Management expects its export business to see stronger seasonal performance going into the 2HFY11, and the juice segment is likely to do better as the company signs up more distributors. Photo: Annual report

This article was posted recently on remisier Ernest Lim's blog, http://www.ernestlim15.blogspot.com/, and is reproduced with permission.

Sino Grandness (“SFGI”) has dropped 19% since its results were released on 10 May 2011. This was sharper than the 5.3% decline in the FTSE ST China Index. What happened and will SFGI continue its decline on the back of souring sentiment towards the S-chips sector?

First, a snapshot on its 1QFY11 results

Revenue rose 131% from RMB76.9m in 1QFY10 to RMB177.6m in 1QFY11.

Net profit after tax surged 374% from RMB6.6m in 1QFY10 to RMB31.3m in 1QFY11.

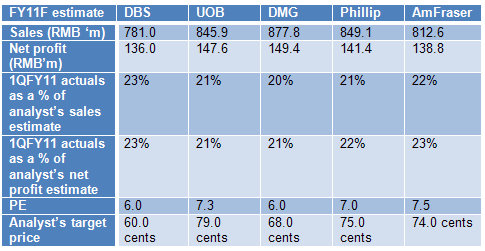

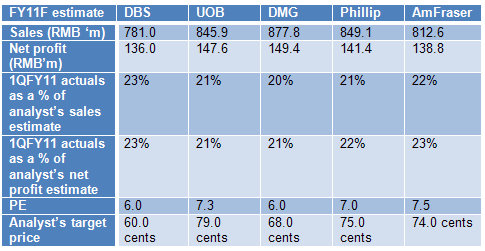

EPS rose 346% from 2.6 RMB cents in 1QFY10 to 11.6 RMB cents in 1QFY11. To put the numbers in perspective, I have compiled a list of analysts’ FY11F top and bottom line estimates (on a best effort basis).

What has happened since its result release?

Some noteworthy events have happened since its results were released which may have contributed to the weakness in its share price. Firstly, the recent accounting problems of the various Chinese firms (not limited to S chips here) sparked a “risk-off” attitude towards Chinese companies.

Some noteworthy events have happened since its results were released which may have contributed to the weakness in its share price. Firstly, the recent accounting problems of the various Chinese firms (not limited to S chips here) sparked a “risk-off” attitude towards Chinese companies.

For example, Hong Kong-listed Chaoda Modern Agriculture Holdings Ltd., a supplier of fruits and vegetables, slid as much as 25% on 26 May 2011 after a report by Next Magazine alleging that the company exaggerated the amount of land it controls.

Another high profile company – Sino Forest, a timber company -- plunged 71% in the two days after a Muddy Waters’ (it’s a firm which researches primarily on Chinese companies) report citing overstatement of assets. According to Bloomberg, the market value of Chinese companies trading in North America shrank almost US$5 billion after Muddy Waters’ reports were released. Such negative publicity, coupled with the recent memories of S chips debacles, have an adverse impact on the S chip sector.

Secondly, some investors may be worried about the impact on SFGI of the drought which affected parts of China such as Anhui, Jiangsi, Hubei etc. However, according to management, SFGI is entering into the peak production period and there seems to be no disruption to its business.

Thirdly, in mid May 2011, there was a food scare in Taiwan over the illegal use of DEHP as a food additive in fruit juice, jelly and sports drinks. DEHP is a chemical found in plastics.

Thirdly, in mid May 2011, there was a food scare in Taiwan over the illegal use of DEHP as a food additive in fruit juice, jelly and sports drinks. DEHP is a chemical found in plastics.

According to Wikipedia, DEHP is carcinogenic and increases the risk of infertility in couples.

For SFGI juice products, according to a Philip Securities report, SFGI confirmed that its fruit juices do not contain such products.

Furthermore, although SFGI outsources its production of juices to an OEM manufacturer, it maintains its quality by stationing one staff at the OEM site to monitor the production process.

Management cites robust outlook

Net profit after tax surged 374% from RMB6.6m in 1QFY10 to RMB31.3m in 1QFY11.

EPS rose 346% from 2.6 RMB cents in 1QFY10 to 11.6 RMB cents in 1QFY11. To put the numbers in perspective, I have compiled a list of analysts’ FY11F top and bottom line estimates (on a best effort basis).

What has happened since its result release?

At 48.5 cents currently, Sino Grandness is way below analysts' target prices of 60-79 cents.

For example, Hong Kong-listed Chaoda Modern Agriculture Holdings Ltd., a supplier of fruits and vegetables, slid as much as 25% on 26 May 2011 after a report by Next Magazine alleging that the company exaggerated the amount of land it controls.

Another high profile company – Sino Forest, a timber company -- plunged 71% in the two days after a Muddy Waters’ (it’s a firm which researches primarily on Chinese companies) report citing overstatement of assets. According to Bloomberg, the market value of Chinese companies trading in North America shrank almost US$5 billion after Muddy Waters’ reports were released. Such negative publicity, coupled with the recent memories of S chips debacles, have an adverse impact on the S chip sector.

Secondly, some investors may be worried about the impact on SFGI of the drought which affected parts of China such as Anhui, Jiangsi, Hubei etc. However, according to management, SFGI is entering into the peak production period and there seems to be no disruption to its business.

SFGI also expanded its point of sales rapidly from smaller convenience stores to large scale supermarkets such as Walmart, Carrefour etc in China. Photo: Company

According to Wikipedia, DEHP is carcinogenic and increases the risk of infertility in couples.

For SFGI juice products, according to a Philip Securities report, SFGI confirmed that its fruit juices do not contain such products.

Furthermore, although SFGI outsources its production of juices to an OEM manufacturer, it maintains its quality by stationing one staff at the OEM site to monitor the production process.

Management cites robust outlook

In the 1QFY11 results presentation, management was bullish on several fronts. Firstly, its export business is likely to see stronger seasonal performance going into 2HFY11.

Secondly, the juice segment is likely to gain further traction as the company is signing up more distributors (16 distributors in Aug 2010 vs 40 distributors in Mar 2011) after the Chengdu trade fair held in March 2011. It typically takes a few months to sign up the distributors after the trade fair.

Besides securing more distributors, SFGI also expanded its point of sales rapidly from smaller convenience stores to large scale supermarkets such as Walmart, Carrefour etc in China.

Capex plans going forward despite no agreement reached on TDR

Secondly, the juice segment is likely to gain further traction as the company is signing up more distributors (16 distributors in Aug 2010 vs 40 distributors in Mar 2011) after the Chengdu trade fair held in March 2011. It typically takes a few months to sign up the distributors after the trade fair.

Besides securing more distributors, SFGI also expanded its point of sales rapidly from smaller convenience stores to large scale supermarkets such as Walmart, Carrefour etc in China.

Capex plans going forward despite no agreement reached on TDR

DMG expects SFGI to invest RMB110m in capital expenditure this year. RMB30m is targeted to add capacity to its export business. Another RMB 30m is to construct a juice production line at the existing Chengdu facility. The balance RMB50m would be spent on constructing its Hubei plant.

In addition to its capital expenditure, it is noteworthy that as of 31 Mar 2011, SFGI has a RMB22.4m short-term loan which is payable within less than a year.

This, coupled with the working capital requirements and the aforementioned capital expenditure, is likely to put a strain on their cashflow, especially since their Taiwan Depository Receipts (“TDR”) may be delayed or cancelled as there have been no updates since the last announcement on 16 Feb 2011.

Management is cognizant of this and highlighted during the 1QFY11 presentation that the company is able to draw down a loan of about RMB50m from banks, if necessary.

Nevertheless, in my opinion, SFGI may do equity financing (such as share placements) if the opportunity arises as they are growing quickly.

Re-rating possible if SFGI continues to deliver results

In addition to its capital expenditure, it is noteworthy that as of 31 Mar 2011, SFGI has a RMB22.4m short-term loan which is payable within less than a year.

This, coupled with the working capital requirements and the aforementioned capital expenditure, is likely to put a strain on their cashflow, especially since their Taiwan Depository Receipts (“TDR”) may be delayed or cancelled as there have been no updates since the last announcement on 16 Feb 2011.

Management is cognizant of this and highlighted during the 1QFY11 presentation that the company is able to draw down a loan of about RMB50m from banks, if necessary.

Nevertheless, in my opinion, SFGI may do equity financing (such as share placements) if the opportunity arises as they are growing quickly.

Re-rating possible if SFGI continues to deliver results

SFGI trades at a FY11F PE of 4.5x. Although this is low (considering the growth that it is likely to be having this year), it is noteworthy that Chinese firms continue to face weak sentiment and negative news flow.

Nevertheless, SFGI has been very active in reaching out to the investment community by doing road-shows not only in Singapore but in Malaysia, Hong Kong etc. so as to create more awareness of the company and increase transparency. A re-rating is likely if SFGI can continue to deliver on its results and expansion plans.

Recent story:YANGZIJIANG, FUXING, SINO GRANDNESS, OCEANUS: What DMG analysts say now....

Nevertheless, SFGI has been very active in reaching out to the investment community by doing road-shows not only in Singapore but in Malaysia, Hong Kong etc. so as to create more awareness of the company and increase transparency. A re-rating is likely if SFGI can continue to deliver on its results and expansion plans.

Recent story:YANGZIJIANG, FUXING, SINO GRANDNESS, OCEANUS: What DMG analysts say now....