CHANGJIANG FERTILIZER’S CFO Joel Leong gave analysts a company update yesterday after the Hunan fertilizer producer posted year-on-year revenue growth of 10.4% to reach Rmb 84.5 million for its third quarter of FY2010.

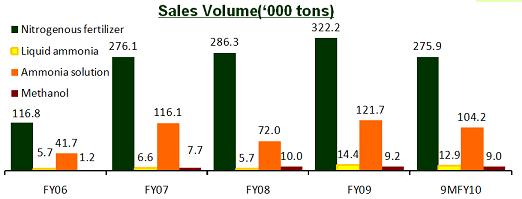

Changjiang’s 3Q10 sales volumes rose for nitrogenous fertilizers (+5.8%), liquid ammonia (+47.4%) and methanol (+42.1%).

Another positive: Average selling prices rose by up to 13.1%.

And there was additional revenue contribution from the commencement of operations in May of its second factory (the newly acquired Changjiang Huafei) in Xiangyin county, Hunan province.

A negative, however, was in the sales of ammonia solution which fell 25.3% as its first plant (in Miluo city in Hunan province) was shut down for routine maintenance and upgrade for 4 weeks from mid Aug to mid Sep.

The previous routine maintenance was performed in end 4Q09 and beginning 1Q10.

Changjiang Fertiliser's gross profit margins declined 3.7 percentage points to 27.2%., affected by higher purchase prices of the company’s feedstock, coal (+21.2% year-on-year).

Coal supply had been affected by the shutdown of many unsafe coalmines.

There were also higher labor and depreciation costs due to additional headcount, plant and machinery when its second plant was integrated into the group.

The new plant is still at operating a lower production efficiency compared to the group's existing plant in Miluo city, but Mr Leong is confident this will improve.

Overall, the group's net profit attributable to shareholders contracted 16.1% to Rmb 18.4 million while net margins fell 6.9 percentage points to 21.8%.

However, cash reserves improved 25.8% to reach Rmb 28.5 million.

On 30 Sep, Changjiang inked a deal to acquire its third plant, which is located in Jiangjia Zhui town, Hanshou county, Hunan province.

The third plant is expected to add another 50,000 tons to its existing capacity of 149,000 tons of anhydrous ammonia each year.

Below is a summary of questions raised by the analysts and Mr Leong’s replies:

Q: Is there an oversupply of nitrogenous fertilizers?

Yes, in 2010. We can switch to produce other products when this happens. A portion of our capacity was switched to produce more liquid ammonia, ammonia solution and methanol to secure better margins. Ammonia is feedstock for products other than fertilizers.

There is no change in market demand for ammonia bicarbonate as this is a traditional product.

Urea prices dropped at the beginning of the year drastically due to a drought. Recovery of urea prices will benefit us, as farmers will switch to cheaper alternatives.

Coal prices will increase in winter, but we see strong recovery in liquid ammonia prices, so margins can be sustained.

Q: Are you setting up processing facilities for ammonia at 2nd and 3rd plant?

Yes

Q: Do you have plans for other fertilizer variants?

We may produce compound fertilizers, but we need to add equipment. Anhydrous ammonia is part of the feedstock.

Q: Can you just produce ammonia and methanol?

Theoretically yes, but we are registered as a fertilizer producer.

Q: What is the time frame for the expansion of your second plant?

We don't have a timeline currently but it will be next year.

Q: Why is depreciable life 15 years for a 30-yr old plant?

We refurbished the plant. We did a one-time write-off for maintenance costs, but we are using the industry average for equipment lifespan.

Q: How many production workers do you have?

Including the third plant, we have over a thousand workers. There is a minimum number of workers for any plant regardless of output.

Q: How much was the increase in staff costs due to wage increase?

This is mainly due to headcount increase from the acquisition.

Q: Do you have a cash flow issue?

The banks are willing to extend Rmb 15 million to Rmb 20 million of loans for the second plant.

Q: What are your risks for 2011?

We will be affected by government incentives to be rolled out in the 12th 5-year plan, which will be announced soon. There may be stricter regulations on environmentally friendly facilities.

Q: Do you currently have to comply with any environmental regulations?

We are waiting for approval on the first plant. The second plant is not subject to any regulation yet.

Q: How much does it cost to implement green equipment?

A ballpark figure is Rmb 20 million to Rmb 30 million per plant.

Related story: CJ FERTILIZER: 2Q10 sales up 56.8% at Rmb 114.5 m