Excerpts from analyst reports...

BOCOM: TIANGONG ‘severely undervalued’

Bocom International is reaffirming its BUY call on specialty steelmaker Tiangong International (HK: 826), calling the world’s No.3 cutting tool and die steel maker “severely undervalued.”

“The company beat five competitors in two years and ranks third among all cutting tool and die steel producers in the world.

"We should not evaluate the company as other iron & steel manufacturers as it is the leader of a fast growing sub-industry, and is developing high value added special materials,” Bocom said.

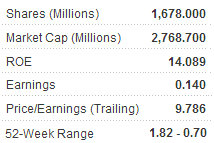

It said that current valuations (FY11F PEG of 0.07x) do not reflect its position as the world’s third largest cutting tool and die steel producer; and the “irrational plunge” in the share price provides good buying opportunities.

“Tiangong Int’l recently issued a positive profit alert, expecting a significant growth in unaudited consolidated net profit from general business operations for the six months ended 30 June 2011 against the corresponding period in 2010 due to the substantial increase in the sales volume of its products.”

Bocom forecasts that the interim net profit for 2011 could grow around 50% y-o-y to RMB165 million, representing fully diluted EPS of around RMB0.09.

“The strong results would show its excellent growth momentum. It ranked 8th in the world and 3rd in China in 2008 and managed to beat five competitors in two years, topping all other specialty steel companies in China.”

Bocom attributes the sharp improvement to two factors:

“Tiangong benefited from the country’s export restrictions on rare earth metals which hike production costs for overseas competitors, and the company’s enhanced product structure and excellent management as well as larger domestic consumption provided uplift.”

Bocom is maintaining its profit forecasts at the moment. FY10-FY12F net profit CAGR could reach 69.6%, equivalent to FY11F/FY12F 5.2x/3.5x PE.

“The recent share price saw sharp declines due to external factors. We think it is severely undervalued and the market will finally come up with a reasonable price. We maintain ‘Buy’ with target price of HK$3 on bright growth prospects.”

See also: TIANGONG Site Visit: China’s Top Die Steel Firm Riding Urbanization Boom

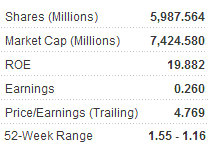

BOCOM: CHINA SOUTH CITY (target: 1.22 hkd) heavily reliant on new projects

Bocom International says commercial property developer China South City (HK: 1668) is awaiting more “explosive growth” but that occupancy rates are key and new project completion is critical.

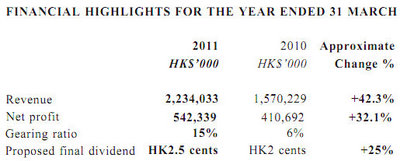

Core earnings rose 32% in the 12 months-to-March period due to revenue contribution from new projects, while the top line surged 42% to 2.23 bln hkd.

Bocom said revenue and earnings growth were mainly attributed to the following:

Revenue contribution of 474 mln hkd from residential properties sales of CSC Heyuan; finance lease income of 213 mln due to completion of office tower in CSC Shenzhen, and an increase in rental income due to contribution from CSC Shenzhen phase II Trade Plaza One and Trade Plaza Two, which were completed in 2H2009.

“For the sales of trade center units in CSC Shenzhen, the major revenue source for the company, recognized sales revenue dropped 3.5% to 1.358 bln hkd. The 11.7% increase in ASP to 16,750 hkd/sq m was not enough to offset the 12.6% decrease in sales volume to 85,600 sq m. Nevertheless, management emphasized the sales volume has already surpassed the target of 70,000 sq m.”

Occupancy rates increased steadily, gearing remains low

Occupancy rates for phase I of CSC Shenzhen rose steadily from 82% in FY03/10 to 86% in FY03/11, with the rate for phase II increasing from 25% to 36% during the period.

“Average effective monthly rental rates were HK$32/sqm and HK$34/sqm for phase I and II respectively. On the other hand, the net gearing increased from 5.6% in FY03/10 to 15% in FY03/11. It was still one of the lowest gearing developers among peers.”

Bocom added that the firm’s aggressive sales target relies on new projects as well as occupancy rates.

“Supported by significant increase in completion volume, the company aimed at sales target of HK$7-9 bln for FY03/12, compared with HK$2 bln achieved in FY03/11. Besides CSC Shenzhen and CSC Heyuan, its projects in Nanning, Nanchang and Xian would commence to generate revenue coming forward."

See also: STOCKS Or PROPERTIES: Which Is Easier To Make Money In?