Excerpts from latest analyst reports...

KIM ENG: Is PROPERTY selloff overdone?

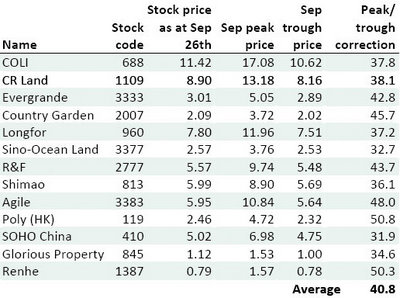

The share prices of major Hong Kong-listed developers corrected sharply during the first four weeks of September with an average drop of 40% from the peak at the beginning of the month.

“There are concerns over tighter cash flow from trust financing, slippage in contracted sales and weakened market sentiment which all contributed to the sector’s weak performance,” Kim Eng said.

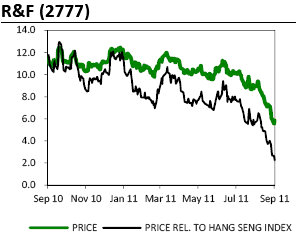

In late September, R&F (HK: 2777) became the first developer to cut its FY11F contracted sales target, which it did by 20%.

“In valuation terms, most developers are trading at close to their October 2008 trough valuations, if not lower. While we believe that the sell‐off was overdone, investors should still stick to large‐scale defensive names with healthy balance sheets, such as COLI (HK: 688).

After the Aug 29th announcement about the inclusion of Taizhou (Zhejiang Province) in the Home Purchase Restriction (HPR) policy, Quzhou followed suit on September 5th. In Quzhou’s HPR policy that is slightly looser than the Taizhou version, only one residential house will be allowed per family, while families with three or more units will be banned from further purchases.

“The market is still focusing on the announcement of a 2nd round of HPR policies for around 30 locations, mostly Tier II and Tier III cities in the Eastern coastal area. Based on the major developers we covered, August’s contracted sales grew by 6.3% m-o-m on average, compared to ‐10.6% and +13.0% for July and June, respectively.”

The brokerage added that the rolling achievement ratio has slowed down to a five‐month low of 6.4 ppts compared to the previous four months.

In the first eight months of 2011, the average achievement ratio reached 61.7%, with the same leaders as in July, namely Evergrande (HK: 3333) COLI and Country Garden (HK: 2007).

“We also noted that CR Land’s (HK: 1109) contracted sales posted a significant 77.5% m-o-m growth in August, boosting its achievement ratio by 14 ppts to 66.8%, the 4th best among the 12 developers we followed.”

See also: BULL RUN: HK Shares To Rise 25% Over Next 12 Months, Says CLSA

KINGSTON: TSINGTAO raw material costs surging

Kingston Securities said that major Chinese beermaker Tsingtao Brewery (HK: 168) is working to confront a 50% y-o-y jump in malt prices -- one of its major raw materials – which has resulted in a 23.4% rise in the cost of sales.

“To resolve the rising cost pressures, the company adjusted the price of mid- to high-end products to keep the trend of the market sale’s continuous growth. The sales volume of its main brand, Tsingtao Beer, increased 23% in the first half to 20.3 mln hectoliters,” Kingston said.

For the past few years, Tsingtao’s gross profit margin and net profit margin have been rising gradually under an optimized product structure and the brand name effect.

Being one of the leading brewery companies in China, Tsingtao Brewery’s sales revenue reached 11.87 bln yuan, up 21.1% during the first six months, and net profit rose 21.6% to 0.99 bln.

In terms of revenue, Shandong province is the biggest market, accounting for more than 50% of sales, while Hong Kong, Macau and overseas accounted for only 1.8%.

“Tsingtao suggests that the China brewery industry still has great potential for consolidation.

“It made further progress in the size expansion and improvement of domestic market layouts. The newly acquired Immense Brewery and Hangzhou Zijintan Wine Co Ltd have begun to reveal their synergistic roles in the market.”

Kingston’s target price on Tsingtao is 46 hkd. (Most recent price: 42.00 hkd).

See also: Is The PRC Valuation Premium Over H-Shares Kaput?