SINGAPORE DAILY The Straits Times recently reported that either the Bank of China or ICBC would be selected for yuan clearing trade in Singapore, with former Prime Minister Goh Chok Tong reassuring Hong Kong that it need not fear competition from the city state.

"We have no ambition to try and rival Hong Kong. Singapore cannot rival it because Hong Kong is part of China. It is close to China; it has got much more trade with China," the report cited Goh, who also serves as Singapore’s central bank chairman, as saying.

Meanwhile, the PRC press says Singapore’s yuan business ambitions are making Hong Kong a bit nervous as the Special Administrative Region (SAR) braces for new competition for an undertaking over which it enjoys a virtual monopoly.

And while experts admit that Singapore will take a hearty slice of the fast-growing and lucrative offshore yuan operations, they also say that the People’s Bank of China – the PRC’s central bank -- will make sure that neighboring Hong Kong holds its place as the primary venue for such business.

Nevertheless, Hong Kong is worried about the new kid on the block – Singapore – because the SAR has been unchallenged in yuan clearing trade for so long, says the Chinese language piece in SinaFinance.

One bank, two cities, manifold competition

First of all, Hong Kong enjoys untold advantages over any potential newcomers to the offshore yuan business, including Singapore.

Here’s the background: The Singapore Monetary Authority said on Tuesday that the PRC government will soon designate a Chinese-funded bank in Singapore – either BOC or ICBC -- for RMB clearing transaction business.

This will allow any Singaporean bank to handle Chinese yuan directly without first having to change hands via commercial banks in Hong Kong or the PRC.

Analysts rightly believe that this development will help to facilitate the promotion of internationalization of the Chinese yuan as well as Singapore as an established financial center, and as a prominent alternative to Hong Kong as an offshore RMB processing venue.

But whether expanding this business to Singapore will present a real threat to Hong Kong’s dominance in the sector is another matter altogether.

A spokesperson for the Hong Kong Monetary Authority said that more and more regions are using the Chinese yuan in everyday transactions, and it is only natural that venues other than Hong Kong would find the need to apply for authorization to carry out offshore yuan business.

Even Singapore’s former leader Goh downplayed the potential competition from the city-state that Hong Kong might face down the road, telling the Straits Times that Singapore could play a key role in yuan trade – but only on a regional scale – helping to facilitate RMB-denominated transactions between the PRC and Singapore's neighbors, as well as possibly the fast-rising Indian subcontinent.

Another report from The Business Times suggested that the winner would ultimately by ICBC, rather than BOC, as the former had recently established a yuan-processing center in Singapore targeting Southeast Asia.

Analysts also pointed out that it was natural for Singapore to seek to expand into trade of the world’s No.2 economy’s local currency – the renminbi – as Singapore is currently the No.4 global foreign exchange trading center, behind New York, London and Tokyo, while Hong Kong ranked fifth.

But as for any hope of taking on Hong Kong head-to-head in offshore yuan trade, the city-state had a steep hill to climb.

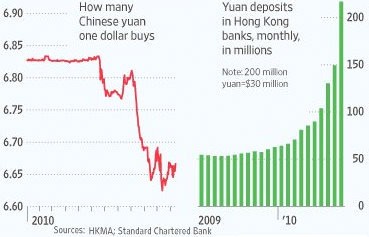

The Special Administrative Region of Hong Kong is currently No.1 in offshore yuan business by a long shot, sitting on over 400 bln yuan in deposits as well as being the repository-of-choice for massive amounts of RMB-denominated bonds issued in the SAR by both the PRC government and a wide range of mainland Chinese enterprises.

But Singapore enjoys cultural and logistical advantages in carrying out offshore yuan trading in Southeast Asia, and analysts generally agree that both Hong Kong and Singapore will not crowd each other out but rather complement one another by engaging in offshore yuan business – each from their own respective vantage points.

See also:

HK WEEKLY WRAP: Index Has First Losing Week In A Month

CHINA AIRLINES, COAL, PROP, HK BANKS: What Analysts Now Say...