|

CDL Hospitality Trust (CDREIT) caught my attention after slumping from $1.19 on 31 Jul to close at $1.03 on 31 Aug. |

Grand Copthorne Waterfront Hotel is part of the CDL Hospitality Trusts. The 574-room hotel is situated on the banks of the historic Singapore River and close to the Central Business District.

Grand Copthorne Waterfront Hotel is part of the CDL Hospitality Trusts. The 574-room hotel is situated on the banks of the historic Singapore River and close to the Central Business District.

| Firstly, why did it drop 12% in Aug? |

The drop may be attributed to three main reasons, viz.

a) 1HFY23 results missed some analysts’ estimates

1HFY23 results released on 28 Jul missed some analysts’ estimates. As a result, some analysts have trimmed their earnings estimates for CDREIT.

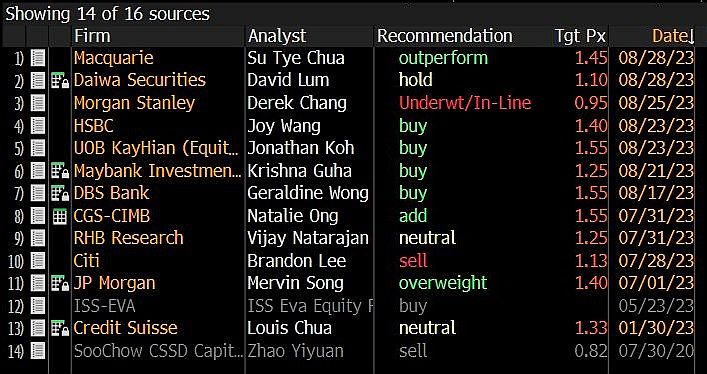

For example, Morgan Stanley reduced their target price from $1.00 to $0.95 and reiterated an underweight / in-line call. Daiwa Securities also reduced their target price from $1.25 to $1.10 and reiterated a hold call.

b) U.S. bond yields soared in August

U.S. bond yields jumped from 3.957% on 31 Jul to a high of 4.354% on 21 Aug (which is also the highest since 2007) before closing at 4.181% on 1 Sep.

As a result, our S Reit sector represented by FTSE ST Reit Index has also fallen approximately 5.5% from an intraday high 734.57 on 31 Jul to 694.21 on 31 Aug. CDREIT underperformed the sector by slumping 11.6% over the same period.

c) Ex-dividend on 4 Aug

Given that CDREIT has already reported results and has ex-dividend $0.0251 / share on 4 Aug, there may be less reason for funds to hold on to the stock, or to accumulate as there may not many near term catalysts.

| Nevertheless, I find CDREIT interesting because… |

a) 1HFY23 would have been stronger if not for….

CDREIT pointed out that results would have been stronger if not for the closure of the entire conference facilities at Grand Copthorne Waterfront Hotel for renovation from April to July 2023, and progressive removal of close to 34,000 room nights from inventory for ongoing bedroom refurbishment works in 1H 2023.

In addition, the last government contracted hotel in CDREIT’s portfolio which exited the program in early January 2023 was still experiencing a gestation period during 1H 2023 as it was rebuilding its leisure, corporate and conference businesses.

Notwithstanding the sub-optimal performance of these two hotels, the Singapore Hotels posted a respectable 39.8% or S$10.2m y-o-y growth in NPI during 1H 2023.

For the eagle-eyed reader, you would have noted that most of the above factors would have eased from 3Q onwards. Based on CGS-CIMB report dated 31 Jul 23, they wrote that Grand Copthorn Waterfront’s 549 rooms have finished renovation in Jun 2023. CDREIT’s renovation for its entire conference facilities at Grand Copthorne Waterfront Hotel was mostly completed as of end Jul 2023.

Furthermore, CDREIT’s management is sanguine on room demand and they have already received a steady stream of bookings for the conference facilities and successfully hiked rates by 22% post refurbishment. This sets the stage for its 2HFY23.

b) Results typically back end loaded

Historically, according to JP Morgan research dated 28 Jul 23, 1H distribution per unit (DPU) typically comprised of an average 46% of the entire FY for FY2015-2019. As a result, if past patterns occur, 2HFY23F should be stronger than 1HFY23.

c) Numerous reasons to be optimistic in 2nd half

Besides the aforementioned factors highlighted above in a & b above, there are numerous factors and demand drivers pointing to a stronger 2H and 1QFY24F. I have outlined some examples below.

- Singapore’s hospitality sector is anticipated to benefit with the upcoming F1 season (15 – 17 Sep). Besides F1, there is a robust lineup of concerts over the next 12 months such as Coldplay (Jan 2024) and Taylor Swift (Mar 2024).

It is forecasted that Coldplay’s concerts are expected to draw a crowd comparable to the recurring Formula One event which welcomed 302,000 fans in 2022. Other events include Singapore Air Show slated in Feb 2024 is expected to draw crowds too.

Singapore comprises of 61.5% of 1HFY23 net property income hence Singapore is an extremely important market for CDREIT.

- CDREIT sees increased flight connectivity and capacity, and China’s reopening as additional drivers which should benefit the markets which CDREIT operates.

A case is point is Singapore. Ahead of Singapore Tourism Board’s (“STB”) expectation of a full recovery by 2024, STB predicts international visitor arrivals to reach approximately 12 to 14m in 2023, generating tourism receipts of around $18 – S$21b (approximately two-thirds to three-quarters of the pre-pandemic levels in 2019).

- Based on DBS Research report dated 31 Jul 23, they cited that CDREIT’s management has also seen a pickup in forward bookings in UK, Europe and Japan.

d) Jul 2023 RevPAR hits record – corroborates CDREIT’s optimism

Based on a JP Morgan report dated 24 Aug 23, they wrote that Singapore’s Jul 2023 RevPAR soared to a record high of $261.20 (+28.3% y-o-y /19% m-o-m). To put into context, the previous highs in RevPAR were $241.7 in Nov-22; $222 in Feb-12 and Sep-08. This is encouraging and corroborates with the optimism shared by CDREIT.

e) Total potential return may be 32% if the consensus is correct

After some analysts cut target prices and estimates post 1HFY23 results, the average analyst target and estimated dividend yield are currently around $1.30 and 6.2% respectively.

Total potential return may be 32% if the consensus is right. However, it is noteworthy that there is a large dispersion in terms of analyst target prices with the lowest at $0.95 and highest at $1.55.

f) CDREIT trades at 0.7x P/Bv –> 2.0x standard deviations below its 5Y average P/B

With the slump in CDREIT’s share price, at $1.03, valuations look attractive on a historical basis. CDREIT trades at 0.7x P/BV, approximately 2.0x standard deviations below its 5-year average price to book ratio of around 0.9x. CDREIT also trades at 6.2% FY23F dividend yield.

g) Chart seems to be exhibiting some bullish divergences

CDREIT seems to be forming a multi month low last seen in Oct 2022. Nevertheless, it is somewhat assuring to see that most indicators (such as MACD, OBV, RSI) which I track are exhibiting bullish divergences.

Near term supports: $1.02 -1.03 / 1.00 / 0.980

Near term resistances: $1.06 / 1.08 / 1.10

h) Recent price action may be indicative of accumulation

CDREIT seems to be posing some interesting buy sell queues* for the past several days. With reference to the chart below, this buy sell queue snapshot was captured on 29 Aug afternoon. I am not sure whether the below sell queues are real as the total sell queue amounts to around 7M+ shares vs 29 Aug’s (at the time of capturing) volume of 2.9M shares.

If the sellers are real, they are likely to be sophisticated investors or institutions who are unlikely to queue in such a way. By queuing in such a way, it is tantamount to “scare” potential buyers away.

Most of the time (definitely not all the time), whenever there are such queues, it is more likely that smart money is accumulating.

Just this year alone, I have seen such behaviour in ComfortDelgro (when it was trading around $1.02-1.03); Tianjin Pharma (when it was trading around US$1.11-1.14), Unusual when it was trading below $0.143 – just to cite a few examples.

*I have highlighted this to my clients on 29 Aug 23.

Risks

As with almost all investments (if not all), they do carry risks. I am only listing some pertinent ones and this is not a comprehensive list of risks. Please refer to the analyst reports HERE for more information.

a) Usual business risks

As CDREIT is a beneficiary of leisure / corporate travel, lower than forecast leisure/corporate travel demand due to whatever reasons, is likely to weigh on CDREIT’s occupancy and room rate. Furthermore, Daiwa analyst pointed out CDREIT may face higher finance and operating expenses which may impact its DPU.

b) Aggregate leverage may increase from 37.9%

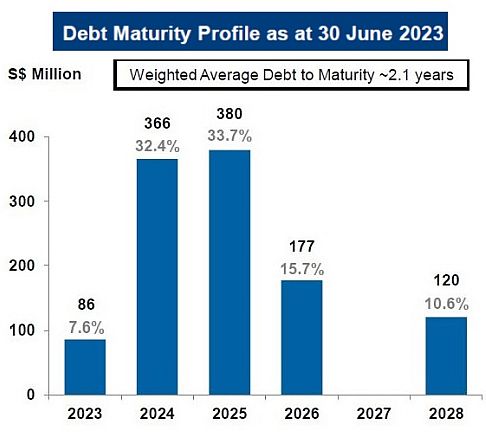

CDREIT’s aggregate leverage may rise slightly, as it draws down loans to fund the remaining construction cost for The Castings. Based on CDREIT’s 1HFY23 results, CDREIT has already put in GBP47.5m out of the maximum commitment Sum of GBP73 3m. This is slated for completion by mid-2024.

c) Weighted average cost of debt may inch up, albeit slightly

CDREIT is in the process of refinancing its GBP50.0m (approx. $86m) expiring in Aug 2023 with a 5-year sustainability linked loan.

Furthermore, based on 1HFY23 results, only 48% of its loans are hedged or on fixed rates. Based on the various analyst reports, this seems to be management’s deliberate intention as we get to (likely) near the end of Fed’s rate hike cycle.

As CDREIT has a relatively large portion of debt (vs other reits) which is unhedged or on floating rates, a continual increase in interest rate may have an adverse impact on CDREIT.

Notwithstanding the above, based on JP Morgan research report dated 28 Jul, they cited CDREIT’s weighted average cost of debt may still remain at low 4%.

d) Not all analysts are positive

Not all analysts are positive. Citi and Morgan Stanley have “sell and underweight calls” with target prices $1.13 and $0.95 respectively.

Having said that, we are now closer to the lowest target price on Street i.e. $0.95 vs the highest price $1.55. It is also good to note that 3 research houses, namely CGS-CIMB, DBS and UOB Kayhian, have ascribed target prices at $1.55.

e) Uncertain macro risks ahead

Macro risks such as continual weakness or deterioration in China’s economy which may result in less Chinese tourists travelling; potential U.S. economic slowdown / recession in 2024 and the potential for cap rate expansion due to but not limited to Fed’s higher for longer rates continue to be present.

Although some of these factors may not have materialised yet, there is a possibility of it happening in the medium term. Thus, these are some of the potential risks which we need to be cognisant of.

f) I am not very familiar with CDREIT

This is my first look into CDREIT hence I am not extremely familiar in CDREIT yet. There may be reasons known to some people in the market but unknown to me which cause CDREIT’s share price to decline recently.

g) Risk of catching a falling knife

This is a standard risk which I have cited in several of my writeups to my clients, most of which are not published on my blog due to time constraints. An example of a write-up which I posted on my blog is Comfort Delgro (click HERE). It closed at $1.03 on 9 Jun at the time of my write-up.

I mentioned that risk reward looks favourable then and I am comfortable to accumulate it for a trading play, yet at the same time, I am aware that there is definitely a risk of catching a falling knife. It was fortunate that $1.02-1.03 marked the low for Comfort Delgro that time and it appreciated for 8 consecutive days post 9 Jun. Comfort Delgro is now trading at $$1.27.

Notwithstanding the above potential bullish reasons, stocks can always go lower. This is why some market watchers advise against catching a stock which is falling. Catching a stock which is free-falling is especially dangerous for small mid cap stocks.

Personally, for large cap stocks, this risk is slightly less as it is usually widely covered by analysts and there should theoretically be fewer blind spots. Nevertheless, I hasten to add that this depends on one’s strategy and risk profile.

Based on my pure personal observation of price action and chart, CDREIT should see good near-term support around $1.00 – 1.03.

h) Large volume sell offs may be a result of a change in positioning by the institutions

Volume has picked up amid the slide in CDREIT’s share price with seven out of past eight trading days hitting above average volume.

On 28 Aug, 8.17m shares changed hands and this marks the highest volume transacted in the past 15 months! Such large volume transactions may be a result of a change in positioning by the institutions. If this is really the case, we do not know how many shares they are prepared to sell at current multi-month low prices.

|

Conclusion

|

Readers have to assess their own % invested, risk profile, investment horizon and make your own informed decisions. Everybody is different hence you need to understand and assess yourself. The above is for general information only. For specific advice catering to your specific situation, do consult your financial advisor or banker for more information

Readers who wish to be notified of my write-ups and / or informative emails, can consider signing up at http://ernest15percent.com. However, this reader’s mailing list has a one or two-day lag time as I will (naturally) send information (more information, more emails with more details) to my clients first. For readers who wish to enquire on being my client, they can consider leaving their contacts here http://ernest15percent.com/index.php/about-me/

P.S: I am vested in CDREIT.

**Note: In line with my usual practice of compiling SGX stocks sorted by total potential return at the start of the month, readers who wish to receive my manual compilation of stocks sorted by total potential return can leave their contacts HERE. I will send the list out to readers around 10 Sep 2023.

With this list, it may be a good first level screening to decide which stocks to sell into strength, or add positions on weakness, or rebalance your portfolios. Nevertheless, please refer to all the important notes in the list to ensure you are aware of the limitations of such screens.

Disclaimer

Please refer to the disclaimer HERE