire a Southeast Asian shipyard.

The Dutch company revealed that it was eyeing targets in Singapore and Vietnam.

President Govert Hamers confirmed their interest in a Bloomberg interview conducted in Singapore as the group sought to be "more cost effective" in serving its customers.

This development was also reported by ASIASIS, the news service for the Asian Shipbuilding industries.

This development was also reported by ASIASIS, the news service for the Asian Shipbuilding industries.

Jaya engages in ship building, chartering, and management businesses. The company is primarily involved in owning and chartering offshore support vessels to industries such as offshore oil and gas, and marine construction.

IHC Merwede, the world's biggest builder of dredgers, had shared in December 2011 that they were keen to acquire a Southeast Asian shipyard.

The Dutch company revealed that it was eyeing targets in Singapore and Vietnam.

President Govert Hamers confirmed their interest in a Bloomberg interview conducted in Singapore as the group sought to be "more cost effective" in serving its customers.

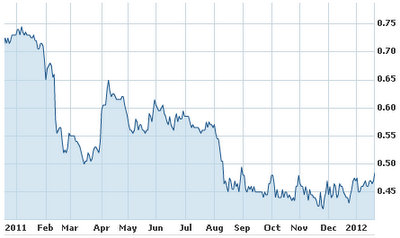

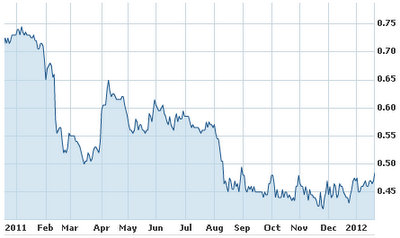

Jaya stock closed at 55 cents today and has a market cap of S$425 million. Chart: Yahoo!

IHC Merwede expects to close at least one deal by Jun 2012. This is in line with the group's plans to expand internationally and grow by 50% in the next five years.

Jaya Holdings is 54.7% owned by Cathay Asset Management, a consortium led by Deutsche Bank.

The consortium acquired the stake from Affinity Equity Partners in February 2011 for S$202.6 million under a loan default.

When Cathay bought the stake, it triggered a mandatory unconditional cash offer for the remaining shares.

As it was a requirement under the rules and Cathay had no intention to privatize Jaya, the offer made was merely procedural.

As expected, the consortium's flimsy bid at a 27% discount to its last traded price of S$0.66 fell through and Jaya stayed listed.

Jaya Holdings is 54.7% owned by Cathay Asset Management, a consortium led by Deutsche Bank.

The consortium acquired the stake from Affinity Equity Partners in February 2011 for S$202.6 million under a loan default.

When Cathay bought the stake, it triggered a mandatory unconditional cash offer for the remaining shares.

As it was a requirement under the rules and Cathay had no intention to privatize Jaya, the offer made was merely procedural.

As expected, the consortium's flimsy bid at a 27% discount to its last traded price of S$0.66 fell through and Jaya stayed listed.

Kim Eng Corporate Finance, the independent financial advisor also advised minorities not to accept the offer then because it valued Jaya too cheaply.

Given Jaya is controlled by a financial investor, there is a possibility that it could be sold "lock stock and barrel" at the right price. Its NAV grew by 16.8% to S$0.72 cents for the financial year ending Jun 2011.

Its earnings was S$0.1086 per share. As Jaya is not in distress and has a much stronger balance sheet today, the Deutsche-led consortium could hold out for a price close to, or even at a premium, to NAV.

So if bidders such as IHC Merwede are serious about privatizing Jaya, a good offer would have to be tabled.

Related report today: JAYA 'likely' to be taken over; STX OSV fair value is $1.60, BROADWAY'S loss 'worse than expected'

Given Jaya is controlled by a financial investor, there is a possibility that it could be sold "lock stock and barrel" at the right price. Its NAV grew by 16.8% to S$0.72 cents for the financial year ending Jun 2011.

Its earnings was S$0.1086 per share. As Jaya is not in distress and has a much stronger balance sheet today, the Deutsche-led consortium could hold out for a price close to, or even at a premium, to NAV.

So if bidders such as IHC Merwede are serious about privatizing Jaya, a good offer would have to be tabled.

Related report today: JAYA 'likely' to be taken over; STX OSV fair value is $1.60, BROADWAY'S loss 'worse than expected'

Comments

There is a difference between treating an investment over a short term and that over a long term. If it is a strategic outlay, then it is treated as an investment (long term assets). If it is invested as a trading outlay, it is classified as "held for sale assets". There is a difference between the two, and it lies in tax liabilities. If the item is classified as investments, any profit arising from its sale is tax exempt because it is a capital gain. If the item is sold within a year or classified as "held for sale assets" any profit arising from its sale is subject to tax. CAM group clearly stated that their purchase of the controlling stake is a strategic one, i.e. mid to long term (and treated as an investment). If it is being sold now it would have to be re-classified as a current asset and any profit from the sale is taxable.

I hope you get a clearer picture of the whole financial perspective on CAM group's stake in Jaya and how it is treated in their books.

Another angle is keeping Jaya listed as Merwede tips in its privately owned dredging business to grow Jaya via a "backdoor listing". This alters the growth profile of Jaya. More importantly, the listed vehicle provides extra funding source to fuel Merwede plans for rapid expansion over the next five years.

1. The Company has previously received an expression of interest from IHC Merwede to acquire certain of the Company’s assets. As at the date hereof, no definitive agreements have been entered into in relation to the sale of such assets, and the Company will provide shareholders with updates if and when such definitive agreements are entered into.

2. Save as set out above, the Company is not aware of: (i) any information not previously announced concerning the Company, its subsidiaries or associated companies which, if known, might explain the trading activity today; or (ii) any other possible explanation for the trading activity today.

3. The Company confirms that it is in compliance with the listing rules, in particular, listing rule 703.

BY ORDER OF THE BOARD

Caroline Yeo

Company Secretary

25 January 2012