LAND BANKS are the bread and butter of real estate firms, and investors buy and sell shares of developers based on the quality and quantity of these property assets.

Likewise, the number of cultivated hectares under an agricultural giant like Chaoda Modern Agriculture Holdings Ltd (HK: 682) is also critical to its market reception.

Therefore, any allegations of overstating can result in drastic legal action.

A Chinese-language piece in Sinafinance said the Special Administrative Region’s Market Misconduct Tribunal launched a preliminary investigation into Chaoda’s activities earlier in September with the date of the next hearing expected soon.

On Wednesday, Chaoda’s Chairman Kwok Ho -- who owns 20% of the company’s shares -- and CFO Andy Chan were charged by the Hong Kong authorities with insider dealing along with a fund manager from Fidelity Management.

In 2009, the two allegedly informed Fidelity Management’s George Stairs about an imminent share placement just prior to it being announced -- information which the fund manager acted upon with profitable trades.

On Friday, both executives responded to the reported allegations, denying the charges, adding that the ongoing legal action against top management in the firm will not materially affect the fruit and vegetable grower’s operations or finances.

Chaoda’s market value has been cut by HK$11.9 billion (US$1.5 billion) since Next Magazine’s May 26 report alleging it exaggerated its farmland, which was denied by the company.

The latest trouble for the Hong Kong-listed firm follows on the heels of a report this spring in a Chinese periodical alleging that Chaoda exaggerated its cultivatable assets in the PRC, said Sinafinance.

The Hong Kong bourse suspended Chaoda's shares from trade since Monday following the initial reports of a government investigation into the agricultural firm.

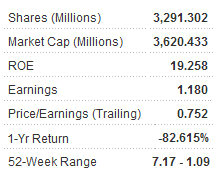

Despite management’s recent assertions that everything is business as usual despite the investigation, Chaoda’s valuation is anything but.

The company’ s shares plummeted 27% on Monday alone, contributing to a dire 83% accumulated decline year-to-date.

Officials with the tribunal have so far declined to offer details into the nature of the charges against Chaoda.

The entity is responsible for hearing cases which involve insider trading, fraud, market manipulation among other misdeeds, and possesses the power to return funds or profits deemed “ill gotten” to their original investors.

Chaoda, the first PRC crop producer to list in Hong Kong, is not the first Mainland Chinese listed agriculture sector firm to be the subject of scrutiny over misconduct allegations, the report said.

However, it is the first to be specifically targeted by Hong Kong authorities for alleged misdeeds.

Toronto-listed timber giant Sino-Forest was accused last month of overstating the scale of its forestry assets, leading to the resignation of Chairman and CEO Allen Chan.

Canada’s Ontario Securities Commission halted trade in the company’s shares for 15 days.

Founded in 1994 and based in Hong Kong, Chaoda Modern Agriculture’s over 22,000 employees produce, sell and export a wide range of agricultural produce, mainly in Mainland China.

Chaoda says on its website that the majority of its fruit and vegetable production is sold as fresh produce.However, it also processes and distributes output for the frozen food sector, which requires a much more sophisticated and expensive cold-storage logistics infrastructure.

Fruit and vegetable exports make up approximately 30% of Chaoda's total turnover.

It exports most of its fresh produce to Japan, South Korea, and other parts of Asia while frozen food exports go to Japan, North America, Europe, and the Middle East.

The firm also breeds and sells some livestock.

Chinese stocks, which recently pumped new life and capitalization into the New York Stock Exchange and Nasdaq, are also in the crosshairs of US regulators. Recent reports cited the chief inspector with the Securities and Exchange Commission as saying the Justice Department is looking into suspect bookkeeping among listcos, with dot.com firms Baidu and Sina both expected to be targeted.

China’s top search company fell 9.2% on Thursday in New York while e-commerce portal Sina dropped 9.7%.

See also: Food Firms WANT WANT, YURUN, TINGYI: Buy Or Sell Them?