AT 6 CENTS apiece, A-Sonic shares are trading at cash and a 25% discount to book value, but investors are viewing it cautiously after the company was placed on SGX's watchlist status as it had suffered 3 straight years of pre-tax losses.

A-Sonic has 2 years from 3 Sep 2010 to restore its financial health, failing which it will be suspended with a view to delisting.

And by “financial health”, SGX means either:

| (1) a full-year of pre-tax earnings excluding exceptional items and market cap of S$40 million or more; or (2) cumulative pretax profits of S$7.5 million or more for the last 3 years (with a minimum pre-tax profit of a million dollars every year); or (3) cumulative pre-tax profits of S$10 million or more for the last 2 years. |

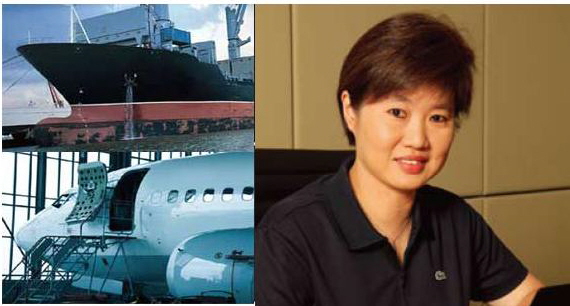

A-Sonic, an aerospace engineering and logistics services provider, suffered 2Q2010 pre-tax losses of US$750,000 after 2 good quarters in 1Q2010 and 4Q2009.

Contributing to the past losses were start-up costs for four overseas offices in 2009 as the company continued to lay the foundation for more sustainable business growth for the long-term.

And the 2007 and 2008 losses were in large part due to impairment of goodwill arising from A-Sonic's acquisition of AirOcean.

There has been good news for the company of late, though. Last month, it made news by becoming the ninth organization approved by Civil Aviation Authority of Singapore (CAAS) for training aerospace engineers.

Big demand for aviation education

”Training accreditation can take as long as 10 months, as the accrediting body needs to audit a school’s training facilities and instructors' track record,” explained A-Sonic CEO Janet Tan during a recent meeting with NextInsight.

That is why start-up losses for education and training for aviation and logistics have taken a toll on A-Sonic's earnings.

Apart from aviation training, the Group also forayed into logistics and business education last Oct by setting up Sterling Campus, a commercial school in Singapore’s civic district. The school has obtained accreditation from The International Air Transport Association (IATA) for technical courses.

The good news: the aviation industry is grappling with a global shortage of engineering skills, as highlighted by a senior Boeing official quoted last month by People Management.

What’s more, the aerospace giant has predicted that the commercial part of the sector will require an additional one million pilots, engineers and maintenance personnel over the next 20 years.

Thus Ms Tan believes there will be demand for A-Sonic’s courses, as 60% of manpower needs specializing in aviation are for engineers and technicians. And certainly the CAAS accreditation will be a big draw.

"CAAS reputation for licensing is as strong as the Singapore brand," she said.

School fees will be borne by individual students, as well as aviation organizations, which are focusing on riding Asia-Pacific’s growth.

Boeing, for example, has based its main training operation for pilots and maintenance crew in Singapore.

|

Market cap |

$$37.4 m |

|

52-week high/low |

12 / 5 cts |

|

Recent stock price |

6 cts |

|

Price to book |

0.75 X |

|

Price to cash |

1.0 X |

|

Gearing (debt/book) |

30% |

Leveraging on A-Sonic’s operational offices in 35 cities in 15 countries, Ms Tan sees Sterling Campus as a regional education service provider which is able to fly its lecturers out to where the demand is.

The school has already started its first professional and IATA course in Jul 2010 in Vietnam.

Sterling Campus offers diploma and certificate courses for O-level school leavers, and wants to eventually tie up with foreign universities for degree courses.

Secondly, education demand is counter-cyclical to A-Sonic’s core business in logistics, which is directly impacted by the level of international trade: During recessions, school leavers flock back to school for lack of jobs.

A-Sonic is the only aviation and logistics group extending its industry experience into the education segment.

It is a move that could prove rewarding as education is a high margin business while logistics is a volume game with relatively low yield.