TECHNICS OIL & GAS has just been awarded a S$32m EPCC contract for 2 wellhead satellite platforms for VietSovPetro, due for delivery in Jun 2012.

This comes hot on the heels of a number of order wins, leading AmFraser analyst Lee Yue Jer to believe that management may speed up certain projects to accommodate the new orders.

As such, he has raised his FY11F (ending Sept 2011) net profit to $20.6m, equivalent to an EPS of 10.1c.

For 9M2011, net profit was already $16.1m, with 3Q PATMI at $7.5m. As such, the new target requires only a $4.4m result in 4Q.

Technics is trading cum-dividend for 11 cents in 12 months, notes Yue Jer, forecasting an 8 cent dividend payout next financial year.

Since the recent 3 cent declared (no dividend expected in 4Q2011) has not been distributed, investors stand to earn 11c, translating into a 12-month dividend yield of 12.6% at the current share price, notes Yue Jer.

“A good high-dividend stock has gotten cheaper in recent months.”

Yue Jer, who has a fair value of $1.22 for the stock, adds: “Technics’ fundamental position is strong, operations are smooth, and the order win momentum is being maintained. BUY.”

Recent story: Buying during market panic: TECHNICS OIL, GMG GLOBAL, OTTO MARINE

Beware the bear?

IF YOU HAVE cashed out of the market, you should stay in cash, says PhillipCapital strategist Joshua Tan.

And "clients in risk assets should de-risk their portfolio as much as possible to hedge the downside, accumulating enough cash for better positioning when the opportunity arises."

He adds in a report on Monday: "We reason that if we are wrong and there is no default, clients can always buy-back in, but to stay heavily invested on a high probability downside event of sufficient proportions is a risk best minimizing or avoiding altogether."

His reasoning: Despite positive posturing by the Greek government, credit markets do not believe that the Greek government will deliver on its end of the bargain to deliver enough budget cuts or revenue increases.

Greek yields have soared, and the spread with German bunds are at record. At the same time, yields on other peripheral nations have climbed.

"The signal is clear – default is on the cards," says Joshua.

There is a silver lining. Economic data out of the US and China are actually rather encouraging. "Our baseline scenario is this – the global recovery isn’t done yet, and as such stocks should trend higher again – but we face a high chance event of Greece defaulting, the consequences of which would spark a banking crisis in Europe."

Sabana REIT, after 2 proposed acquisitions, could yield 10%

With equities taking major hits in recent months and with more volatility expected in the near term, S-Reits have become attractive for their relative stability and high yield.

For example, Sabana Shari'ah Compliant Industrial REIT (88.5 cents) is expected to yield around 10%.

It was the focus of analyst reports after announcing on 11 Sept the proposed acquisitions of 2 Toh Tuck Link for S$39.8m and 3A Joo Koon Circle for S$40.2m.

Both are sale and leaseback transactions on a triple net basis for a term of three years.

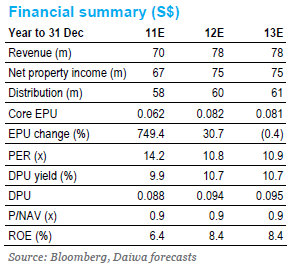

Daiwa analyst David Lum CFA estimates that the acquisitions, both scheduled to be completed in 4Q11, would be distribution-per-unit (DPU) accretive.

Daiwa has revised up its DPU forecasts by just over 5% for 2012-13.

OCBC says 'buy' OKP with 65-cent target price

OCBC Investment Research has initiated coverage of OKP Holdings, saying that relative to its construction peers, OKP's operating and net margins lie above industry averages.

Its superior margins are expected to continue, because:

1) recent wins on its order books hold clauses which protect OKP against significantly higher material prices;

2) increased number of Design & Build contracts in the pipeline should yield bigger margins; and

3) the fact that the company has factored in labour costs trends when tendering for projects.

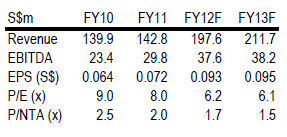

OCBC said the company's forward P/E for 2011 and 2012 lies below industry averages, making valuations undemanding.

We assume that OKP will continue to enjoy similar market share of future public infrastructure projects, adding ~S$156m of new contracts each year for both FY12 and FY13.

Applying the industry average of 7x forward P/E to FY12 EPS, OCBC derived a fair value of S$0.65, implying 13% upside.

Recent story: CHEUNG WOH, OKP, LEADER ENVIRONMENTAL: What analysts now say....