Excerpts from Macquarie Equities Research report

Analyst: Mark Matthews

An investor related to me last week that he asks each of the property analysts he knows who is bullish on the sector ― OK, you are bullish. Tell me where you can afford to buy.

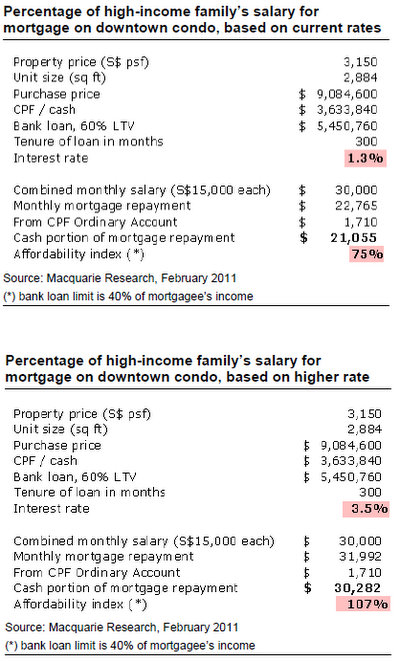

The tables below give the answer.

They show the current price per square foot for Ardmore Park, a decade-old large condominium building in District 10, the “tony” part of town (along with District 9).

The average size of the apartments is large, at 2,884 sqf, which is also representative of the sizes of apartments in that part of town.

A family in Singapore earning S$30,000 per month would make US$280,000 per year, which is much more than the median household income of US$66,000, and should presumably qualify them as in the upper tier and able to live in Districts 9 or 10.

But actually, they can’t.

The table shows what percentage of their income would need to go toward their mortgage payment (the “affordability index”), based on current rates offered for the first 3 years, which is to say around 1.3%. It works out to be 74% of their income.

In fact after the third year mortgages usually adjust to a higher rate of around 3.5%, but it is assumed buyers re-finance.

The second table shows what percentage of their income would need to go toward their mortgage payment (the affordability index, based on a mortgage rate of 3.5%. It is 107%, in other words, more than their entire combined salaries.

The message in these numbers is simple: If prime Singapore property isn’t affordable now, it’s going to be even less affordable if interest rates go to 3.5%. But what’s saying they will?

I put the question to Macquarie head of Asian economics research, Richard Jerram. He said rates in Singapore won’t go up this year, because there is no inflation in the US, and Singapore rates broadly follow US rates.

But, Richard added, there is a reasonable chance that rates start rising next year. Then the question is, what is a neutral Fed Funds rate?

As a rule of thumb, a neutral rate is equal to nominal GDP growth. For argument’s sake, let’s say the number is 4% (which is on the low side vs. the average nominal GDP growth since 1970 of 6.8%,and the average Fed Funds rate of 6.1%).

Perhaps the Fed Funds rate doesn’t get there next year, but let’s say it got there by 2015.

That would mean a funding cost for Singapore property of around 5%, which would mean the monthly mortgage payments of an Ardmore Park apartment would be 30% higher than the household income of a family that makes US$280,000 per year.

In summary, investors in property today think they have a positive carry, but it exists in fact only due to abnormally low interest rates, which are not perpetual.

Meanwhile, the government seems to be trying to convince people that upside is limited, by taxing a large proportion of the upside. Combined with a normalisation of the US economy, it’s not a great risk/reward profile. It’s somewhat ironic, but really the worst case scenario for Singapore property is a robust US recovery!

Recent story: PROPERTY PRICES, STOCKS: What analysts now say....