Photo by Leong Chan Teik

SINO GRANDNESS had a great year in 2010 as its net profit surged 76.7% to RMB 116.9 million, placing the stock (51 cents) at a trailing PE of just 5.5X.

There is yet more business growth to come, as suggested by two key pieces of information which stood out at a briefing yesterday.

Firstly, Sino Grandness acquired a client in Australia – the Coles chain of supermarkets - last year for its canned mushrooms business.

Coles ordered 250 containers of the mushroom, or about 45% of its year's requirements, said Parry Ng, the VP for investor relations at Sino Grandness.

This is a significant inroad within a year – and Coles has jumped onto the top 10 list of customers of Sino Grandness.

The S-chip company intends to expand its customer base and cross-sell products.

The second outstanding piece of information was that the company’s newly-introduced fruit juices and fruit-vegetable juices have turned out to be big winners.

From RMB20 million in 2Q, sales rose to RMB30m in 3Q and RMB50 m in 4Q.

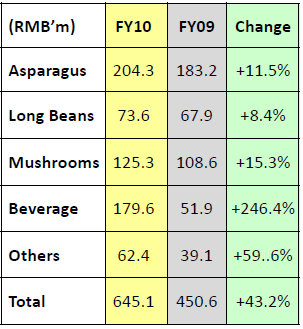

This is the business segment to watch: In 2010, the juices and the herbal drink (collectively termed beverages) had already achieved RMB179.6 million in sales, up 246.4% year on year.

Said Mr Jack Huang, chairman and CEO, at a lunch briefing for analysts and fund managers yesterday at Peach Garden: “Within two years, we aim to grow our beverage segment to equal the sales of our current core business of OEM canned fruits and vegetables.”

A back-of-the-envelope calculation by some analysts showed that this could translate into Group revenue of over RMB $1 billion for FY2012, assuming the OEM segment grows at a CAGR (compounded annual growth rate) of 10-15%.

Last year, the beverage segment also, thanks to economies of scale, enjoyed a gross profit margin of 37.6%, up from 25.8% in 2009 when it had only the herbal drink.

The margin expansion helped offset a decline in gross margin arising from higher cost of raw materials for the OEM business of manufacturing canned asparagus, canned long beans and canned mushroom for distributors such as Lidl, Carrefour and Walmart in Europe and North America.

As a result, the Group’s overall gross margin was 32.5%, compared to 32.3% in 2009.

Ripe for growth

To grow the juice business, Sino Grandness will expand its sales and distribution network and do R&D to introduce new products.

An example is the loquat fruit juice drink which was launched in January this year to resounding success.

Photo: Internet

Starting from this year, aside from convenience stores, the juices will increasingly become available in big supermarket chains in cities such as Shenzhen in Guangdong province, where more than 60 Walmart supermarkets will carry the juices.

Sino Grandness is currently in talks with other chains such as Tesco and Carrefour, said Mr Ng.

In terms of geography, Sino Grandness will focus on the east, southeast and southwest of China.

The production of the juices is 100% outsourced but Sino Grandness plans to reduce that percentage by setting up its own factory in Hubei. Construction begins this year.

Given the early success of its juices, Sino Grandness is setting up, by June, a production line for juices in its existing Shenzhen factory that does OEM business in canned vegetables.

This, plus the construction of the factory in Hubei, will account for the RMB70-80 million capex this year, compared to the RMB137 million spent last year in expanding the production capacity for the OEM business from 32,000 tonnes to 45,000 tonnes a year.

Recent stories:

VIKING, BROADWAY, SINO GRANDNESS: What analysts now say...

The Edge weekly's 10 stock picks for 2011