WARREN BUFFETT invested $5-billion in Bank of America, sending the stock surging as much as 20%.

This deal will net him a guaranteed dividend payout of about $300 million a year, whether the stock goes up or down.

Buffet's latest investment move is similar to the $5-billion deal he reached with Goldman Sachs Group back during the financial crisis of 2008, after which the market recovered and rallied.

Like Buffet, many value investor bulls are awake and hunting for value.

Much research has been done on small companies "flying under the radar" of big investors or having little coverage from the sell-side.

Research suggests that these companies might exhibit higher returns than the companies with high analysts coverage.

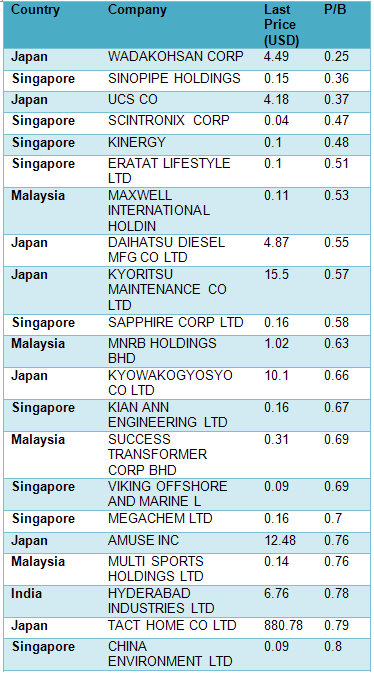

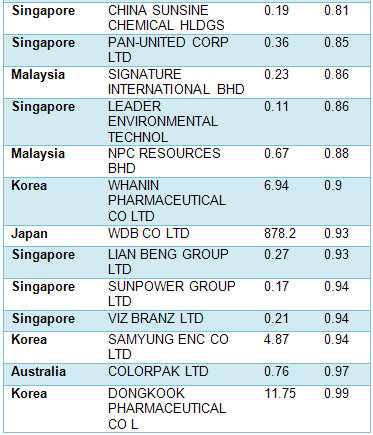

AsiaPacFinance.com has picked out such stocks for you (see table on the right). As of 25th August 2011, these stocks:

1. Have no more than 2 analysts covering them,

2. Are under $300 million in market cap.

3. Have Positive EPS revisions for the Current Year over the past 90 days.

4. Are trading under book value.

Glenn Ho is Director at AsiaPacFinance, serving retail investors globally through Research, Trading Strategies, and Investment Seminars. The financial portal collaborates with banks and brokerages by providing technical analysis and investor education across asset classes. AsiaPacFinance is also the first company to invent a stock screener that combines both fundamental and technical analysis. You can reach Glenn at AsiaPacFinance.