Excerpts from latest analyst reports…

CIMB maintains 67-cent target price for LIAN BENG (37 cents)

Analyst: Leong Weihao

3QFY11 results within expectations, with core net profit for the quarter coming in at S$10.4m (+71% yoy); forming 25% of our FY11 forecast.

Net profit of S$14.1m (+131% yoy) for the quarter included a S$3.1m gain on disposal of investment properties.

9MFY11’s core net profit of S$33m (+90% yoy) forms 79% of our full year FY11 forecast.

The positive showing in 3Q11 came on the back of continued strong revenue growth, which offset the impact of a slightly weaker gross profit margin.

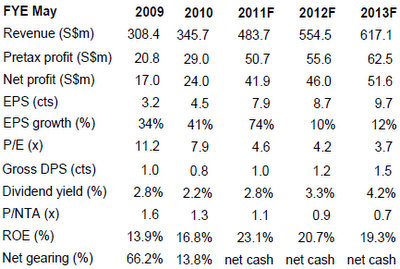

• Maintain BUY, TP of S$0.67 intact. With the strong earnings remaining steady, we keep our FY11-13 net profit estimates unchanged.

We continue to peg LBG’s valuations to a 10% discount to our target multiple for Yongnam, still based on 7.2x CY12 P/E, deriving a fair value (target price) of S$0.67.

• Prospects remain sound. On the domestic front, the Singapore Government is expected to roll out infrastructure projects in the year ahead. The private property market should also maintain a stable momentum going forward. As at 28 Feb 2011, Lian Beng’s order book stood at a healthy S$661m. The order book should provide a steady flow of revenue through FY2013.

Credit Suisse: More losers than winners from inflation

The broker examined the impact on both the expense and revenue sides arising from increases in oil, soft commodities and metals prices and higher costs for wages and transportation.

It also considered the companies’ pricing power and Singapore’s exchange rate monetary policy and impact of a rise in interest rates.

Not surprisingly, companies with high materials or wage costs, low margins and limited pricing power to pass through the incremental costs are most impacted.

These would include HLA, Amtek, SATS, NOL, Wilmar and ST Engg.

The few beneficiaries are Midas, DBS, Straits Asia, Yongnam and Genting.

Wages are probably the only common cost component that affects most number of companies here, given Singapore’s high wage cost base.

Those most affected by rising wages are SATS, ST Engg, CD and Raffles Medical. Sector-wise, gaming (Genting) and banks (DBS) are the key beneficiaries here,as they are expected to benefit from higher rates.