Excerpts from latest analyst reports…

BOCOM BUY on retailers XTEP, INTIME, LE SAUNDA

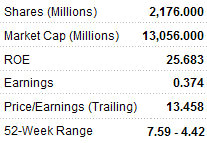

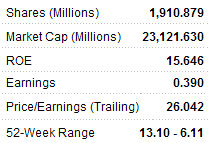

We like and Xtep International Holdings Ltd (HK: 1368), Intime Department Store Group Company Ltd (HK: 1833) Le Saunda Holdings Ltd (HK: 738).

Xtep is well positioned to benefit from the Chinese government’s strategy to accelerate urbanization and boost incomes of low to middle income consumers.

Xtep's current valuation is attractive when its 10.9X FY11F P/E (ex-net cash 8.6X P/E) is compared to 17.3% FY10F – FY12F EPS CAGR.

We like Intime’s young store portfolio and highest EPS growth among peers under our coverage, 36.3% CAGR of FD Core EPS from FY10 to FY12F.

We expect Le Saunda to achieve 43.8% EPS growth in FY11F and then 23.8% EPS CAGR from FY11F to FY13F.

Le Saunda's strong earnings growth is driven by 25%-35% revenue growth per year; healthy gross margins supported by 5%-10% ASP increases, and a decline in the administrative expenses ratio.

Its current valuation is undemanding at 12X FY11F P/E.

China's March retail sales growth beat consensus

China’s March retail sales jumped 17.4% year-on-year, higher than consensus.

Retail sales growth rate accelerated month-on-month from 15.8% in Jan & Feb 2011 to 17.4% in Mar 2011.

Growth of department store-related merchandise was very healthy.

Cosmetic sales growth improved by 5.1 ppt to 21.2%.

Clothing, footwear and textiles sales growth was stable at 21.9%.

Department store operators like Intime and Maoye (HK: 848) already reported impressive 27.2% and 30% same store sales growth (SSSG) in 1Q11, respectively.

We also expect Golden Eagle (HK: 3308) to deliver very good 1Q11 SSSG.

The central government is determined to push disposable income growth and enhance domestic consumption

In 2011, twelve provinces already raised minimum wage standards.

According to our checks with some retail chain operators, average per staff salary increment is not less than 10% in 2011.

The Personal Income Tax assessment scheme is very likely to be reformed in 2011 to lower the tax burden, especially for low to middle income groups.

We suggest investors stick to two major investment strategies in the “Twelfth 5-year Plan”

Primary strategy: Mid-to-high end consumption benefits from rising of middle and high income classes.

Secondary strategy: Mass market brands should benefit from further urbanization, continuous increase of minimum wage standard and reform of Personal Income Tax assessment scheme.

See also:

XTEP 2010 Net Up 25.7%: What Analysts Now Say...