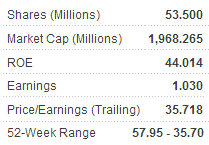

XIAMEN MEIYA PICO Information Co Ltd (SZA: 300188), a leader in China’s network security industry, is trading very close to 52-week lows, shedding another 3% on Tuesday to its current 36.79 yuan.

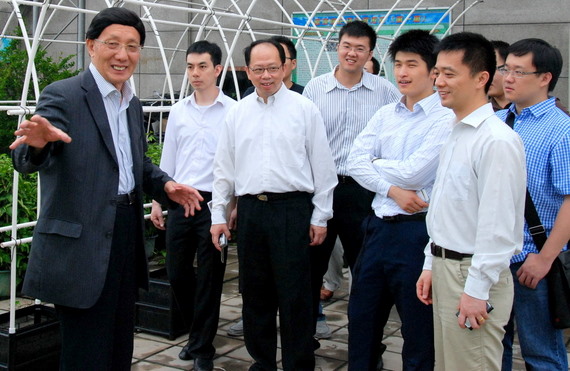

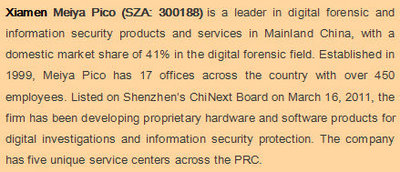

NextInsight recently accompanied 10 Greater China fund managers to the company’s Fujian-based facilities to find out if Meiya Pico might be a diamond in the rough and ready for a major rebound, with Hong Kong-based Aries Consulting being the chief organizer of the trip.

The company was listed March 16 on China's version of the Nasdaq -- the ChiNext Board (aka: GEM Board).

Meiya Pico Board Secretary Yang Aiguo said he was confident that the A-share listed firm was in the right sector to realize a fast-growth trajectory.

NextInsight: Why should investors be paying particular attention to Xiamen Meiya Pico?

Meiya Pico Board Secretary Yang Aiguo: “We are mainly engaged in providing two major products with related services: electronic data forensics (EDF) and network security products, which includes digital intellectual property rights protection. So as you know all of these are hot items in Greater China right now.

As for EDF and network information security, at present how large is the market growth potential for these undertakings, and what are the expected prospects for companies engaged in these sectors?

Mr. Yang: According to renowned global consulting firms including IDC (International Data Corporation), it is generally expected that this year, the worldwide electronic data forensics market size is expected to reach 1.8 bln usd. The domestic electronic data forensics industry got off to a relatively late start, but on the whole its development in the PRC is faster than the global average.

From 2006 to 2008, the domestic industry grew at an average of over 50% per year, and in 2008 the domestic EDF products market stood at around 180 mln yuan. It is forecast that within the next five years, the EDF industry annual growth rate in the PRC be sustained at over 20% and by 2015 should reach nearly one bln yuan. Within 10 years, the market will exceed two bln yuan.

The network data security industry has already been transformed into a key strategic sector in Mainland China’s overall industrial outlay, and it is increasingly a focus for economic planners. Therefore, I definitely feel that network security products offer an excellent development opportunity for would-be investors.

The IDC survey results show that in 2008, the domestic information security industry's overall market capacity was approximately 8.3 bln yuan, with a stable growth trend. Within five years, the PRC’s network security product market capacity is expected to exceed 15 bln yuan.

How would you assess the current industry development and capacity expansion process of the PRC’s computer forensics business, particularly the progress made in business development, taxation policy and technological innovation?

Mr. Yang: These are all critical areas for our company in terms of fully realizing our growth potential, and are all key components for us to watch as we take our next steps.

Initially, our key clients were courtrooms, legal offices and other consumers of network data security products and services. However, thanks to aggressive market exploration and word-of-mouth networking, we soon found ourselves receiving orders from a growing and widening spectrum of government clientele as well as an expanding list of business enterprises.

These include a wide range of industries as well as financial and fiscal institutions, with a focus on those departments that engage in supervisory activities.

Does this market position provide any particular benefits?

Mr. Yang: This affords Meiya Pico a very strong competitive advantage.

As many of our clients are engaged in similar supervisory and oversight electronic activities, we are able to replicate our success and marketing pitches from one potential client to another, thereby enjoying a positive reinforcement of sorts in our marketing campaign.

This also allows us keep close tabs on the supply and demand calculus within the industry, especially for clients in legal and fiscal circles, provides us with a leading-edge barometer of exactly what products and services will be in demand tomorrow and how to get a headstart on the technological adjustments and innovations necessary to satisfy dynamic market demand.

Earlier this year, we initiated a large-scale marketing campaign which included active participation in every industry-related product exhibition worthy of mention. In the first five months, we took part in five such major exhibitions as well as launching marketing activities in a variety of Tier II and Tier III cities. All of these have already produced fruitful results.

What are your company’s major growth opportunities going forward?

Mr. Yang: Overall, information technology is very much reliant on the progress and fate of the expanding 3G network, social networks, “smart” technology and communications, and the growing potential of network data storage technology. These all present huge growth opportunities for electronic data forensics products and services.

As mentioned, most of our clients are in the judiciary system, with a growing presence in law enforcement offices and other government organs as well as a growing range of enterprises and industries. In fact, our marketing campaign has as one of its major objectives a plan to diversify more into the private enterprise market.

As for our market breakdown, the domestic electronic data security market is our biggest growth area for now, with our products and services to be found at all levels of government – from the township and county level all the way up to the provincial level.

We also place a great emphasis on technical training and strong academics. Our Chairman Mr. Liu Xiangnan got his start as a professor at the prestigious Xiamen University, and many members of Xiamen Meiya’s current management team are his former students.

With such a prestigious academic pedigree, Chairman Liu attaches great importance to the company's corporate culture and human resources environment.

In addition to helping set up an in-house library and reading room, he also was instrumental in getting us an exercise room and fitness room, and also encourages the staff to regularly engage in challenging pursuits such as designing and assembling aircraft models and building landscape models.

He is also an avid green thumb, and has quite a collection of plant species flourishing on the roof of our firm, including some of the more exotic and functional varieties such as blueberries.

The expansive roof garden’s irrigation system, which Chairman Liu designed, has received favorable recognition by both government authorities and listed peers alike.

So as you can see, there is definitely an active and positive fostering of innovation and ingenuity here at Meiya Pico.

See also:

Heading To Fujian: 10 Fund Managers, Five Listcos (Including Fuxing, Yamada)

CHASEN Continues On Upward Profit Trend, Positive Outlook