Excerpts from latest analysts reports....

BOCOM says JIANGXI COPPER (HK: 358) thriving on strong commodity price

Analyst: Luo Rongjin

Copper price to maintain its upswing trend Strong domestic demand for copper boosted both international and domestic copper prices. LME 3-month copper prices closed at US$10160/tonne recently, the second time to break above US$10,000/tonne in Feb. Copper futures and spot prices in Shanghai also reached historical highs of RMB76,000/tonne. Imported copper totaled 364,000 tonnes in Jan, exceeding market expectation.

The huge imports reflected robust domestic demand, which drove up copper prices. Meanwhile, data from ICSG showed that the global copper market would see supply shortages in 2011. Concerns over tight supply would further fuel copper price hikes in 1Q11. We expect the LME copper price to hit US$12,000/tonne in 1H11.

Jiangxi Copper’s copper ore business will benefit from the increase in copper prices Jiangxi Copper’s copper ore business will see the largest benefit amid the price hike of copper. Gross profit of its copper ore business will increase by some RMB3bn for every copper price increase of RMB2000/tonne, representing an increase of RMB0.1 in its EPS. Therefore, the rapid growth in copper price will significantly boost its profits in 2011.

Uplift of TC/RC will improve the profit generated from the processing of imported copper concentrates Apart from the excess return arising from the stronger-than-expected increase in copper price, uplift of TC/RC in 2011 will improve the profit generated from the processing of imported copper concentrates markedly. TC/RC for the processing of imported copper concentrates (long-term contract) was US$70/US$7.0 cents in 2011, an increase of over 30% against the TC/RC in 2010. Imported copper materials account for around 40% of total consumption, an increase in TC/RC will improve the profit generated from the processing of imported copper concentrates markedly.

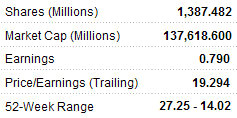

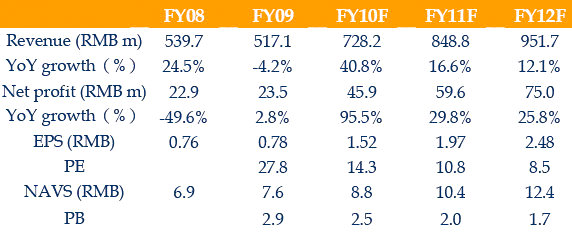

Jiangxi Copper tops the industry in terms of copper smelting scale and copper concentrate output Rising copper prices will benefit Jiangxi Copper strongly. Production scale of copper cathode is expected to reach 1m tons in 2011. We conservatively estimate that FY11F/FY12F copper cathode ASP will reach RMB72,000 per ton/RMB76,000 per ton, equivalent to FY11F/FY12F EPS of RMB1.97/RMB2.48 or FY11F/FY12F 10.8x/8.5x PE. FY11F/FY12F net profit growth could reach 29.8%/25.8%. Given the leading position in copper smelting and undemanding valuations, we keep its “Buy” rating with TP of HK$33.6, equivalent to FY11F 14.0x PE.

See also: SHIPPING STOCKS, HU AN CABLE: What Analysts Now Say...

UOB Kay Hian says China Auto Sector “Not as good as it appears”

Analyst: Ken Li

Passenger vehicle sales in Jan 2011 came in as expected with a y-o-y growth of 17% and m-o-m fall of 9%. However, some automakers registered unsatisfactory sales:

Dongfeng Nissan (HK: 489) sold 63,363 vehicles in Jan 2011, up 5% y-o-y and 15% m-o-m

Geely (HK: 175) recorded sales of 45,634 units in Jan 2011, up 4% y-o-y and down 19% m-o-m

BYD’s (HK: 1211) sales fell 15% y-o-y to 52,054 units in Jan 2011, making it the first automaker that saw sales decline this year

Our view:

We remain cautious on sales outlook for 2011. The strong growth in Jan 2011 can be attributed to the extraordinarily strong sales in Dec 2010 when buyers rushed to purchase cars ahead of the cancellation of tax concession at end-2010. From experience, some automakers tend to defer the booking of sales from December to January of coming year, if year-end sales were strong.

Jan 2011 was high season, as people would like to buy cars right before Chinese New Year (CNY). However, we expect sales for Feb 2011 to fall 35% m-o-m from Jan 2011, due to CNY holiday. For the full year 2011, we anticipate auto sales in China to only grow by not more than 10% vs 10-15% of consensus, based on roll-back of policy stimulus, restriction on car registrations by Beijing and high comparison base of 2010.

It seems that the consensus was over-optimistic about sales growth this year by extrapolating strong growth in 2010 into 2011. We expect analysts to trim their assumptions on sales growth for automakers, triggering a further de-rating going forward. Maintain: Underweight

See also: CHINA AUTO: Domestic Consumption Sparking Sector