Translated by Andrew Vanburen from

進退兩難的比亞迪

(中文翻譯,請看下面)

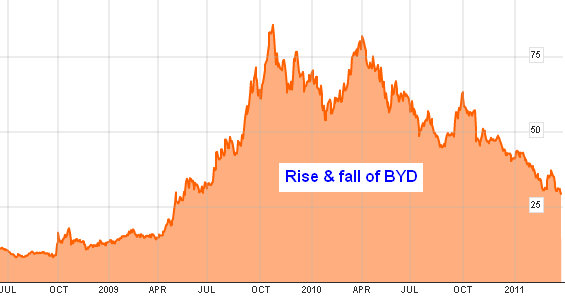

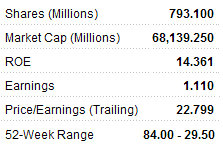

CHINA’S TOP electric vehicle (EV) maker, BYD Co Ltd (HK: 1211), is stalled on the side of the proverbial road, with its Hong Kong-listed shares currently stuck at 52-week lows after the Shenzhen-based automaker’s 2010 net profit fell 33.5% to 2.52 bln yuan.

One bright spot for the firm – in which Warren Buffett’s Berkshire Hathaway holds a near 10% stake – was its battery and electronic components operations.

Last year, turnover increased by 18.28%, mainly due to the rapid growth of the handset components, assembly services and ODM businesses, but the overall slower growth prompted the company to not recommend a dividend for 2010.

In 2009, the dividend was 0.33 yuan per ordinary share.

Let’s take a look at what went wrong with China’s most prominent EV maker and see what factors are needed to jumpstart its moribund valuation.

You’ll recall that BYD along with Tencent Holdings Ltd (HK: 700) were two of the biggest market darlings just two short years ago.

Back in the day, as they say, the world’s most famous living investor, Warren Buffett, was so bowled over with BYD’s potential that he poured 232 mln usd of his own investment firm’s money into the forward-looking automaker for a near 10% stake.

And Tencent, China’s biggest internet and mobile value-added services provider, owner of the ubiquitous QQ social networking service, was the most profitable internet firm in China in 2009, and as end-2010, the Hong Kong-listed firm is the world’s No.3 internet company behind Google and Amazon, with a total market cap of nearly 40 bln usd.

However, while Tencent continues to fly high (at times, its simultaneous on-line QQ users top 100 mln, or around a third the population of the US!), BYD has succumbed of late to what it describes in its annual earnings statement as “intense competition and rising distribution costs.”

BYD was founded in 1995 by Mr. Wang Chuanfu, who at last count was China’s wealthiest individual.

The dedicated producer of rechargeable batteries became the largest producer of cell phone batteries just a decade after launching the business, and made the semi-logical choice to diversify into electric vehicle production, purchasing a loss-making SOE automaker in 2003 followed up by a listing on Hong Kong’s mainboard in 2007.

Photo: autoinfo.gov.cn

But despite its F3 sedan being the bestselling model in the PRC last year, BYD has been spinning its wheels of late.

I believe the two key words in BYD’s comeback are: “Buffett” and “electric.”

You will recall that “BYD” stands for “build your dreams.”

This Shenzhen-based firm needs to return to that mentality, the can-do futuristic energy that first attracted Warren Buffett two years ago.

That means, it needs to focus on its core strength: electric vehicles (EVs).

This runs counter to the company’s current sales mix, with its top-selling F3 sedan, which made up around a third of the BYD’s auto revenue, being somewhat less than futuristic and innovative.

Firstly, it is not an EV, nor is it a hybrid, but runs wholly on old-fashioned fossil fuels.

Secondly, it has been harried by accusations within the industry that its appearance from the front is nearly a carbon copy of earlier-generation Toyota Corollas, while its rear is the spitting image of Honda’s Fit Aria.

True or otherwise, this is not the sort of chatter that “The World’s 16th Most Innovative Company of 2010” wants to hear associated with its name, and BYD would do well to get back to the creative credentials that first attracted Mr. Buffett and his checkbook.

Also not helping the cause have been reports from self-appointed worldwide whistleblower Wikileaks.

The tell-all website, which has been embarrassing world leaders and diplomatic circles for the past year, earlier this month reported that BYD’s proprietary rechargeable battery technology was not necessarily a result of “in-house” innovation, but may in fact be largely reverse-engineered using inferior components.

Again, these are only reports, and no one can honestly claim that Wikileaks has a monopoly on accuracy or veracity.

But these reports swirling around, a lackluster reporting season and what appears to be a casual Sunday drive away from the company’s core strength – hybrid/electric vehicles – is something that must reverse course if this company is to once again attain “darling” status among Hong Kong’s H shares.

Victim of its own success?

Fifth century BC Chinese philosopher and mystic Laozi, considered by many to be the founder of Taoism, once said: “The flame that burns twice as bright burns half as long.”

This could apply to the meteoric rise of BYD, which began a few years ago making rechargeable batteries at a small factory in Shenzhen to having the top selling sedan in the world’s biggest auto market (China) last year.

Has this stupendous success gone to management’s head?

Does the company need to rethink its growth strategy to once again fire on all cylinders... or in BYD's case, power from all fuel cells?

BYD needs to return to its innovative ways, focus on the sustainable product lines and business models, and once again attract the attention of the most astute investors the world over – domestic and foreign.

In this way, it will drive China’s EV industry forward.

See also: CHINA AUTO: Domestic Consumption Sparking Sector

進退兩難的比亞迪

(文: 黃國英, 豐盛融資資產管理部董事)

「故備前則後寡,備後則前寡,備左則右寡,備右則左寡,無所不備,則無所不寡」。

比亞迪(1211)跟騰訊(700),09年曾並肩為股皇,近命運殊異。騰訊盈利破頂,EPS按年升55%,派息增近四成。比亞迪卻屯邅不堪,EPS按年下跌37%,莫水,連派息都剪埋…真雲泥之別。

提起比亞迪,腦海必現「巴菲特」、「電動車」兩大關鍵詞。散戶欽敬,連綿不絕,寫詩讚曰:「新能源,電動車,過幾年,實好yeah。」技術拔羣,夢想宏大,無人敢非。何故股價飛流直下,高位跌逾六成?四字曰:「火頭太多」。

衰在火頭太多

孫子曰:「凡用兵之法,馳車千駟,革車千乘,帶甲十萬,千里饋糧;則內外之費,賓客之用,膠漆之材,車甲之奉,日費 千金,然後十萬之師舉矣。」儲能電站、太陽能電站、電動車之所以值錢,在於快人一步面市。

市場潛力大,自然群雄並起,環球逐鹿,務求一統天下。

研發費用, 自不可缺,一如美、蘇當年鬥快登月,招兵買馬,大興土木,鬥快燒錢。

比亞迪無印鈔機,唯靠手機及汽車兩瓣,提供新能源部門的軍費。

就像當年劉備,先據荊州為本,後圖益州。熟讀《三 國》,會明白今日之比亞迪,就是昔日劉備。話說劉備率眾入川,委關羽守大本營。後受命攻樊城,雲長剛愎自用,被呂蒙偷襲,痛失荊州豐沃之地。

單靠益州寡薄 的資源,難以支持蜀軍全滅魏、吳。

分析員報告,偏重分析盈利,自己則聚焦現金流。09年時,公司單靠經營現金流,已夠投資所需有餘。但從2010年起,經營現金流大幅轉弱,要靠銀行短債,應付各項投資需求,額度由09年底的5.5億,升至去年底的110億。

原理就像借貴利讀大學,唔讀就窮硬,畢業後先會慢慢有景,但依家俾息俾到頭暈。110億債,假設利息8釐,又會唔見近9億錢。

搞電動車投入極大

要改善經營現金流,比亞迪要靠沽存貨、收街數。問題是汽車銷量,舊款漸慢,新款未出,一、二月按年銷售量,下跌18%。又要整合經銷商,離離合合,會否拖慢收數速度?「乜唔係今年有電動巴士賣咩?」估計四月投產,預期2010年產700部,一部2百萬元,有14億營業額(未知是否要給數期),但如要發大生產,又要搵錢擴大電池產能…

今時比亞迪,有啲兩頭唔到岸。如新能源業務繼續全速行軍,就要周圍撲水頂CAPEX/R&D,尤其汽車業務,必須盡快逆轉;如放慢研發腳步,現金流出減慢,壓力紓緩,卻怕從此給虎視眈眈的對手拋離。新業務收成期延後,今時有利,他日或為害極深,痛失龍頭地位。

借短錢總有盡時,新能源發展,卻不能失機。如果我是王傳福,經營無大改善,趁市值仍有近700億港元,我會揀供股籌旗。

請閱讀: CHINA AUTO: Domestic Consumption Sparking Sector