Translated by Andrew Vanburen from: 善用期權 仿效海豹突擊隊攻堅 (中文翻譯, 請閱讀下面)

THE FREE world was captivated and generally relieved earlier this month by the successful Navy Seals operation to take out terrorist mastermind Osama bin Laden.

But what many don’t yet realize is that their real-time tactics and long-term strategy both worked to ensure ultimate success, and I believe investors would do well to take away a few important lessons.

This month saw two major headline-grabbing events.

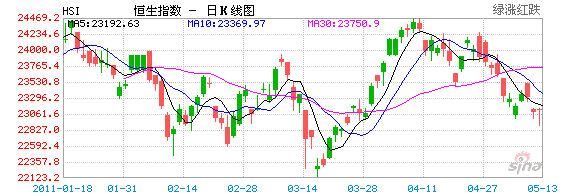

One was the implosion in commodity prices which was driven in large part by a topsy-turvy US employment market.

The second was the blitzkrieg raid by the US Navy Seals on the clandestine compound of Osama bin Laden.

The former is rather complex and multifaceted, so perhaps in this business cycle it is more instructive to study the Navy Seals’ success and analyze what it might mean for stock markets.

On the surface, the elimination of bin Laden does not necessarily mean a return to global prosperity across the board, because to be realistic (if not a shade pessimistic), the ridding of one terrorist leader does not mean the end of terrorism.

In fact, many local media reports have said as much, urging investors not to “overreact to bin Laden’s demise” or exhibit “irrational upside market exuberance”.

But what is worthy of introspection is the tactical and strategic methodology of the outfit that carried out the successful operation – the Navy Seals.

Keeping bin Laden’s demise in perspective

The Navy Seals are undoubtedly a highly-efficient, modern fighting tour de force gradually assuming legendary status.

A little over two years ago, the elite unit took out three heavily-armed Somali pirates holding foreigners hostage aboard vessels off the Horn of Africa, with the shots fired from several hundred meters away.

Successful stock option strategies are analogous to the success of the Navy Seals. I will attempt to explain the less-than-obvious connection between two seemingly unrelated entities.

The Seals waited nearly a decade for their call to action, no doubt patiently biding their “down-time” by keeping abreast of the latest strategic information at their avail as well as keeping one ear tuned to their sources – real or virtual – for any hard information on the latest whereabouts of the Saudi native sometimes referred to as “Geronimo.”

This was the Seal’s “long position,” their “hold pattern,” waiting for the iron to heat up before the strike (“sell”).

However, once the unit gets wind of a “20” (military jargon for a target’s location), then the wheels are set in motion, and quick sales are made to cash in on the real-time knowledge (one could even compare it to "enlightened" insider information).

Getting back to what the operation in Pakistan means for the market, it seems that not even a blade of grass will sprout up in this current lull, so trying to piggy-back on the success of the Seals seems a bit desperate.

But that doesn’t mean that we investors can’t learn a thing or two about short-term tactics, and long-term strategies – both executed to perfection by this month’s military operation.

See also:

HK Weekly Wrap: Index Adds 0.5%, 0.9% Today Despite Tighter Credit

TWO SUREFIRE MARKET STRATEGIES: Diversification, Discipline

善用期權 仿效海豹突擊隊攻堅

(文: 黃國英, 豐盛融資資產管理部董事)

上周政經大事,一為商品爆炸,二為拉登被剿。商品大勢,容後再表,本期先談拉登。無謂班門弄斧,化身地緣政治專家,僅用常識,已知拉登之滅,影響有限。之前在報章寫道:「拉登之死,不值得市場如此亢奮,今時今日,根本無人會憂慮恐怖活動的風險,何況拉登只是一個icon,不會因為解決一個人,就從此天下太平。」既謂無關宏旨,談之何益?本文主角,乃拉登對家,制其於死命的美軍海豹突擊隊(US Navy SEAL)。

拉登之死不值亢奮

不崇陰謀論,姑且不理所謂「剿匪做騷」之嫌,頗接近實際情況的版本,是八十海豹,伙同中情局特工,拂曉出擊,乘直升機機降拉登大宅。殺敵、捕俘、撤退,全程僅四十分鐘,快過一集電視劇。除損機一架外,全師而還,大仇得報,美舉國歡騰。

海豹突擊隊,可謂現代版天降神兵,屢建不世奇功。之前海豹亦曾力戰索馬里海盗,遠在千米小艇外,狙擊headshot三海盜。或問:股海如戰場,海豹何在?對曰:期權是也。拙作「決勝在期權」,就一再將期權長倉(買call、買put),比作軍隊中的特種部隊。要了解期權妙處,倘不嫌棄,備打油詩一首,以搏諸君一笑:「期權長倉特種兵,以小搏大最菁英。尋常悶局不戀戰,風高浪急顯本領。」

眼下市場寸草不生,賺錢難過搵拉登。大路進兵,狂撈正股,勞多功少,日恐夜慌。一如美國攻打阿富汗,帶甲十萬,日費千金。鏖戰十年,拉登個影都未見過。一不留神,隨時被塔利班反咬一口,覆軍殺將。期權則恰恰相反:注碼限險、以小搏大。

期權長倉,押注期權金,全盤皆北,損失限在此數。所以就算形勢逆轉,都不會出現侷斬、追收孖展等火燒後欄的驚險場面。一如八十海豹輕兵攻堅,若不幸中伏,遍地塔利班,最壞情況,就是殺身成仁;總不會無端端連聯軍總部,都被攻破。是為注碼限險。

輕兵上陣控制風險

此外,期權此一工具,可提供槓桿。期權長倉,風險受限,回報卻不受制約,用之可複製正股回報,卻不需承受對等風險, 動用資本亦微。恰似八十海豹,能以一敵百,戰力在八千雜牌軍之上。兩者戰績可能相若,但以海豹出陣,最多損兵數十;正規軍應戰,則可能死傷逾千。是為以小 搏大。

那是否以後只靠期權突擊,正股大軍全部解甲還鄉?劍走偏鋒,亦非吉兆。特種部隊,需用得其時、用得其所。海豹菁英,不可能次次出動,捉魚毛蝦仔又去,維持秩序又去;更不可用於持久戰,因為只有突擊,才可將雙方戰力的差距,拉到最大。爭持不下,終會釀成蟻多摟死象困局。93年摩加迪索一役(關鍵詞:Black Hawk Down),是為一例。期權亦然,時間值乃是天敵,若不理對象、誤判時機、輕率下注,用之必敗。雖然以小搏大,不會傷及筋骨,但不停小敗,也是枉然。

請閱讀:

HK Weekly Wrap: Index Adds 0.5%, 0.9% Today Despite Tighter Credit

TWO SUREFIRE MARKET STRATEGIES: Diversification, Discipline