|

||||||||||||||||||||||||||||||||||||||||||||||

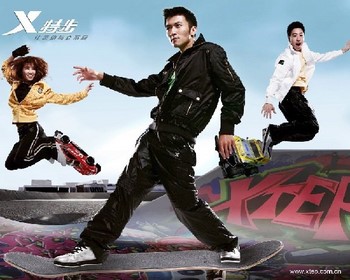

XTEP INTERNATIONAL Holdings Ltd (HK: 1368) has hit the ground running, according to Bocom International, as the brokerage has brought the fashion sportswear company into its coverage universe with a "buy" call and a target price of 6.31 hkd, with a 27.3% upside seen.

Bocom said that the Chinese firm’s synergistic structure and ability to anticipate trends in the hypercompetive sector have propelled it to the No.3 position in its home market.

“Xtep adopts an integrated business model from design to manufacturing, marketing to wholesaling. Thanks to its good strategies and execution, Xtep brand used only six years from establishing its brand in 2002 to becoming the third largest domestic sportswear brand in 2008.”

Bocom was especially impressed with the Hong Kong-listed firm’s strength in the fashion sportswear segment, originally a niche market which Xtep has expertly turned into a major revenue driver in a relatively short space of time.

“With focus of product functionality and utility factors, the concept of ‘fashionable and trendy sportswear’ has differentiated Xtep from its peers. As its strategic focus, second and third tier cities have outpaced China’s overall GDP, which brings Xtep substantial growth potential,” Bocom said.

The brokerage added that Xtep’s multifold marketing activities (both entertainment and sports) will “further enhance” the company’s brand image and recognition.

“Xtep will eventually gain market leader position as a differentiated fashion sportswear brand.”

It said that by utilizing in-house production facilities, Xtep can quickly respond to changing market demands as well as fashion trends as well as meet replenishment orders.

“Moreover, average unit production cost by self-production is lower than outsourcing. In H12009, Xtep had 12 footwear production lines and 20 apparel production lines with a total annual production capacity of around 12 mln pairs of footwear products and three mln pieces of apparel products.

“Utilization rate of self-owned production facilities was nearly 100% over this period.”

Valuation ‘undemanding’

Xtep’s current valuation is “undemanding” said Bocom, due to the fashion sports firm’s improved growth and strengthening cash position.

“Xtep now trades at FY10(e) 12.5x P/E, making it not only one of the lowest FY10(e) stocks in China’s sportswear sector, but also in the whole Chinese retail universe.”

The current share price was “undemanding” due to the fact that its FY10(e) 0.51x PEG is also “the cheapest among all sportswear brand names” compared to Li Ning, Anta and Dongxiang (all Hong Kong-listed), whose PEG’s range between 0.92x and 1.12x.

Seeking sneaker-hold in China’s interior cities, second tier markets

Bocom said Xtep is wisely anchoring its hitching its future growth to the relatively faster economic development of China’s second and third tier cities, as well as spreading its foothold in the interior provinces.

According to Bocom’s sportswear retail store density analysis, the brokerage found that the sportswear market is less saturated in mid to western provinces than in first tier coastal cities.

“Xtep will focus retail network expansion in Hunan, Anhui, Shandong and Henan (provinces) in the future and about 85% of new stores will target second and third tier cities.”

By mid-2009, Xtep had 5,405 self-branded stores in China, and management eyes 5,800 stores by the end of 2009 and 10,000 within another half decade.

Xtep is also seen piggypacking on the expected success of the world’s best known theme park franchise.

“The approved Disney park franchise in Shanghai should boost Xtep’s recognition in China which should present a good opportunity for Xtep’s Disney Sport brand business,” Bocom added.

It expects Xtep to accelerate the development of its Disney Sport retail network in China. Also, Xtep has been awarded licenses to distribute Disney Sport products in Hong Kong, Macau, Taiwan as well as 21 additional global emerging markets, which will help boost the Disney Sport brand’s revenue contribution to nearly 11% in 2011 from 7% in 2008.