Excerpts from latest analyst reports....

DMG & Partners: Special dividends in the works from Nera?

Analysts: Edison Chen & Terence Wong, CFA

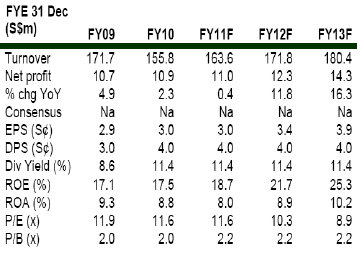

Rock-solid financial position. Assuming it pays out S$14.5m in dividends as in the past (4.0 S¢/share), NeraTel would still have a net cash pile of S$47.5m (13.1 S¢/share).

This is mainly attributable to NeraTel’s ability to leverage on its hardware suppliers, resulting in an efficient cash conversion cycle.

A sign of special dividends. We expect NeraTel to maintain its 4.0 S¢/share payout, translating to a yield of 11.4% based on S$0.35.

We also observed that the last time cash was above S$50m in 2005, a special dividend (15.0 S¢/share) was announced, though a huge portion of it came from the disposal of business.

Nonetheless, another special distribution may be on the way as management indicated that they are comfortable working with a cash position of S$20m.

DMG: Second Chance trading at 8.0% yield

Analysts: Lynette Tan, Terence Wong, CFA

Plans to expand real estate business while keeping retail business. Second Chance is still on the lookout for real estate opportunities to grow the business, with an aim to achieve a market capitalisation of at least S$1b by 2022.

It is open to real estate activities such as property development (via joint ventures), and acquisition of distressed properties.

Attractive dividend yield. At S$0.38, Second Chance is trading at an attractive 8.0% yield, which we believe is sustainable, given its stable operating cash flow.

We maintain our BUY recommendation and TP of S$0.53, based on DDM (dividend discount model).

Recent story: SINGAPORE STOCKS that have soared despite market tumble

On 30 July 2010, the Group announced that its wholly-owned subsidiary, Nera Infocom (M) Sdn Bhd (‘Nera Infocom’), received a claim from MBF Cards (M’sia) Sdn Bhd (‘MBF’) for losses and damages amounting in aggregate of RM10.7 million (approximately S$4.5 million) in relation to a Maintenance and Service Agreement dated 4 April 2005 between Nera Infocom and MBF. On 8 February 2011, MBF made additional claims resulting in the new aggregated claims to be RM41.2 million (approximately S$17.1 million).Nera Infocom strongly disputes the amount of claim and are currently under legal proceedings. The recent hearing was on 12 October 2011 and the next trial date is set on 27 October 2011.