Source: Nomura Singapore

Nomura Singapore sees Singapore's GDP growth recovering to 6.5% this year, which will underpin employment growth and consumer confidence.

It notes that market valuations are reasonable with the market price-to-book at 1.7x and market PE at 14x, both at long-term averages.

The dividend yield for the market also looks attractive at 3.4%, compared to 0.5% earned on 12-month deposits.

Here are excerpts from Nomura's April 7 report authored by Lim Jit Soon and his analysts:

Action

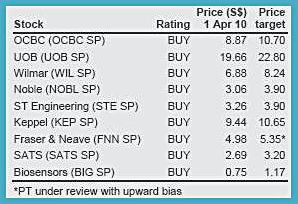

Following the consolidation in 1Q, we believe that the market is poised for are-rating, supported by the improving economy, reasonable valuations and favourable liquidity. We like companies who can show above-market EPS growth(+12%) and are less affected by macro concerns. We like banks (OCBC and UOB), commodity plays like Wilmar and Noble, and high dividend stocks with good EPS growth like ST Engineering, SATS and Fraser and Neave.

Anchor themes

2010 will be a year of rebalancing as Singapore readjusts its economic policies and model to address the issues of over-reliance on developed markets and declining productivity. Policy risks may emerge, including more measures to contain asset inflation and increased regulation on global financial services.

Nomura is positive on United Overseas Bank. NextInsight file photo

Singapore 2Q Outlook: Ready to re-rate

12% upside, tracking market EPS growth expectations

Following the consolidation in the first quarter, we think the Singapore market is positioned to re-rate on the back of improving economic fundamentals, positive employment outlook and reasonable valuations (FY10F P/BV of 1.7x and PE of14x). Key catalysts include a strong 1Q reporting season, positive macro datapoints and favourable liquidity conditions domestically.

Three policy considerations that may impact

The government has been concerned about asset inflation and has come up withsome measures to counter this. The productivity focus suggests slower long-term growth, with more sustainability. The government is also focused on energy efficiency, by encouraging greater use of public transport and infrastructure.

Bullish on banks, commodities and high dividend plays

We are positive on banks (OCBC and UOB) for their earnings momentum in FY10on lower credit charges. We favour Wilmar and Noble given strong demand for commodities in Asia and as inflation hedges. We are also positive on high-yield plays with reasonable valuations and growth prospects such as ST Engineering, Singapore Airport Terminals (SATS) and Fraser and Neave.

Bearish on property and gaming

We are cautious towards the property sector given the policy risks (monetary tightening and more administrative measures for the property sector) and prefer exposure to the office market via the office REITs. Sell CityDev, Buy CCT and K-REIT. We are negative towards Genting Singapore and CDL H-REIT given what look to be overly optimistic expectations.

Macro risks less of impact on Singapore

The impact of the macro global risks on Singapore is less pronounced due to Singapore’s sound fiscal position.