The exceptional liquidity this morning is a surprise given that the stock has been typically illiquid, mainly because the chairman and his CEO own 77.4% of the company through a vehicle, Worldshare.

Given the strong market interest, the stock, which closed up 1.5 cents at 51 cents at lunch break today, has become the subject of speculation as to deals that may be in the pipeline.

If nothing else, the company seems to have found an enthusiasm to step up its profile in the Singapore investment community. Recently, it organised visits to its manufacturing facilities in China for analysts and investors.

The higher profile, of course, comes hot on the heels of a sterling business recovery - and stock price rebound.

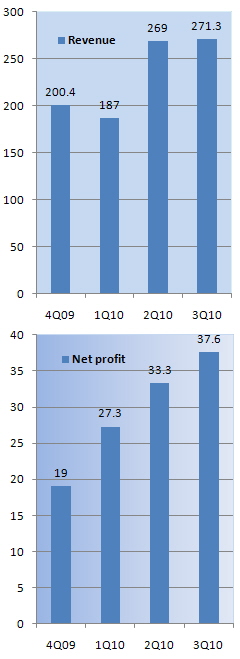

Since the start of the year, its stock has shot up 209% from 16.5 cents to 51 cents - a performance that has tracked its business recovery. It has reported quarter after quarter of sharp jumps in profit.

This S-chip had an earnings per share of RMB0.24 (4.7 Singapore cents) in the first nine months of this year, up by 140% year on year.

Assuming that 4Q profit is the same as 3Q's, then the full-year profit would be RMB135.8 million, or 6.65 Singapore cents in earnings per share. That's about 7.7X PE based on a recent stock price of 51 cents.

For 9M2010, its gross profit margin was 25.5%, almost unchanged year on year.

Record quarterly sales in 3Q

In its recent 3Q results announcement, it said it had achieved record quarterly revenue of RMB 271.3 million since its listing in 2006.

The significant increase in the Group’s turnover arose from sales for its conventional, high performance and high tonnage stamping machines.

Demand for its products increased as manufacturers in China continued to boost their production capacities given the robust local economy.

“The Group believes that sales for conventional, high performance and high tonnage stamping machines will continue to experience growth as the PRC maintains its status as the world’s manufacturing base.

"This will present business opportunities for the Group as the stamping industry forms the backbone of many manufacturing industries,” it said.

Bright World’s operating cashflow in the first nine months of this year was positive at RMB144.5 million compared to negative RMB2.5 m in the corresponding period last year.

Its trade receivables turnover days (a financial ratio to measure the average number of days it takes to collect receivables, i.e how fast it converts from sales to cash) improved from 242 days as at 30 Sept 2009 to 127 days as at 30 Sept 2010.

The company didn't pay any interim dividend and it would be closely watched to see if a final dividend as generous as last year's would be paid.

Recent story: BRIGHT WORLD PRECISION: Why hefty surprise dividend?