Analyst: Oliver Campbell

We spent the last 2 days visiting factories across a range of industries - software development, hardware components, consumer electronics, automotive and apparel/footware - in Shenzhen/Dongguan. Unsurprisingly margin-pressure from wage increases dominated the conversation.

Rather more surprising was factory managers’ pragmatism about perceived headwinds. Having spent the past 5 years working through ongoing wage hikes, currency appreciation, demand volatility and raw material inflation, managers did not appear particularly concerned about the outlook for 2H10.

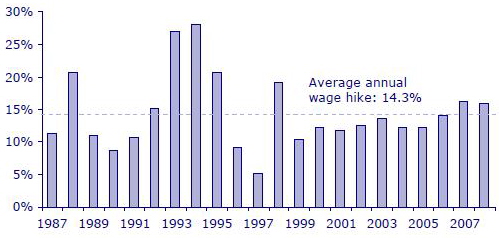

Average manufacturing wage growth in China (YoY %)

Guangdong is evolving

Ø Guangdong is a dichotomy of high-tech R&D and commodity manufacturing.

Ø Margin pressure dominated discussion, specifically wage hikes.

Ø Other margin debates centred around RMB appreciation, raw material costs, pricingand end-demand.

Ø We came away feeling that concerns are overdone, as these so-called headwindsare not new to the tech industry.

Wage concerns overdone

Wage concerns overdoneØ Wages are rising (10-15% per year), staff turnover is high (5-20% per month) and retention is tough.

Ø Wages have been rising at 15% per year over the past 5 years anyway.

Ø Many firms’ overtime puts them between RMB1500-2000 for unskilled labour.

Ø Wage hikes are across the board, a degree of costs can be passed onto customers.

Currency, raw materials, pricing and demand

Ø RMB started appreciating in 2005 and is resuming in 2010.

Ø Commodity prices boomed in 2008, yet firms remained profitable.

Ø Tech ASPs drop around 10% every year, manufacturers have been able to deal with it via automation and input cost reductions.

Ø Outlook for 2H10 seems positive with TV channel inventory at Skyworth “lower than the market believes” and two PC component makers suggesting 20-30% QoQ shipment growth in 3Q10.

Chinese takeaways

Ø In Guangdong manufacturing, labour as % of Cogs not as high as other components like raw materials

Ø Moving “inland” or “to Indonesia/Vietnam is not as simple as it sounds.

Ø Consensus among manufacturers is that wage-hike can now be passed on in higher ASPs.

Ø We believe concerns are overdone. Regarding tech we remain positive on Hon Hai, Compal, Quanta.

Source: CLSA Asia-Pacific Markets