Analyst: Kevin Chong

Several reasons for new order pickup at Chinese yards

The recent new order pickup experienced by Yangzijiang (YZJ) and Cosco Corp(COS) has been a positive surprise. We believe there are several reasons for this strength:

1) increased Chinese domestic ordering;

2) shift of orders from small struggling yards to larger established ones;

3) lower vessel prices prompting newbuildings;

4) improved financing from key Chinese lenders; and

5) higher loan-to-value for new vessels vs. used ships and lower spreads offered to top shippers by traditional lenders.

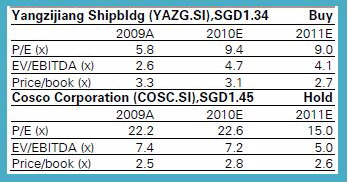

We rate YZJ a Buy and COS a Hold.Global Markets Research Comp

L-R: Yangzijiang's CFO Liu Hua, chairman Ren Yuanlin and Kathy Zhang, MD, Financial PR. NextInsight file photo

Increased domestic orders; order shift to established yards

Clarkson indicates that domestic ordering (private and state-owned companies) in China has increased from 23% of all contracts placed in 2008 to 44% in 2009, in part due to the Chinese stimulus package launched in February 2009 allowing Chinese buyers to benefit from a 17% subsidy on ship prices. The government has recently introduced a new incentive to trim capacity and help yards. In China, there has been a cancellation of orders at struggling small yards and re-ordering at larger, established shipyards as customers take advantage of lower prices.

Lower prices spur vessel orders; container orders may improve

Compared to the 2008 market peak, ship newbuilding prices have fallen by close to 30% but have recently seen a slight recovery. This price decline has spurred an 85% yoy surge in YTD vessel new orders to 606 ships, with bulk carriers (69% of total) and oil tankers (13% of total) accounting for most orders. Container vessel orders are beginning to rise after Evergreen’s recent order; YZJ indicates that customer enquiries have begun to increase for such ships.

Source: Deutsche Bank, July 7

According to Marine Money, China has many reasons for supporting the domestic shipyards and has done so by either offering loans to the yards or their clients. China Exim Bank currently focuses on new shipbuilding contracts and has worked with numerous foreign ship owners; their preference is for top-tier shipping companies with a sizeable order book in China. Split from China Exim Bank in 2001, Sinosure believes it is a good time to be in the ship finance business.

Financing conditions have improved but banks are still selective

While financing conditions have improved, credit is likely to remain reserved for the most creditworthy clients. Some positive data points have emerged recently,with a few European banks indicating that they would increase lending to the shipping industry in 2010. We understand that new vessels would typically be able to secure loan-to-value of about 60-70%, while for used vessels this figure isabout 50%; accordingly, customers prefer to invest in new ships.

Buy Yangzijiang Shipbuilding; Hold Cosco Corp

We rate YZJ a Buy for its strong execution track record and attractive valuations (as one of the cheapest Chinese shipbuilding stocks). COS’ valuations currently appear fair; we rate the stock a Hold. Our target prices are S$1.75 for YZJ, and S$1.58 for COS. We base YZJ’s target price on the Gordon Growth model and use an average of the Gordon Growth model and PEG for Cosco. Key upside risks: rise in new order wins and strong project execution.

Key downside risks: greater-than-expected steel price increases, fewer–than-expected new order wins and tightening of credit markets.