After first stopping by Singapore-listed Bright World Precision Machinery, we visited another manufacturing giant in Danyang city – Tiangong International Company Ltd (HK: 826) -- as part of Financial PR / Aries Consulting’s "Discover the Dragon" series of company visits.

On my ride to Tiangong’s production facilities, around a two-hour drive from China's financial capital Shanghai, I read an interesting article by US columnist John Dorfman on how to spot good stocks.

‘When you buy a stock that has been falling, you have the thrill of trying to catch the bottom and strive for maximum gains.

'When you purchase a rising stock, you have the excitement of buying into an enterprise that is showing strength and generating excitement.

‘Intellectually, I believe it doesn’t matter which direction a stock is moving when you buy it; all that counts is how good a value it is. Yet emotionally, I prefer buying stocks that were undermined.’

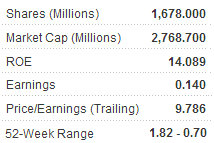

I believe Tiangong has been largely undermined by the market since its listing on the Hong Kong mainboard in 2007, and its shares still enjoy a good deal of upside potential.

The company specializes in the production of high-speed steel (HSS), HSS cutting tools and die steel, all of which are ultimately used in various industrial applications including the aerospace, automotive, railway, machinery and construction sectors, therefore revealing the critical importance to the Mainland Chinese economy and the high priority that economic planners deem the sector.

In FY2010, Tiangong delivered a set of encouraging results with total revenue of RMB 2.35 billion, representing an upsurge of 77%.

The growth of HSS, HSS cutting tools, and die steel was 65%, 34%, and 84%, respectively.

Over the 12-month period, Tiangong’s share price was up by 40.3%, from HK1.19 to HK1.67.

Think you missed all the action? Not in my opinion.

The recent ‘Positive Profit Alert’ announcement made by the company has indicated its expectation of and confidence in recording a significant increase in net profit for the six months ended 30 June 2011.

Nevertheless, it’s easy to see considerable room for additional gains, and Tiangong is definitely a stock that should appeal to value-oriented investors.

We met Mr. Zhu Xiaokun, Chairman of Tiangong, who has built up the company into the world’s largest high speed steel (“HSS”) supplier with annual production of its HSS cutting tools topping the world.

Capacity of die steel ranks top 3 in around the globe. The market share of Tiangong in HSS, HSS cutting tools and die steel is approximately 44%, 15% and 6%, respectively, in China’s special steel industry.

Tiangong’s newly-developed titanium alloy business is helping diversify the company’s offerings. Like Bright World Precision, Tiangong caters to the needs of a myriad of industries.

Established World-Class Customer Base

“One of the critical success factors for Tiangong is its strong bond with its world-class customers,” said Mr. Zhu.

The strong credentials of Tiangong were built upon its longstanding relationship with major customers, namely Bosch, Tovoly, Black & Decker, Irwin and DFG, as well as delivering consistent product quality and its ability to keep production costs low.

As such, the company has established a strong and diversified customer base in the PRC and around the globe.

Leading through Vertical Integration and Product Innovation

As a leader in the special steel industry, Tiangong is one of the few Chinese companies that offer both upstream HSS production and downstream cutting tools operations.

Mr. Zhu pointed out that this vertical integration brings nearly 5% cost advantages to the company, which is significant to manufacturers.

This enables Tiangong to enjoy both lower costs and more stable supplies of raw materials and more importantly, helps it achieve better margins than its competitors in the market.

Tiangong is continuously striving to drive product development, technology advancement and embrace changes as part of a broader effort to stay ahead and respond to the competitive challenges in the special steel industry.

“We have invested RMB 360 million and imported advanced production lines of 1,300 tons of precision forging machines for the next three-period,” said Mr. Zhu.

“This shows our commitment to seek continuous improvements in offering quality and innovative products, and strengthening our market leadership by differentiating ourselves from our competitors in the near future.”

Tiangong is one of the only two special steel producers in China equipped with such advanced precision forging facilities.

In another effort to boost its product quality and innovation, Tiangong entered into technological alliances with the Central Iron and Steel Research Institute, Chengdu Cutting Tools Centre, Nanjing University of Science & Technology and Southeast University. As of June 2011, the company has offered 15 types of HSS cutting tools and 30 die steels products with bright growth prospects.

China’s Urbanization and Industrialization Boom Drives Abundant Orders

In China, demand from automotive, railway, aviation, property development and new energy sectors has intensified, and benefited the special steel industry.

Mr. Zhu believes that the company’s enhanced product structure and experienced management, together with the favorable policies on restricting the supply of rare metals to overseas manufacturers, will provide the leading edge for Tiangong to capitalize on opportunities from urbanization and industrialization in the PRC.

“We have leveraged on the strong growth momentum from 2010 by obtaining abundant orders in HSS cutting tools, die steel and HSS productions with a full production schedule until the end of 2011,” said Mr. Shi Guo Rui, CFO of Tiangong.

“Our comprehensive product offerings were immensely popularized among our new and existing renowned customers due to our product quality and innovation. We have revised our target in FY2011 with expectations of boosting our production capacity of HSS, HSS cutting tools and die steel by 50,000 tonnes, 350 million units, 65,000 tonnes respectively.’

World’s No.3 Die Steel Producer, Bright Growth Prospects

Die steel is a type of special steel used for the production of dies and moulds. It is also known as the “mother of tools” since it is a key application in the production process for a myriad of industries namely high-speed railways, automotives, aviation and plastic products.

Currently, the company offers 30 types of die steel products to domestic and overseas producers in places including North America, Europe and Korea.

During the site visit, Mr. Shi pointed out that die steel was the largest profit contributor of the company in FY2010, and also considered the greatest revenue source that will enhance earnings growth for Tiangong in FY2011.

The company benefits from rising domestic consumption and China’s restrictive policies over the overseas supply of rare materials that leads to an increase in production costs for its competitors.

Hence die steel has generated a higher gross profit margin of 29.2%, than HSS (19.9%) and HSS cutting tools (16.4%).

According to the latest study issued by Steel & Metals Market Research (SMR), Tiangong has climbed up the ladder and ranks third in the world’s specialty steel market for the first time since its introduction in 2005, just behind world renowned firms BOHLERUDDEHOLM Group (BUAG) from Austria and SB Steel AG from Germany.

“I am delighted to see that Tiangong managed to beat five competitors in two years, topping all other specialty steel companies in China and squeezing into the top 3 list in the world,” said Mr. Zhu. “This reflects our continuous efforts in delivering quality and innovative products, and more importantly, the true value of Tiangong as a company that strives to be the best special steel supplier in the world and its ability to deliver sustainable business growth in the near future.”

Management expects more orders in the die steel business after ranking as the world’s third largest cutting tool and die steel producer, and is well-placed to gain market share. This is a high growth sector in China that serves as a potential catalyst to maintain healthy margins and drive higher profitability for Tiangong.

Set for Solid Phase of Growth

Tiangong is on track to record strong revenue in the current financial year based on the abundant orders driven by China’s urbanization and industrialization boom. Together with the continual expansion of the die steel business, chances are that the company might even beat the market’s expectation and take its business to the next level.

See also:

BRIGHT WORLD PRECISION MACHINERY, CHINA MINZHONG, OKP, ARMARDA: What Analysts Now Say...

BRIGHT WORLD, BROADWAY, TELECHOICE: What Analysts Now Say...