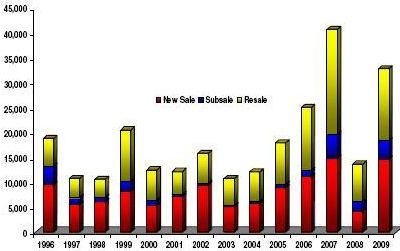

DMG & PARTNERS IS OVERWEIGHT on the property sector, especially on developers with greater high-end residential exposure.

Its top pick for the sector is City Developments (CIT) for its astute market timing and broad domestic residential exposure.

Within the small and mid cap space, the broker likes Wing Tai Holdings and SC Global Developments given their considerably high-end exposure and favorable valuations.

Prime and luxury property capital values remain 15–18% off their last upcycle peaks, and DMG expects them to re-rate, due to the following:

(1) improved macroeconomic environment,

(2) low interest rates,

(3) entrance of more foreign buyers

(4) 30% price discounts to Hong Kong’s high-end property prices, and

(5) culmination of “Remaking Singapore” with the IRs’ opening.

Government policy risks will impact most on the mass segment, with minimal bearing on the high-end segment.

Excerpts from the report:

City Developments - broad-based exposure to Singapore property

Buy, Target Price S$12.44

Analyst: Brandon Lee

City Developments (CIT) is Singapore’s leading residential property developer, with a well-diversified portfolio, which stretches across the mass, mid and high-end segments.

Aside from property development, its other core businesses are hotel operations and rental of properties.

Its hotel operations are conducted via London-listed Millennium & Copthorne Hotels PLC (53% stake), which owns, manages and/or operates more than 120 hotels in 19 countries.

Its rental of properties segment are Singapore-centric, covering 4.8 million sqf in net lettable area of completed industrial, office and retail properties and another 1.8 million sqf under development.

CIT has four new project launches in FY10, i.e. the 228-unit The Residences at W (March), 429-unit Chestnut Avenue site (April), 158-unit Concorde Residences Redevelopment (April) and 642-unit Pasir Ris Parcel 2 (June).

DMG expects these projects to generate healthy take-ups, and believes the stock will continue to trade upwards in light of its 22% RNAV exposure to the rebounding high-end segment and overall buoyant residential sales.

Its maintains a BUY call on CIT with target price of S$12.44, pegged at 20% premium to FY10F RNAV of S$10.37.

Buy, Target Price S$2.15

Analyst: Brandon Lee

Wing Tai Holdings is a mid-cap property developer with sizeable exposure to Singapore’s residential market (70% RNAV), largely the high-end segment (60% RNAV) which comprises 800,000 million sqf in unsold GFA.

DMG expects Wing Tai to be a key beneficiary of rising interest in prime and luxury projects, especially when prices are still at discounts to the 4Q07 peak, and given the improved macroeconomic climate and increased offshore buyers.

It has a regional real estate exposure through Malaysia-listed DNP Holdings and Hong Kong-listed USI Holdings, in addition to other businesses like apparel retailing, franchise operations and hospitality.

In Feb this year, it sold 40 out of 50 units launched for the 147-unit L’VIV at S$1,980 psf, an impressive 15% premium to nearby projects like Newton One and Trilight.

The management is now looking to replenish its mass-mid landbank, although DMG is of the opinion there is no hurry given its 500,000 sqf of unsold GFA here. Current balance sheet implies S$1.0 billion of debt headroom before hitting maximum net gearing of 1.0x.

DMG maintains its BUY call on Wing Tai with target price of S$2.15, pegged at 10% premium to FY10F RNAV of S$1.96.

Recent story: CITYDEV: JP Morgan's top property pick