FOCUS MEDIA NETWORK Ltd (HK: 8112), the largest digital out-of-home (OOH) advertising media firm in Singapore and Hong Kong, is rapidly boosting the size of its “captive audience” in elevator lobbies and leading retail chains across the region.

Established in 2004 and listed in Hong Kong in July of this year, Focus Media Network primarily reaches and targets high-income consumers in lift lobbies of office and commercial buildings in the two markets, selling advertising time on its eye-level flat-panel displays.

"But it is also aggressively targeting the display OOH display market within leading retail chains, including Mannings in Kong Kong and Watsons in Singapore, with plans to soon boost its presence soon in Mannings to 300 stores from 200 currently, the company’s Chairman and CEO PJ Wong told investors.

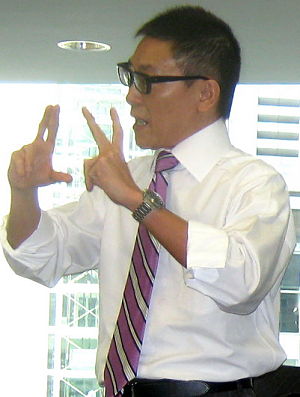

Speaking to investors at an Aries Consulting-sponsored "Company of the Month" event in Hong Kong on Friday, the charismatic and energetic CEO -- the only Singaporean to have started and publicly-listed a media company in Hong Kong -- said: “Our model has been proven in business as well as on Wall Street.”

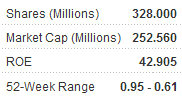

A cursory look at the firm’s current valuation validates this, as the current share price is at 0.77 hkd, or around the mid-point of its 52-week range.

But even more impressive has been revenue growth, which jumped 59% in FY2010 in the Hong Kong market to over 35 mln hkd.

Meanwhile, the top line in Singapore over the same period added 16% to 13.2 mln hkd.

Focus Media Network’s total group revenue for full-year 2010 shot up 45% to 48.5 mln hkd, producing an eye-catching net profit leap of 118% to 11.7 mln.

This all translated into extremely robust margins for the firm, which in 2010 stood at 80% for gross margins and 24% for the net.

And the company expected even better results for the third quarter, which Mr. Wong said would be announced “soon.”

"Due to our unique model of revenue share with our landlord partners instead of paying rental, our gross margins have remained consistent over the years," he said.

He added that the company has a “strong” balance sheet, with cash balance of 19.4 mln hkd plus net proceeds of 43.5 mln from a private placement on July 28 of this year.

FOCUS not Myopic

Although Focus Media Network is currently focused primarily on the OOH markets in Singapore and Hong Kong, it doesn’t intend to limit itself solely to these two major metros.

“We are targeting to become the first pan-Asian digital OOH company,” Mr. Wong said.

And judging by the firm’s rapid penetration into new regional country markets, it shouldn’t be too long before the goal is reached.

“We have already begun implementing our brand footprint mapping of Focus Media’s business model in several countries,” he added.

In addition to Singapore and the Special Administrative Region (SAR) of Hong Kong, they included Mainland China – which is operated via Focus Media (Nasdaq: FMCN), Taiwan, Indonesia, India, Malaysia, Philippines, Vietnam and Australia, with a presence already established in Latin America and Russia as well.

The company has a unique shareholding structure, with fund firm iMediaHouse holding a controlling 51.53% share, Wong’s International Holdings (HK: 99) with 18.75%, Chevalier International Holdings (HK: 25) with 4.4% and Access Financial Services Holdings with 0.32%.

That leaves a clean cut 25% of issued shares in the hands of public shareholders, who can buy and trade the company’s shares on Hong Kong’s Growth Enterprise Market (GEM) Board.

“I am often asked why we chose to list on Hong Kong’s GEM Board and not the Main Board. First, we didn’t want to wait in line too long, Second, we chose GEM first as a start, and plan to move on from there, and we expect to upgrade to the Main Board in due time,” Mr. Wong said.

Captive Audience

Mr. Wong said the company’s strong positioning in leading office and commercial building complexes in Singapore and Hong Kong gives Focus Media Network a distinct market advantage.

“Our office lobbies in particular provide a conducive location for our screens with high traffic rates during peak times. In short, we enjoy a captive audience among a very high-spending sector of society.”

He said that there was no shortage of blue-chip high-profile firms actively seeking out Focus Media Network to run their ads on the company’s lobby monitors, with individual ad campaigns running an average of one month.

“We in the industry realize that advertising is an inexact science and there is no way for either the advertiser or ad firm to empirically prove exactly how effective a particular campaign is. That being said, it must be working very well because 60% of our current customers are repeat customers.”

Mr. Wong said elevator lobbies were the perfect place to market to the masses, particularly the well-heeled variety.

“People waiting in lift lobbies know they will be waiting idly there for around one minute, so we really take advantage of this key minute to market to this captive crowd.”

See also:

SINGAPOREAN Succeeds In HK, Lists Company At 20X PE

CHOW SANG SANG, FOCUS MEDIA: Jewelry, Ads Show Recession-Resistant Results