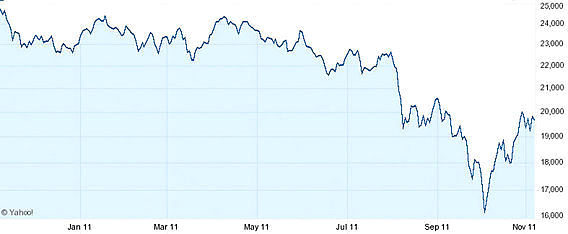

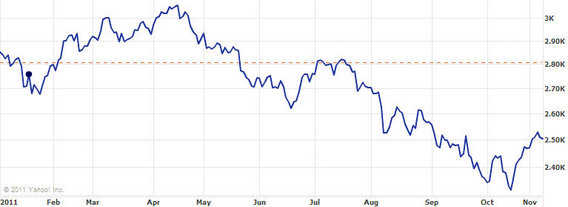

HONG KONG shares have been charging back of late, but A-shares on the Mainland – especially their dual-listed equivalents to Hong Kong that have historically sold at a premium in Shanghai and Shenzhen – have not been so quick to recover.

However, a market watcher believes China shares are set for a sustained bounceback.

A Chinese-language piece in Sinafinance cited a regular contributor as basing the assertion on several factors, which we will get to momentarily.

One clear and present danger for investors these days – whether in Central, Shanghai... or Chicago – is boredom.

It is only natural that the seemingly daily dose of dour news coming out of Europe and North America – particularly the former these days – will become less and less eyebrow raising after a while.

Human nature’s capacity for surprise, aftter all, has its limits.

So when a particular trading weeks kicks off with Greece on the verge of bankruptcy and finishes Friday with pronouncements from Berlin and Paris that in no way can the European Union afford to stand idly by while one of its members goes bust -- the investing world pays attention.

But when on the following Monday the whole cycle begins anew, with Greece threatening to revert back to the drachma and the head of state looking at an early retirement, investors from Hong Kong to Harbin will be excused if they begin stifling collective yawns, the report said.

So now, news that the Eurozone’s No.3 economy Italy is seemingly following Athens down the road to ruin becomes almost anticlimactic, with investors adopting a “been there, done that” attitude to the whole scenario.

But it is perhaps this relative lack of panic, and the understanding that Greece is “small enough to rescue” and Italy is perhaps “too big to fail” that keeps investors’ wits about them, and prevents funds from making a quick and thorough exodus from capital markets the world over.

That is not to say that a market meltdown is out of the question, but the current zeitgeist does seem to point to a manageable crisis in Europe that is gradually being pushed off front pages thanks to daily overexposure and repetitiveness.

So with the daily dose of debt woes as a backdrop, investors in this part of the world – especially in Mainland China – cannot be blamed for showing signs of resurgent optimism.

And data released this week showing the PRC’s consumer price index (CPI: the chief barometer of inflation) rose just 5.5% year-on-year in October – down from 6.1% last month -- is also fueling a more sanguine outlook on growth in the world’s No.2 economy.

However, getting back to the EU, investors are clearly getting bored with news from the political and economic union and perhaps take a somewhat empathetic view of residents and investors there whose fates seem to change every day with all the fairness and consistency of a night at the casino, or a day at the races, Sinafinance said.

That being said, A-shares in Shanghai and Shenzhen are almost certainly primed for a rebound for at least six reasons:

1) A shares haven’t rallied nearly to the extent their peers on the Hong Kong market have of late, an incongruous phenomenon, as A-shares usually bite at any good news bigger and bolder than Hong Kong-listed shares

2) Most of the "bad news" from around the world has already been digested by the market

3) The US economy is performing somewhat better than expected of late

4) EU powerhouse states seem resolved to fix the crisis before it becomes catastrophic

5) A-share markets have been one of the worst regional performers of late, so bargain hunters will not stay out much longer

6) Inflation in the PRC finally appears to be cooling off, raising the likelihood of cheaper credit flooding into more hands – and more stocks

See also:

Counting The Costs Of Living In SHENZHEN

VODONE Target Hiked 75%; QINFA Surges 28% In 2 Days On M&A; XTEP Downgraded To 'Sell'